House Prices: The Long View

There was an interesting post at Debit vs. Credit two days ago suggesting that now may not be the time to buy a house. The gist of the argument was that house prices still have a way to go before they return to normal. This was illustrated with a chart of median new home prices as a ratio to median income since 1963. That’s not the most ideal set of data to use, for reasons that I will spare you.

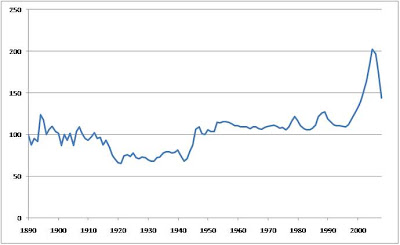

The most useful measure of house prices are the S&P/Case-Shiller Home Price Indices. They only go back to 1987, but one of the co-inventors of the index, Robert Shiller, has chained together other useful house indexes to patch up a composite going back to 1890. (This is the third post that has mentioned Prof. Shiller in the past month. Just coincidence, I swear.)

I downloaded the data from his site, updated and cleaned up a few things, and produced the following chart, showing the inflation-adjusted sale price index for existing homes since 1890.

If you’ve never seen something like this before, you may be experiencing some shock and confusion. This is normal. Just keep breathing deeply. You thought house prices went up over time, didn’t you? Well, they do, but mostly because of inflation. Recent experience excepted, house prices are generally flat over long periods of time once inflation is factored out.

A few other observations worth making:

1) The last index value in this chart (which is for November 2008) is 144.0, still 13% higher than the 1989 peak of 127.4. That does suggest that we have a little more to go, or at least did as of November. On the other hand, it’s already down 40% from the 2005 peak of 202.5, so the worst may be behind us.

2) The recent run-up in house prices actually began in 1996. (From 1996 to 2005 real prices went up 86%.) It may not have gotten weird enough to be noticed in the media until the last years of the boom, but the index began hitting all-time highs as early as 2000. I mention this because it’s currently fashionable to blame the low interest rates of 2003-04 for the housing bubble. They sure didn’t help, but the worst you can say is that they were gasoline thrown on an already blazing fire.

3) As impressive as the 1996-2005 run up is, it is not entirely out of the ordinary. From 1942 to 1947, real house prices went up 60%, which is the best five year run in history. Further, prices pretty much stabilized after that and did not give back very much of the gain. This needs to be pointed out to those who say, in hindsight, that of course house prices had to fall after 2005, because the rapid gains made in years before were just unsustainable.

So is this a good time to buy a house? That depends. Do you need one to live in? There are many factors to consider, including interest rates, tax breaks and other incentives from the government, and local market conditions. (It is worth stating the possibly obvious that the chart above is a national average. Specifics of a particular area may differ both in the short and long run.)

But if you are looking at a house as a possibly shrewd investment, something you can buy cheap now and sell dear later on, you are likely to be disappointed. Even if the crisis were over today, and house prices returned to their pre-bubble habits, the normal state of things is that they don’t go up very much.

501 Comments

Other Links to this Post

-

Top 100 Financial Blogs for College Students - OnlineDegrees.org — March 11, 2013 @ 1:48 pm

RSS feed for comments on this post. TrackBack URI

By Sara Paul, July 20, 2010 @ 7:04 pm

As a Realtor, thanks for pointing out that home ownership is first of all: shelter, a place to retire or raise a family, or start your life, etc.; and secondly: a long term investment. Too many people were seeing their homes not as secure shelter but an ATM machine. If people would just go back to 20% down, they could ride the waves of the economy and if life changes, they can get out.

By Michael Covington, August 2, 2010 @ 9:40 am

Interesting. My impression is that the quality of houses went down in the 1920-1940 period (lots of small, hastily built ones, most no longer standing), and there may have been a modest rise in quality after 1980, which would explain why the graph goes down and up a bit. But certainly no sharp rise in quality in the 1990s.

By robb, March 10, 2011 @ 3:45 pm

Good article. I think the most recent bubble was different from the 40′s in that the rapid increase from 42 to 47 took house prices from below average in 42 back up to a little above average in 47, while in the increase from 96 to 05, prices started a little above average in 96 and went to ridiculous levels in 05. I think this means we still have a long way to go down.

By Maple Leaf, May 5, 2011 @ 11:24 am

I just bought a small condo, after much tortured deliberation. I needed a place to live and rents in Seattle are rising so owning seemed a better option. I don’t regret it. My mortgage (with dues and taxes) equals the same as rent. When I bought, I calculated what I could afford and stuck with that. My mortgage interest is tax-deductable so it’s a win-win situation. Because I purchased smart, I can still put money in savings. I agree with Sarah. Homes are purchased to be homes. If you get to the point where you’re borrowing on your home, it’s probably down hill from there.

By Marsha Killington, Colonial Heights VA, May 14, 2011 @ 4:06 pm

Housing costs need to include taxes, insurance, and (most of all) the costs of maintenance and upgrades to be comparable. My own house costs between 5 and 10% of its value each and every year just to maintain and replace things like roofing, HVAC systems, driveways, landscaping, masonry repointing, painting inside and out, not to mention colossally expensive upgrades like kitchens and baths just to maintain an average condition for my neighborhood–else the house is unsalable even in a normal market. Caveat emptor!

By car transport quotes, September 10, 2011 @ 7:09 am

Ya,I’m totally agree with you here. Really a nice observation is presented by you here regarding home prices. Keep up such posts in near future also.

By Keenan, May 23, 2013 @ 10:00 pm

Greetings! I know this is kinda off topic but I was

wondering if you knew where I could get a captcha

plugin for my comment form? I’m using the same blog platform as yours and I’m

having difficulty finding one? Thanks a lot!

By Rodney, May 26, 2013 @ 12:08 pm

Howdy, I do believe your site could be having web browser compatibility issues.

