This is the last in my five part discussion of Dave Ramsey’s Seven Baby Steps. (I kicked it off here, and then discussed Step 2, Step 4, and Step 6.) In this post I will tackle Ramsey’s final step, number 7, in which you are instructed to continue to build wealth using equity mutual funds and real estate and to share your bounty with others.

In some ways this is the least substantive of Ramsey’s steps. It is the “and they lived happily ever after” step, as much a carrot to inspire those working their way through the earlier parts of the program as it is a practical set of instructions. But it does provide an excuse to revisit Ramsey’s investment philosophy.

Ramsey is consistent in his aversion to debt. You might call him Shakespearian. “Neither a borrower nor a lender be.” Once you’ve got your debt paid off, invest your savings in growth stock mutual funds and possibly unlevered real estate. Do not lend it to others and do not invest in bonds or bond funds. I think that foolishly limits your investment options, but there is something appealingly old-school about it.

Read more »

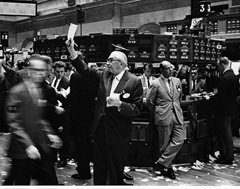

Last weekend The New York Times, no doubt in response to criticism that the media reports nothing but grim news about the economy, did its best to cheer us up with an article about how a stock market debacle from 75 years ago wasn’t really all that bad after all.

It started out squarely addressing the problem.

It started out squarely addressing the problem.

Historical stock charts seem to show that it took more than 25 years for the market to recover from the 1929 crash — a dismal statistic that has been brought to investors’ attention many times in the current downturn.

I’m not that easily cheered up, partly because I understand the nature of the optical illusion that makes those charts “seem to show that it took more than 25 years” to recover from the ‘29 crash. The charts tend to make the uninformed observer think it took 25 years to recover because it’s actually true. It was not until 1954 that the Dow got back to its 1929 high.

Read more »

Given all the attention generally paid to mortgages, and especially recently, you might think that the basic principles might be widely understood. Alas, no. See, for example, and I cite it only as a typical example, Suze Orman’s 2009 Action Plan, in which she addresses the advisability of borrowing using a  HELOC (Home Equity Line of Credit, essentially a second mortgage on your house) to pay off credit card debt.

HELOC (Home Equity Line of Credit, essentially a second mortgage on your house) to pay off credit card debt.

Do not do this. Even if you have enough equity to keep your HELOC open, this is a dangerous mistake. You are putting your house at risk. When you borrow from your HELOC, your home is the collateral. [page 30.]

That has a strong, almost visceral, intuitive appeal. And as strident as Orman is, she is fairly typical in her warnings against “putting your house at risk.” (See this from the Times a while back.) But it is pretty poor advice for many, probably most, people.

Read more »

I’m sure many of you read Get Rich Slowly anyway, but in case you don’t, I’ve got a guest post there today about target date funds.

A reader named Trent pointed me to a story that 60 Minutes did last week, Retirement Dreams Disappear With 401(k)s. It’s not their best work, and I’m not one who thinks much of their best work.

Helpfully, the CBS website gives a near transcript of it, so I can easily quote the way over-the-top copy read by the reporter, Steve Kroft.

the way over-the-top copy read by the reporter, Steve Kroft.

It was a gray, chilly morning in midtown Manhattan and a line of unemployed, mostly white-collar workers, stretched for blocks around the Radisson Hotel. More than 1,000 middle managers, stockbrokers, consultants, secretaries and receptionists had come hoping to find a job.

It was called a career fair, but there was no merriment – only a whiff of desperation.

Many of the people at the career fair have been out of work for months and burned through their liquid assets; their future, even bleaker than the present.

Read more »