This Time it’s Not Different

Friday calls for lighter fare, so today I thought I would present evidence that this financial crisis we are now living through is not particularly unique. Realizing that some may find the idea that we are doomed to go through this  every few decades less than cheering, I will present it in the form of a quiz. As I’ve said before, everybody likes a quiz.

every few decades less than cheering, I will present it in the form of a quiz. As I’ve said before, everybody likes a quiz.

Question 1: The Buildup

In what year did BusinessWeek editorialize as follows about the stock market?

For five years at least American business has been in the grips of an apocalyptic, holy rolling exaltation over the unparalleled prosperity of the "new era" upon which we, or it, or somebody has entered.

Stock prices are generally out of line with safe earnings expectations, and the market is now almost wholly "psychological."

1999 or 2000 are good guesses. Sounds like the top of the dot-com bubble doesn’t it? Remember all that talk about how the web had ushered in a new paradigm of business and how three digit multiples for internet stocks made perfect sense? And all the hand-wringing that went with it?

It’s not from the turn of the millennium. Here’s another quote from around the same time, this from a well-known (but often ignored) economist speaking at  an annual conference:

an annual conference:

I repeat what I said at this time last year and the year before that sooner or later a crash is coming…. The Federal Reserve System has put banks in a strong position, but it has not changed human nature.

The word “crash” gives it away. Both quotes are from 1929.

Question 2: The Crisis

This one is harder. Try to guess the year. At the height of this fiasco, things got a little out of hand in lower Manhattan. This is from the excellent book Every Man a Speculator

Five thousand of the unemployed demonstrated on Wall Street chanting "We want work," and demanding that banks open up credit lines to businesses promising work. … Populist mayor ____ demagogically denounced Wall Street, declaiming that “those who produce everything get nothing and those that produce nothing get everything.” He was instantly abandoned by his onetime conservative backers in the business community. The New York Times accused him of raising the banner of “the most fiery communism.” … When ____ was unceremoniously dumped from the Democratic Party ticket, his friends blamed it on “Wall Street Democrats” who were more than ready to see the government bail out failing banks, but not destitute workers.

Some of the politics may sound familiar today, although it is hard to imagine the Times complaining about fiery communism or a New York mayor being dumped because of it.

You might have guessed the 1930s, when mass protests, communism, and the justice of government bailouts were in the news. But you would have been off by 73 years. This was a description of the panic of 1857.

Question 3: The Aftermath

One more. After this stock market disaster, it did not take long for the media  to develop the theme of how shocking the new economic reality was going to be for those recently rich Wall Street types. From the New York Times:

to develop the theme of how shocking the new economic reality was going to be for those recently rich Wall Street types. From the New York Times:

"People who have had such faith in the stability of those markets are going to be forced to evaluate what they consider stable, predictable and important in life." said Dr. Steven Berglas, a Boston psychologist. "Their sense that the more they made, the more control they had over life is going to be totally ripped from their psyches, and for a lot of people it’s going to be very stressful."

"You get security from a friend, from a family, from a network, from community," he said. "People are going to be looking around and seeing how vulnerable they are, how they have no one to turn to, that they have no one comforting them over the prize bottle of Margaux. Those are the people who are going to get hurt."

____, the venerable Wall Street analyst, said "these yuppies are unprepared and unconditioned" for a bear market. "They’ve greeted every one of these bad days as buying opportunities and as quasi corrections."

This pseudo sympathy for the traumas of formerly well paid young people sounds familiar, doesn’t it? But it’s not that recent. This is from October 21, 1987, two days after what is still the worst single day in stock market history, in which the S&P 500 lost 20.4%.

Long term effects of Black Monday were possibly less traumatic than anticipated. The S&P would end 1987 down slightly less than 2% for the year. Over the next 12 years it would average 19.06% return annually.

One of my favorite bits of wisdom is the quip, attributed to John Templeton, that "The four most dangerous words in investing are ‘This time it’s different.’" To be sure, the details really are different. But the big picture stuff, the parts we care about, are pretty much always the same. Because even though the names of the companies may change, and the technology may progress, what drives the market is people, and we haven’t changed at all.

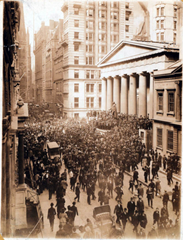

[Pictures show Wall Street on very bad days in 1884, 1907, and 1929.]