Whenever I take a look at your site in Safari,

it looks fine but when opening in IE, it’s got some overlapping issues. I simply wanted to provide you with a quick heads up! Besides that, wonderful blog!

By http://nastroyke-info.ru/, March 13, 2023 @ 8:09 pm

Hmm is anyone else encountering problems with the pictures

on this blog loading? I’m trying to determine if

its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

By карта из дерева на стену с подсветкой, March 14, 2023 @ 6:37 am

I’m not that much of a internet reader to be honest but your

blogs really nice, keep it up! I’ll go ahead and bookmark your site to

come back down the road. Cheers

By карта из дерева на стену с подсветкой, March 14, 2023 @ 6:46 pm

What’s up it’s me, I am also visiting this site daily,

this site is in fact nice and the visitors are truly sharing pleasant thoughts.

By карта мира деревянная на стену с подсветкой, March 20, 2023 @ 1:51 am

This piece of writing will help the internet viewers for creating new blog or even a blog from start

to end.

By карта из дерева на стену с подсветкой, March 21, 2023 @ 6:52 pm

I’m gone to tell my little brother, that he should also pay a

visit this weblog on regular basis to take updated from

hottest reports.

By http://hitmind.ru/, March 22, 2023 @ 5:16 pm

I’m not sure where you are getting your information, but good topic.

I needs to spend some time learning more or understanding

more. Thanks for magnificent info I was looking for this information for my mission.

By хранение вещей в минске, March 24, 2023 @ 8:33 pm

Please let me know if you’re looking for a author for your blog.

You have some really great posts and I believe I would be a good

asset. If you ever want to take some of the load off, I’d really

like to write some material for your blog in exchange for a

link back to mine. Please shoot me an e-mail if interested.

Many thanks!

By хранение вещей минск, March 24, 2023 @ 8:56 pm

Thank you for the good writeup. It in fact was a amusement account

it. Look advanced to more added agreeable from

you! By the way, how can we communicate?

By http://masakra.ru/, March 25, 2023 @ 4:55 am

My brother suggested I may like this website. He was

entirely right. This submit actually made my day. You cann’t

believe simply how a lot time I had spent for this information! Thank you!

By хранение бытовой техники, March 25, 2023 @ 5:00 am

Write more, thats all I have to say. Literally, it seems as though you relied on the video

to make your point. You obviously know what youre talking about,

why waste your intelligence on just posting videos to your site when you could be giving us something enlightening to

read?

By хранение техники, March 25, 2023 @ 6:20 am

This piece of writing is actually a good one it assists

new internet users, who are wishing in favor of blogging.

By http://mydwg.ru/, March 28, 2023 @ 1:18 am

In fact when someone doesn’t understand after that its up to other people that they will

help, so here it occurs.

By удаление пигментных пятен, March 28, 2023 @ 4:55 am

If you are going for finest contents like me, only pay a quick visit this

web page all the time for the reason that it offers feature contents, thanks

By лазерное удаление тату цена, March 30, 2023 @ 12:33 am

I was able to find good information from your articles.

By удаление тату минск, March 30, 2023 @ 12:59 am

Hello there! I simply would like to offer you

a big thumbs up for your great information you have got here

on this post. I’ll be coming back to your website for more soon.

By удаление тату минск, March 30, 2023 @ 1:33 am

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a

comment is added I get three e-mails with the same comment.

Is there any way you can remove me from that service?

Thanks!

By сколько стоит свести тату, March 30, 2023 @ 3:26 am

Superb, what a web site it is! This webpage presents valuable information to

us, keep it up.

By http://remontiruj-info.ru/, March 30, 2023 @ 4:21 am

Hi this is somewhat of off topic but I was wanting to know if blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding know-how so I wanted to

get advice from someone with experience. Any help would be enormously

appreciated!

By http://infostroitely.ru/, March 31, 2023 @ 4:03 pm

Thankfulness to my father who told me concerning this webpage,

this webpage is truly remarkable.

By http://avto-zhelezo.ru/, April 3, 2023 @ 2:44 pm

Aw, this was a very nice post. Spending some time and actual effort to produce a top notch article… but what can I say… I procrastinate

a lot and don’t manage to get anything done.

By Хранение вещей Минск, April 3, 2023 @ 5:38 pm

We are a bunch of volunteers and opening a new scheme in our

community. Your web site offered us with valuable information to work on. You’ve performed a formidable activity and our whole

community can be thankful to you.

By http://stroitely-tut.ru/, April 5, 2023 @ 12:17 pm

Wonderful site you have here but I was curious about if

you knew of any forums that cover the same topics discussed in this article?

I’d really love to be a part of community where I

can get feed-back from other experienced people that share the same interest.

If you have any recommendations, please let me know.

Cheers!

By http://masterstroy-info.ru/, April 6, 2023 @ 9:25 pm

Do you have a spam issue on this blog; I also am a blogger, and I

was curious about your situation; we have created some nice practices and we

are looking to trade techniques with others, be sure to shoot me

an email if interested.

By http://specstroyka-info.ru/, April 7, 2023 @ 2:39 pm

Does your site have a contact page? I’m having trouble locating it but, I’d like to shoot you an e-mail.

I’ve got some creative ideas for your blog you might be interested in hearing.

Either way, great website and I look forward to seeing it expand over time.

By сервис хранения вещей, April 9, 2023 @ 8:48 pm

I think this is one of the most significant information for me.

And i am glad reading your article. But want to remark on few general things, The site style is wonderful, the articles is really nice :

D. Good job, cheers

By https://vyvod-iz-zapoya-minsk.ru/, April 16, 2023 @ 2:06 am

Ahaa, its fastidious conversation about this piece of writing here at this webpage, I

have read all that, so at this time me also commenting here.

By https://vyvod-iz-zapoya-minsk.online/, April 16, 2023 @ 7:50 am

I’m very happy to discover this page. I want to to thank

you for ones time for this wonderful read!!

I definitely savored every part of it and i also have you bookmarked to check out

new stuff on your website.

By http://vopros-remonta-info.ru/, April 16, 2023 @ 8:53 am

I don’t know if it’s just me or if perhaps everyone else experiencing problems

with your blog. It appears like some of the written text on your content are running off the screen. Can someone else please comment and let me

know if this is happening to them too? This may

be a problem with my internet browser because I’ve had this

happen before. Thanks

By http://tut-proremont.ru/, April 19, 2023 @ 12:32 pm

magnificent submit, very informative. I wonder why the

other experts of this sector don’t notice this. You should proceed your writing.

I’m sure, you’ve a great readers’ base already!

By http://otremontirowal.ru/, April 20, 2023 @ 6:41 pm

I am regular visitor, how are you everybody? This post posted at

this web page is really good.

By http://smartremstr.ru/, April 21, 2023 @ 11:43 am

My programmer is trying to convince me to move to .net from

PHP. I have always disliked the idea because of

the costs. But he’s tryiong none the less.

I’ve been using WordPress on numerous websites for about a year and am nervous about switching

to another platform. I have heard excellent things about blogengine.net.

Is there a way I can import all my wordpress posts into

it? Any help would be really appreciated!

By http://sad-ogorod-info.ru/, April 21, 2023 @ 8:30 pm

I think this is one of the most significant info for me. And i am

glad reading your article. But should remark on some general things, The website style is ideal, the articles is really great :

D. Good job, cheers

By http://vgryadkah.ru/, April 25, 2023 @ 6:37 am

Hello this is somewhat of off topic but I was wanting to know if

blogs use WYSIWYG editors or if you have to manually code with HTML.

I’m starting a blog soon but have no coding know-how

so I wanted to get guidance from someone with experience.

Any help would be greatly appreciated!

By http://dachnik-info.ru/, April 28, 2023 @ 6:59 pm

For the reason that the admin of this site is working, no question very rapidly it

will be well-known, due to its quality contents.

By suba, April 29, 2023 @ 5:18 pm

Disabled sports also adaptive sports or parasports, are sportsplayed by persons with a disability, such as physical and intellectual disabilities.

By bronx moving companies, May 1, 2023 @ 3:37 am

wow, awesome post.Really thank you! Really Great.

By roofing contractor, May 1, 2023 @ 9:56 am

Really enjoyed this blog post.Much thanks again. Will read on…

By yes-dacha.ru, May 1, 2023 @ 2:28 pm

I used to be recommended this blog by means of my cousin. I am not positive whether this publish is written by way of him as no one else realize such unique approximately my difficulty. You are wonderful! Thank you!

By Gen Z is entrepreneurial, May 2, 2023 @ 8:43 am

Hi there, just became aware of your blog through Google, and found that it istruly informative. I am going to watch out for brussels.I will appreciate if you continue this in future.A lot of people will be benefited from your writing. Cheers!

By chapter 13 bankruptcy lawyers near me savanna, May 2, 2023 @ 11:35 am

wow, awesome blog article.Really looking forward to read more. Want more.

By ivistroy.ru, May 2, 2023 @ 11:37 am

I like the valuable information you supply for your articles. I will bookmark your weblog and test again here frequently. I am quite certain I will be informed a lot of new stuff right here! Good luck for the following!

By Communication, May 3, 2023 @ 1:55 am

I am extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the nice quality writing, it?s rare to see a nice blog like this one today..

By anxiety counseling columbia, May 3, 2023 @ 2:45 am

Appreciate you sharing, great blog article.Really thank you! Will read on…

By Mang hpde, May 3, 2023 @ 12:05 pm

Hello, you used to write magnificent, but the last few posts have been kinda boring… I miss your great writings. Past several posts are just a little out of track! come on!

By obshchestroy.ru, May 3, 2023 @ 12:30 pm

Thanks for one’s marvelous posting! I quite enjoyed reading it, you might be a great author. I will make certain to bookmark your blog and definitely will come back in the future. I want to encourage continue your great posts, have a nice morning!

By Over Night Agra tour from Delhi, May 3, 2023 @ 5:00 pm

I value the article.Much thanks again. Really Cool.

By remont-master-info.ru, May 4, 2023 @ 3:08 am

Hi there to all, how is all, I think every one is getting more from this website, and your views are nice for new users.

By Relationship Questions, May 4, 2023 @ 8:29 am

WE HELP YOU SOLVE THE PROBLEMS IN YOUR LIFE AND IN YOUR RELATIONSHIPS(Offices all over the UK)

By Andy Pau, May 4, 2023 @ 9:07 am

That is a great tip especially to those new to the blogosphere. Simple but very precise infoÖ Thanks for sharing this one. A must read article!

By smartremstroy.ru, May 5, 2023 @ 2:22 am

Howdy terrific blog! Does running a blog like this take a lot of work? I have no knowledge of computer programming but I was hoping to start my own blog soon. Anyways, if you have any recommendations or tips for new blog owners please share. I know this is off topic but I just needed to ask. Thank you!

By nemasterok.ru, May 5, 2023 @ 7:35 am

It’s enormous that you are getting ideas from this piece of writing as well as from our discussion made here.

By remstrdom.ru, May 5, 2023 @ 3:23 pm

Great post. I am facing a few of these issues as well..

By bra manufacturer, May 6, 2023 @ 5:47 am

Thanks-a-mundo for the article.Much thanks again. Fantastic.

By mirsadovnikov.ru, May 6, 2023 @ 2:37 pm

I am extremely inspired together with your writing skills and alsowell as with the format for your blog. Is this a paid subject matter or did you customize it yourself? Either way stay up the nice quality writing, it’s rare to see a nice blog like this one nowadays..

By glavdachnik.ru, May 7, 2023 @ 2:51 pm

I am actually happy to read this weblog posts which consists of plenty of helpful information, thanks for providing these data.