28 Comments

Other Links to this Post

-

Name That Downturn! | The History Factory — September 25, 2012 @ 11:52 am

RSS feed for comments on this post. TrackBack URI

By funkright, May 29, 2009 @ 1:05 pm

I love the quotes “those who produce everything get nothing and those that produce nothing get everything..” and “The four most dangerous words in investing are ‘This time it’s different.’” Truly speaks to what and who we value in societies (at least in the west) and the shortsightedness of our memories..

By Dangerman, May 29, 2009 @ 1:56 pm

“it is hard to imagine the Times complaining about fiery communism”

That’s certainly true.

The Times is mostly pro-fiery communism these days.

By scannon, May 29, 2009 @ 1:58 pm

Thanks for including the photos. I wonder what photo from this period people will use in the future as the graphic that best represents the mortgage meltdown.

By SJ, May 29, 2009 @ 2:39 pm

“…is people, and we haven’t changed at all.”

I’m sad =(

By Dave C., May 29, 2009 @ 4:06 pm

If you are a value investor, then a recession truly is a buying opportunity though, isn’t it?

By Rob Bennett, May 29, 2009 @ 4:52 pm

I agree that people don’t change in fundamental ways. And markets are comprised of people. So I suppose that it’s also fair to say that markets don’t change in fundamental ways.

But the environment in which the stock market operates has changed in ways that I believe might be described as fundamental.

We are a richer people today. That means that preserving and growing money have become more important goals. What makes this crisis different is that this is the first stock overvaluation crisis that is going to cause millions of middle-class retirements to fail. In the old days, most middle-class workers did not aspire to financially stable retirements. We worked until we were too sick or old to go on. So the difference this go around is a plus. Still, it is not perceived as a plus. Going from thinking that you will be able to retire to accepting that you will not is a hard blow.

My view is that all of the economic crises suffered in the United States in the 20th Century were suffered as a result of the idea that there is no need to change one’s stock allocation when prices go to insanely dangerous levels (this idea has been promoted in recent decades as the “Passive Investing” concept). In the aftermath of earlier crises, people stepped back from the idea that valuations don’t matter and adopted more conservative investing strategies. But no one ever put a stake through the heart of the Passive Investing concept. So it always came back to life a few decades later, after people had forgotten how much damage it had done.

My hope is that this time the damage is going to be perceived as being so great (because the dashing of our hopes for financially secure retirements will this time affect far more people than it has ever affected before) that we will kill this idea that valuations don’t matter once and for all.

If that indeed happens, this one will go down in history as the economic crisis that brought on a fundamental change in our understanding of how stock investing works. I think that we might someday look back on all this as having been the best thing that ever happened to us. I certainly hope that it turns out that way.

Rob

By GPR, May 29, 2009 @ 6:45 pm

Something that has changed is that we no longer see newspapers print sentences with over 30 words in them, or use awesome phrases like “demagogically denounced.”

I had to go over to Wikipedia to look up dates for Karl Marx – I really was dating the “The Commie Manifesto” to about 1890-1910, not 1848. I blame public schools.

By Kent @ The Financial Philosopher, June 1, 2009 @ 8:55 am

As usual, there are several thought-provoking comments here.

With regard to human nature, there is nothing that will change it — at least in terms of nature’s cycles, which includes human behavior.

With specific regard to financial markets, the sentiment cycle does not change, either — only the basic shape changes (i.e. the duration of the particular emotions prevailing in a given time).

For example, there is no doubt that hope will again be the prevailing sentiment (if not already), just as complacency will return. The specific time fore complacency to manifest itself again is not known at this moment.

Once complacency returns the door will open for greed.

For a bit of reference, I’ll close with some words of wisdom, more than 2500 years old, which give at least some assurance that human behavior will not likely change…

“Don’t let your special character and values, the secret that you know and no one else does, the truth – don’t let that get swallowed up by the great chewing complacency.” ~ Aesop (620 – 560 BC)

“There is no calamity greater than lavish desires. There is no greater guilt than discontent. And there is no greater disaster than greed.” ~ Lau Tzu (604BC – 531BC)

By Rupert Fenrich, December 16, 2011 @ 4:35 am

Very nice post. I just stumbled upon your blog and wished to say that I have really enjoyed surfing around your blog posts. After all I will be subscribing to your rss feed and I hope you write again very soon!

By this, March 27, 2023 @ 2:38 pm

bad credits can happen at any point in your life so be prepared to always get some extra income;;

By alex been, April 29, 2023 @ 8:59 pm

whoah this blog is fantastic i love reading your articles. Keep up the good work! You know, a lot of people are searching around for this information, you can help them greatly.