By Aluminum PCB, May 7, 2023 @ 4:19 pm

Very good article.Much thanks again. Awesome.

By pvc sheet china, May 8, 2023 @ 2:20 am

Great, thanks for sharing this blog post.Really looking forward to read more. Want more.

By daftar poker88, May 8, 2023 @ 4:24 am

single women datingtree ring dating for kids

By E-commerce, May 8, 2023 @ 7:43 am

Thanks so much for the blog article.Really thank you! Much obliged.

By china soft cooler, May 8, 2023 @ 3:10 pm

Very informative blog article. Will read on…

By wolf-gold-slot-review.com, May 9, 2023 @ 3:48 am

I don’t know who you are but certainly you are going to a famous blogger if you aren’t already Cheers!

By reserva taxi, May 9, 2023 @ 5:56 am

Thanks a lot, Quite a lot of stuff.what is essay writing help me write my essay speech writing services online

By radio taxi madrid, May 9, 2023 @ 7:07 am

power bank reviews australia of America offers a fewvarious rates tiers.

By infoda4nik.ru, May 9, 2023 @ 8:56 am

Hello there, simply become aware of your blog thru Google, and found that it is really informative. I’m gonna watch out for brussels. I will appreciate should you continue this in future. Lots of other people might be benefited from your writing. Cheers!

By Wholesale t-shirt suppliers in Bangladesh, May 9, 2023 @ 10:17 am

modafinil provigil provigil online modalert online

By ogorodkino.ru, May 10, 2023 @ 1:53 am

I’m not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for fantastic information I was looking for this information for my mission.

By diaphragm sheet material, May 10, 2023 @ 2:37 am

Really enjoyed this blog post.Really thank you! Really Great.

By beautiful home design, May 10, 2023 @ 4:54 am

write a thesis master thesis writing service

By sadovoe-tut.ru, May 10, 2023 @ 8:36 am

Truly no matter if someone doesn’t know after that its up to other people that they will help, so here it occurs.

By hay day скачать на компьютер, May 10, 2023 @ 5:55 pm

Hi there, I check your blogs like every week. Your writing style is awesome, keep up the good work!

By hay day скачать на компьютер, May 11, 2023 @ 3:11 am

Asking questions are actually nice thing if you are not understanding anything entirely, except this piece of writing gives pleasant understanding even.

By Msvtpv, May 11, 2023 @ 3:55 am

buy cialis 10mg real cialis fast shipping male ed drugs

By poker88, May 11, 2023 @ 3:42 pm

ventolin hooikoorts ventolin generic release date ventolin spray sastav

By baccaratsite, May 11, 2023 @ 10:49 pm

Your article has answered the question I was wondering about! I would like to write a thesis on this subject, but I would like you to give your opinion once baccaratsite

baccaratsite

By mma, May 12, 2023 @ 9:33 am

I truly appreciate this post. I’ve been looking everywhere for something similar to this! Thank goodness I found it on Bing. You have made my day! Thank you again! soyos

By Zaza casino login, May 12, 2023 @ 4:26 pm

Nice post. I was checking continuously this blog and I’m impressed! Very helpful info specifically the last part

By no deposit bonus, May 13, 2023 @ 2:37 am

I’m gone to say to my little brother, that he should also paya quick visit this blog on regular basis to take updated from most up-to-date newsupdate.

By technology, May 13, 2023 @ 5:16 am

free online slots online slot games slot games

By gambling sites, May 13, 2023 @ 10:46 am

lisinopril side effects hydrochlorothiazide potassium wasting

By players, May 13, 2023 @ 7:06 pm

Greetings! Very helpful advice in this particular post! It is the little changes that will make the greatest changes.Many thanks for sharing!

By Mindi Chapman, May 14, 2023 @ 1:26 am

I?m not sure where you’re getting your information, but great topic. I needs to spend some time learning much more or understanding more. Thanks for fantastic info I was looking for this info for my mission.

By просмотры в яппи, May 14, 2023 @ 8:08 am

Saved as a favorite, I really like your site!

By накрутка просмотров яппи, May 14, 2023 @ 4:22 pm

I want to to thank you for this great read!! I certainly enjoyed every little bit of it. I’ve got you bookmarked to check out new stuff you post

By 부평출장마사지, May 15, 2023 @ 3:43 am

Im grateful for the article.Thanks Again. Awesome.

By накрутка просмотров яппи, May 15, 2023 @ 6:39 am

I was able to find good info from your blog posts.

By renewable energy, May 15, 2023 @ 7:19 am

Hi there! Do you use Twitter? I’d like to follow you if thatwould be okay. I’m absolutely enjoying your blog and look forward to new updates.

By checking account, May 15, 2023 @ 12:18 pm

dissertation help literature review dissertation outline

By casino online slots, May 15, 2023 @ 8:59 pm

walmart store pharmacy pharmacy discount card rx relief

By slot machine, May 16, 2023 @ 2:31 am

West Virginia recently ushered in a new era for West Virginia gambling.

By smoktech, May 16, 2023 @ 5:55 am

Great, thanks for sharing this article post.Really looking forward to read more.

By games developed, May 16, 2023 @ 7:31 am

Yes! Finally someone writes about achieve rapid weight loss loss.

By LinkBuilder, May 16, 2023 @ 1:11 pm

You can certainly see your enthusiasm in the work you write. The world hopes for even more passionate writers like you who aren’t afraid to say how they believe. Always go after your heart.

By Reformas estructurales madrid, May 16, 2023 @ 7:33 pm

I really like what you guys are up too. This type of clever work and reporting!Keep up the excellent works guys I’ve includedyou guys to my own blogroll.

By online slots, May 16, 2023 @ 11:09 pm

Good blog you’ve got here.. Itís hard to find excellent writing like yours nowadays. I honestly appreciate individuals like you! Take care!!

By replica chanel, May 17, 2023 @ 3:39 am

I really enjoy the blog.Really looking forward to read more. Great.

By Карта мира из дерева на стену, May 17, 2023 @ 5:49 am

Hey! I know this is kind of off-topic but I had to ask. Does operating a well-established blog like yours take a lot of work? I’m completely new to writing a blog but I do write in my diary everyday. I’d like to start a blog so I will be able to share my experience and thoughts online. Please let me know if you have any suggestions or tips for new aspiring bloggers. Appreciate it!

By roulette game, May 17, 2023 @ 6:05 am

hi!,I like your writing very a lot! share we communicate extra about your article on AOL? I need an expert in this house to resolve my problem. Maybe that’s you! Taking a look forward to look you.

By diaper price philippines, May 17, 2023 @ 11:29 am

Thanks so much for the article.Thanks Again. Much obliged.

By Taxi aeropuerto, May 17, 2023 @ 12:05 pm

That is a very good tip especially to those fresh to the blogosphere. Short but very accurate information… Thanks for sharing this one. A must read article!

By cobalt removal agent, May 17, 2023 @ 12:11 pm

Thank you ever so for you blog article.Much thanks again. Want more.

By poker88, May 17, 2023 @ 2:52 pm

I enjoyed your post. Thank you. I have been looking everywhere for this! This is an excellent, an eye-opener for sure! I truly appreciate this post.

By visit website, May 17, 2023 @ 9:36 pm

✅เลือกสมัครรับโบนัสเครดิตฟรี

By may phun rua ap luc cao, May 17, 2023 @ 11:53 pm

I always was interested in this subject and still am, thankyou for putting up.

By mercedes glc 2023, May 18, 2023 @ 4:43 am

I’m extremely impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the excellent quality writing, it is rare to see a great blog like this one today.

By visit website, May 18, 2023 @ 10:33 am

I am really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you customize it yourself? Anyway keep up the nice quality writing, it is rare to see a nice blog like this one these days..

By Startupo.fr, May 19, 2023 @ 2:41 am

slots games free online slots online slot games

By agrosadovnik.ru, May 19, 2023 @ 4:27 am

I am extremely impressed with your writing skills and also with the layout on your blog. Is this a paid theme or did you customize it yourself? Either way keep up the nice quality writing, it’s rare to see a nice blog like this one nowadays.

By bob tape, May 20, 2023 @ 2:36 pm

My brother suggested I would possibly like this website. He used to be totally right. This submit actually made my day. You cann’t believe just how much time I had spent for this information! Thank you!

By bob tape for breast lift, May 21, 2023 @ 10:20 am

Hey there would you mind stating which blog platform you’re working with? I’m planning to start my own blog in the near future but I’m having a difficult time choosing between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I’m looking for something completely unique. P.S My apologies for getting off-topic but I had to ask!

By Baidu Baike/ Encyclopedia, May 21, 2023 @ 1:36 pm

Im grateful for the article. Will read on…

By Kelmum, May 21, 2023 @ 2:28 pm

buy azipro 500mg order neurontin 100mg pill buy gabapentin 100mg for sale

By купить пуговицы, May 22, 2023 @ 3:39 am

Hi, i think that i saw you visited my web site so i came to

By gui hang di My tai TpHCM, May 22, 2023 @ 10:27 am

what is hydroxychloroquine prescribed for chloroquine phosphate online

By set up business in hong kong, May 23, 2023 @ 4:51 am

A big thank you for your article post.Really thank you! Will read on…

By instax film, May 23, 2023 @ 6:16 am

Hey, thanks for the blog. Really Cool.

By gkindex.com/, May 23, 2023 @ 9:19 am

Really informative blog.Thanks Again. Will read on…

By Ddhqad, May 23, 2023 @ 10:35 am

oral furosemide 40mg doxycycline pills antihistamine tablets

By Прогон сайта хрумером, May 23, 2023 @ 10:44 am

fantastic issues altogether, you just gained a emblem new reader. What might you suggest in regards to your submit that you made a few days ago? Any sure?

By Tour Thai Lan 5 Ngay 4 Dem, May 23, 2023 @ 11:37 am

Is anyone here in a position to recommend Remote Control Vibrators? Cheers xox

By nhom dinh hinh, May 23, 2023 @ 2:16 pm

Howdy juzt wanted too give you a brief heads up and let you know a feew of the imagesaren’t loading correctly. I’m not sure why but I thinkits a linking issue. I’ve tried it in two different browsers and both show tthe same outcome.

By download nekopoi, May 23, 2023 @ 7:25 pm

Im obliged for the post.Thanks Again. Great.

By prazdnikopen.ru, May 23, 2023 @ 11:20 pm

Good day! I could have sworn Iíve been to this blog before but after going through some of the articles I realized itís new to me. Regardless, Iím definitely happy I came across it and Iíll be bookmarking it and checking back often!

By find more here, May 24, 2023 @ 1:42 am

Hi there! I simply want to give you a big thumbs up for your great information you have got right here on this post. I will be returning to your blog for more soon.

By Exquisite rare herbs: Blue Tansy, Sea Buckthorn, Helichrysum, May 24, 2023 @ 3:43 am

I dugg some of you post as I thought they were very useful extremely helpful.

By rope assembly| laptop lock| brake cable| tool lanyard| plastic stretchy spring coil keychain key}, May 24, 2023 @ 4:10 am

Im thankful for the blog article.Really looking forward to read more. Will read on…

By Qbeqxk, May 25, 2023 @ 4:20 am

levitra 10mg pills plaquenil online buy hydroxychloroquine buy online

By Nbmugg, May 25, 2023 @ 5:54 pm

buy ramipril without a prescription cost amaryl arcoxia 60mg uk

By comprar seguidores Instagram, May 26, 2023 @ 2:44 am

Aw, this was an exceptionally nice post. Finding the time and actual effort to make a very good article… but what can I say… I hesitate a whole lot and don’t manage to get anything done.