By купить диплом недорого, June 27, 2023 @ 7:51 pm

If you are going for most excellent contents like I do, simply visit this web site every day as it gives quality contents, thanks

By spravki-kupit.ru, June 28, 2023 @ 12:43 pm

купить справку в москве

By накрутка просмотров яппи, July 30, 2023 @ 6:53 am

Hi there! Do you use Twitter? I’d like to follow you if that would be ok. I’m definitely enjoying your blog and look forward to new updates.

By smartremstroy.ru, July 31, 2023 @ 5:20 pm

I always used to read piece of writing in news papers but now as I am a user of web so from now I am using net for posts, thanks to web.

By химчистка мебели жодино, September 2, 2023 @ 7:18 am

Hi my family member! I want to say that this article is awesome, great written and come with almost all significant infos. I’d like to see more posts like this .

By химчистка дивана борисов, September 2, 2023 @ 3:14 pm

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My website has a lot of exclusive content I’ve either authored myself or outsourced but it appears a lot of it is popping it up all over the web without my agreement. Do you know any solutions to help reduce content from being ripped off? I’d truly appreciate it.

By Bob, September 5, 2023 @ 2:39 pm

Overview: Our best alternative UK live dealer welcome bonus is the package up to £50 by LeoVegas Casino. The 30% wagering contribution for live games is appealing, but your extra spins will be limited in Big Bass Splash. Still, you can use your live casino deposit bonus allows you to delve deeper into Evolution live casino games. Most online casinos offer what are called “No Deposit” Bonuses. That means you can play real money casino games without making any kind of deposit. By simply creating a new online casino account you instantly get bonus cash to test the waters. A 20x wagering requirement means you must playthrough your requirements 20 times before you can withdraw any winnings.Case: 100% up to £100 with a wagering requirement of x20.Bonus money example: Deposit £50 and get £50 bonus money. The wagering requirement is the bonus money multiplied by 20 (£50 x 20 = £1000).Deposit amount + Bonus money example: Deposit £50 and get £50 bonus money. The wagering requirement is the deposit amount + bonus money multiplied by 20 (£50 + £50 x 20 = £2000).

http://www.clean-ace8.com/bbs/board.php?bo_table=free&wr_id=19263

It’s time to double down at Agua Caliente Casinos. We offer single deck, double deck and 6 deck shoe games. Plus, on our shoe games, we offer a side bet Buster Blackjack. The casino was previously named the Spa Resort Casino. The name was changed to ‘Agua Caliente Casino Palm Springs’ in early 2019. Enjoyed the casino as casinos go… Did not win but that is not unusual for me. Staff were nice and we had fun. Low cash gambler…. Tonight two of the valley’s casinos, Fantasy Springs and Augustine, remain closed. So Burdette was relieved to hear Agua Caliente Tribal Chairman Jeff Grubbe say last week that concerned casino employees would have a choice when to return to work. For live table gamers, the casino offers 1 Blackjack table, 1 Roulette table, 1 Craps table and 3 3 Card Poker tables.

By Julissa Fontenot, September 6, 2023 @ 12:50 pm

Your website is an amazing source of information on these subjects. Thank you for offering your expertise with the world.

By sadovoe-tut.ru, September 6, 2023 @ 11:32 pm

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

By loan near me, October 7, 2023 @ 10:46 am

I love your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to create my own blog and would like to know where u got this from. cheers

By online television, October 9, 2023 @ 8:37 am

I don’t even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you are going to a famous blogger if you are not already Cheers!

Cheers!

By online television, October 11, 2023 @ 1:54 am

Nice blog here! Also your website a lot up fast! What host are you using? Can I am getting your associate link for your host? I want my site loaded up as fast as yours lol

By online television, October 18, 2023 @ 2:58 am

Great delivery. Great arguments. Keep up the amazing work.

By стяжка, October 23, 2023 @ 5:02 am

Не знаете, какой подрядчик выбрать для устройства стяжки пола? Обратитесь к нам на сайт styazhka-pola24.ru! Мы предоставляем услуги по залитию стяжки пола любой площади и сложности, а также гарантируем высокое качество работ и доступные цены.

By snabzhenie-obektov.ru, October 24, 2023 @ 4:57 pm

комплексное снабжение строительства

By штукатурка по маякам стен, October 26, 2023 @ 9:27 pm

С механизированной штукатуркой стен от mehanizirovannaya-shtukaturka-moscow.ru ремонт становится не только быстрым, но и качественным. Попробуйте самостоятельно, вы не разочаруетесь!