By 光算, June 14, 2023 @ 10:56 am

Appreciate you sharing, great post. Fantastic.

By https://www.skupkamsk.site, June 14, 2023 @ 11:48 am

где продать золото цена

By шкафы-купе на заказ в Твери, June 14, 2023 @ 4:21 pm

I feel this is one of the so much significant information for me. And i’m glad reading your article. However want to observation on few basic things, The website taste is perfect, the articles is in point of fact nice : D. Good process, cheers

By Hvndlr, June 15, 2023 @ 2:59 am

buy cheap acillin generic ampicillin 250mg buy generic metronidazole 400mg

By svooulrt, June 15, 2023 @ 4:36 am

buy accutane online in canada where to buy accutane usa

By fiptklmk, June 15, 2023 @ 4:38 am

Considering purchase accutane treatment? Visit accutane prices for affordable options.

By rhfuvuhf, June 15, 2023 @ 5:05 am

How does a 10 mg dosage of Accutane compare to other available dosages? https://isotretinoinex.website/

By evropski univerzitet, June 15, 2023 @ 8:01 am

That is a good tip particularly to those fresh to the blogosphere. Short but very accurate information Thanks for sharing this one. A must read post!

By Ntrkfz, June 15, 2023 @ 12:53 pm

sumycin 250mg tablet flexeril 15mg generic order ozobax pills

By Evropski univerzitet "Kallos" Tuzla, June 15, 2023 @ 1:18 pm

I need to to thank you for this good read!! I certainly loved every bit of it. I’ve got you saved as a favorite to look at new things you postÖ

By логистический склад, June 15, 2023 @ 1:24 pm

Hello there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

By investing in stocks, June 15, 2023 @ 6:53 pm

A fascinating discussion is definitely worth comment.I think that you should write more about this topic, it might notbe a taboo matter but usually folks don’t discussthese subjects. To the next! Many thanks!!

By investment platforms, June 16, 2023 @ 3:00 am

It is in reality a great and useful piece of information. I am satisfied that you simply shared this helpful info with us. Please keep us up to date like this. Thanks for sharing.

By best fx broker, June 16, 2023 @ 6:08 am

pill with 159 meloxicam mobic type of medication meloxicam warnings

By логистический центр Минск, June 16, 2023 @ 2:48 pm

I got this web site from my friend who told me concerning this web site and now this time I am visiting this site and reading very informative articles at this place.

By Xsybtx, June 16, 2023 @ 10:42 pm

generic bactrim septra over the counter clindamycin over the counter

By Sdvooa, June 17, 2023 @ 2:22 am

buy generic toradol 10mg how to get inderal without a prescription buy inderal 20mg generic

By bezogoroda.ru, June 17, 2023 @ 2:26 pm

My relatives all the time say that I am wasting my time here at net, except I know I am getting familiarity daily by reading such nice articles.

By solar flood lights outdoor, June 18, 2023 @ 8:28 am

Im thankful for the blog.Much thanks again. Want more.

By Mctnzf, June 18, 2023 @ 4:37 pm

plavix 75mg us medex over the counter buy generic warfarin over the counter

By Taedys, June 18, 2023 @ 6:48 pm

buy erythromycin 500mg for sale buy sildenafil 50mg for sale purchase nolvadex pills

By investing in indices, June 19, 2023 @ 6:50 am

การเดิมพันที่ง่ายที่สุดคงหนีไม่พ้นคาสิโนออนไลน์เพราะไม่ว่าจะอยู่ที่ไหนทำอะไรก็สามารถทำเงินได้ตลอดเวลา เว็บการพนันออนไลน์อันดับ 1 เว็บคาสิโนออนไลน์ที่ทันสมัยที่สุด ใช้ระบบอัตโนมัติในการฝากถอน ง่ายต่อการใช้ และยังมีทีมงานคอยดูแล 24 ชั่วโมง

By commission free stock trading, June 19, 2023 @ 7:02 pm

Hi there, this weekend is nice in support of me, because thisoccasion i am reading this fantastic educational post here at my residence.Here is my blog post; craksracing.com

By stock charts live, June 20, 2023 @ 5:12 am

Thanks for sharing your thoughts about ネットカジノ.Regards

By Pnqiul, June 20, 2023 @ 7:15 am

buy reglan 10mg online cheap purchase reglan sale buy esomeprazole online cheap

By may bay phun thuoc, June 20, 2023 @ 1:44 pm

You said it perfectly..how to write a essay paper custom papers online assignment writing help

By Httedo, June 20, 2023 @ 4:17 pm

purchase rhinocort without prescription ceftin sale purchase careprost generic

By on thi thue, June 20, 2023 @ 7:39 pm

aralen hcl is hydroxychloroquine an antibiotic

By Cowden Hammond, June 21, 2023 @ 12:22 am

Very energetic article, I enjoyed that bit. Will therebe a part 2?

By 庇护个人陈述, June 21, 2023 @ 1:25 am

Fantastic article post.Really thank you!

By party stany jicín, June 21, 2023 @ 4:56 am

It’s really a nice and useful piece of information. I’m happy that you just shared this helpful information with us.Please keep us informed like this. Thanks for sharing.

By hotnewsofday.com/???????????????????/, June 21, 2023 @ 9:30 am

Awsome info and right to the point. I don’t know if this is really the best place to ask but do you folks have any ideea where to hire some professional writers? Thx

By Jackie Haines, June 21, 2023 @ 3:57 pm

Truly no matter if someone doesn’t be aware of afterward its upto other viewers that they will help, so here it happens.

By Перекладные фокусы, June 21, 2023 @ 3:59 pm

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but other than that, this is great blog. An excellent read. I’ll definitely be back.

By Tetracycline side effects, June 21, 2023 @ 6:50 pm

Tetracycline brand names

By Aacyll, June 21, 2023 @ 11:57 pm

oral topiramate cheap topiramate 200mg cheap levofloxacin 250mg

By Uamkbs, June 22, 2023 @ 1:01 pm

how to get robaxin without a prescription buy generic methocarbamol suhagra 50mg ca

By for more information, June 23, 2023 @ 5:39 am

I really liked your article post.Much thanks again. Fantastic.

By fajas colombianas, June 23, 2023 @ 2:14 pm

continuously i used to read smaller content which alsoclear their motive, and that is also happening with thispiece of writing which I am reading at this time.

By Dlxamy, June 23, 2023 @ 2:48 pm

order avodart online cheap dutasteride generic buy meloxicam medication

By valvulas de retencion, June 23, 2023 @ 4:55 pm

medications for ed ed pills from canada – reasons for ed

By remote ssh iot, June 24, 2023 @ 1:35 am

Thank you for your article. Really Great.

By ufabetwins.info/ufabet-???????/, June 24, 2023 @ 3:40 am

Sweet blog! I found it while searching on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I’ve been trying for a while but I never seem to get there! Many thanks

By Rush, June 24, 2023 @ 8:33 am

Thank you ever so for you blog post.Really thank you! Want more.

By Cevkcd, June 24, 2023 @ 9:40 am

order aurogra 50mg generic order estrace 1mg for sale estrace 1mg for sale

By first time home buyer dc, June 24, 2023 @ 11:25 am

Fantastic blog article.Really thank you! Great.

By Evropski univerzitet "Kallos" Tuzla, June 24, 2023 @ 5:12 pm

tadalafil peptide tadalafil liquid tadalafil bph mechanism

By 雙效 威而 鋼, June 24, 2023 @ 5:43 pm

Major thankies for the post.Much thanks again. Want more.

By this website, June 24, 2023 @ 7:51 pm

Itís nearly impossible to find well-informed people on this topic, but you seem like you know what youíre talking about! Thanks

By Nigsuf, June 25, 2023 @ 4:55 am

celecoxib 200mg drug celecoxib 200mg canada order zofran 8mg generic

By laser welding machine for sale/hand held laser welding machine, June 25, 2023 @ 6:14 am

Really appreciate you sharing this blog post.Really thank you! Really Cool.

By see this website, June 25, 2023 @ 11:06 am

A round of applause for your blog article.Much thanks again.

By Web Site, June 25, 2023 @ 2:08 pm

Really enjoyed this article. Really Cool.

By check my source, June 26, 2023 @ 3:12 am

Major thanks for the blog.Really thank you! Much obliged.

By Craiganams, June 26, 2023 @ 7:29 am

купить бетон в домодедово цена

By Ctikdg, June 26, 2023 @ 8:26 am

lamictal over the counter prazosin 1mg over the counter order minipress 1mg for sale

By Hyperbaric Chamber Dublin, June 26, 2023 @ 8:27 am

I am not sure where you are getting your info, but great topic.I needs to spend some time learning more or understanding more.Thanks for fantastic info I was looking for this info for my mission.

By vammebel.ru, June 26, 2023 @ 9:03 am

It is appropriate time to make some plans for the future and it is time to be happy. I have read this post and if I could I wish to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I wish to read more things about it!

By additional info, June 26, 2023 @ 9:35 am

I really like and appreciate your blog.Thanks Again. Great.

By Hbot Ireland, June 26, 2023 @ 10:19 am

sublingual tadalafil tadalafil liquid taldenafil

By spravki-kupit.ru, June 26, 2023 @ 3:48 pm

справки москва

By visit homepage, June 26, 2023 @ 5:23 pm

Thanks-a-mundo for the article post.Really thank you! Much obliged.

By Vkxkmi, June 26, 2023 @ 8:23 pm

spironolactone 100mg pills cheap valacyclovir buy valtrex pill

By www.ufabetwins.info/????????????????????/, June 27, 2023 @ 2:45 am

What’s up, after reading this awesome piece of writing i amtoo happy to share my experience here with mates.

By this post, June 27, 2023 @ 4:33 am

Major thankies for the blog.Really looking forward to read more. Much obliged.

By see this here, June 27, 2023 @ 8:58 am

Wow, great blog article.Really thank you! Really Cool.

By ??????, June 27, 2023 @ 10:12 am

Heya i’m for the primary time here. I found this board and I findIt truly helpful & it helped me out much. I am hoping to give one thing back and help others suchas you helped me.

By Professor Smith, June 27, 2023 @ 10:59 am

Hi there, I found your web site by the use of Google even as searching for a similar matter, your site got here up, it seems to be good. I have bookmarked it in my google bookmarks.

By диплом высшего образования с занесением в реестр, June 27, 2023 @ 12:03 pm

Wow, marvelous blog layout! How long have you been blogging for? you make blogging glance easy. The full glance of your site is great, let alonesmartly as the content!

By Tour My, June 27, 2023 @ 12:22 pm

Awesome article post.Really thank you! Will read on…

By great post to read, June 27, 2023 @ 1:45 pm

I really liked your blog.Thanks Again. Much obliged.

By official site, June 27, 2023 @ 5:20 pm

I appreciate you sharing this post.Really looking forward to read more. Fantastic.

By Gladys Goddard, June 27, 2023 @ 8:14 pm

It is in reality a great and helpful piece of information. I’m glad that you just shared this helpful information with us. Please stay us informed like this. Thank you for sharing.

By FDM 3D printing prototype servic, June 28, 2023 @ 2:29 am

Awesome article post.Much thanks again. Keep writing.

By this website, June 28, 2023 @ 6:18 am

Thank you for making this really good article. I’ll return to see more.

By Accountants Bermondsey, June 28, 2023 @ 9:28 am

I’m not sure where you are getting your info, however good topic.I needs to spend some time finding out more or figuring outmore. Thank you for wonderful information I used to be on the lookout for this information formy mission.

By Dtkwea, June 28, 2023 @ 9:34 am

order tretinoin cream sale avana for sale brand avanafil

By Whoxbu, June 28, 2023 @ 11:07 am

finasteride 5mg tablet order viagra 100mg pills buy sildenafil online cheap

By mini label printer, June 29, 2023 @ 7:05 am

Awesome article post.Really thank you! Great.

By mini label printer, June 29, 2023 @ 8:26 am

wow, awesome blog post.Thanks Again. Want more.

By Canada Immigration, June 29, 2023 @ 1:17 pm

I really liked your post. Great.

By накрутить просмотры яппи, July 30, 2023 @ 7:57 am

I like the valuable information you provide in your articles. I will bookmark your weblog and check again here frequently. I am quite certain I will learn plenty of new stuff right here! Good luck for the next!

By types of ball valve, July 31, 2023 @ 1:03 am

Nullam pharetra odio ligula, at auctor sem faucibus a.

By dog dress shirt, July 31, 2023 @ 2:01 am

Really appreciate you sharing this article post. Cool.

By Psychic Parties, July 31, 2023 @ 3:19 am

I am often to running a blog and i really admire your content. The article has really peaks my interest. I am going to bookmark your site and maintain checking for brand new information.

By aftercare tattoo, July 31, 2023 @ 5:24 am

Fantastic blog post.Really looking forward to read more. Awesome.

By Pixelmate Exhibition Co. Ltd., July 31, 2023 @ 8:45 am

Hi mates, how is everything, and what you desire to say concerning this post, in my view its truly amazing in favor ofme.

By tattoo oslo, July 31, 2023 @ 9:23 am

A round of applause for your article post.Thanks Again. Much obliged.

By bokep indo, July 31, 2023 @ 12:11 pm

Thanks for sharing your ideas. I’d also like to express that video games have been ever before evolving. Technology advances and innovations have made it easier to create sensible and enjoyable games. These kind of entertainment games were not as sensible when the actual concept was first of all being tried. Just like other designs of technologies, video games as well have had to evolve by means of many years. This is testimony for the fast progression of video games.

By Ccjnqq, July 31, 2023 @ 5:51 pm

dexamethasone 0,5 mg cheap cheap zyvox 600 mg buy nateglinide 120mg online

By Nlgbee, August 1, 2023 @ 12:51 am

purchase trileptal generic ursodiol 150mg price buy actigall 150mg online cheap

By pizza herbs, August 1, 2023 @ 3:22 am

Great, thanks for sharing this post.Really looking forward to read more. Cool.

By stroitelstvo domov pod kluch, August 1, 2023 @ 8:15 am

I am so grateful for your article. Keep writing.

By birla niyaara worli posession date, August 1, 2023 @ 8:27 am

This is one awesome blog post.Thanks Again. Really Great.

By Australian High Commission, August 1, 2023 @ 12:44 pm

Wow, great blog. Really Great.

By artistas locales malaga, August 1, 2023 @ 2:21 pm

Aw, this was an incredibly nice post. Finding the time and actual effort to generate a very good article… but what can I say… I procrastinate a whole lot and never manage to get anything done.

By Arctic Blast, August 1, 2023 @ 4:21 pm

The very root of your writing while sounding reasonable at first, did not really sit very well with me personally after some time. Someplace within the sentences you actually were able to make me a believer unfortunately just for a very short while. I still have got a problem with your leaps in assumptions and one might do nicely to help fill in all those gaps. If you actually can accomplish that, I could definitely end up being impressed.

By daachnik.ru, August 1, 2023 @ 5:09 pm

Hello, I log on to your new stuff daily. Your writing style is awesome, keep up the good work!

By e visa India, August 1, 2023 @ 5:28 pm

Really informative article.Much thanks again. Keep writing.

By www.ngtechgist.com, August 1, 2023 @ 6:03 pm

I really enjoy the article.Really looking forward to read more. Really Cool.

By daachnik.ru, August 1, 2023 @ 8:19 pm

Everything is very open with a clear explanation of the issues. It was truly informative. Your website is very useful. Thank you for sharing!

By lungeklinikken, August 2, 2023 @ 3:02 am

Very good post.Really thank you! Cool.

By credit card processing iso programs, August 2, 2023 @ 6:04 am

Hi there! This is kind of off topic but I need some guidance from an established blog. Is it tough to set up your own blog? I’m not very techincal but I can figure things out pretty fast. I’m thinking about creating my own but I’m not sure where to begin. Do you have any tips or suggestions? Cheers

By windows 10 pro product key, August 2, 2023 @ 7:43 am

Im thankful for the article.Really thank you! Keep writing.

By https://vnmu.edu.vn/members/jaemcree.25406/#info raising an AI, August 2, 2023 @ 9:58 am

Hello There. I found your blog using msn. This is an extremely well written article.I’ll be sure to bookmark it and come back to read more of your useful information. Thanks for the post.I will definitely return.

By delaremontnika.ru, August 2, 2023 @ 11:58 am

Great beat ! I wish to apprentice even as you amend your site, how can i subscribe for a blog site? The account aided me a appropriate deal. I were tiny bit familiar of this your broadcast provided vibrant transparent concept

By grønn fugemasse, August 2, 2023 @ 1:05 pm

This is one awesome blog.Much thanks again. Awesome.

By чистка дивана на дому цена жодино, September 2, 2023 @ 8:35 am

I’m not sure where you are getting your info, but good topic. I needs to spend some time learning more or understanding more. Thanks for fantastic information I was looking for this information for my mission.

By химчистка дивана на дому борисов, September 2, 2023 @ 11:30 am

Hi there! Do you know if they make any plugins to help with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Thanks!

By чистка диванов борисов, September 2, 2023 @ 11:53 am

Right now it seems like Drupal is the top blogging platform out there right now. (from what I’ve read) Is that what you’re using on your blog?

By Mqowad, September 2, 2023 @ 3:24 pm

monograph 600mg canada cost cilostazol 100mg cilostazol 100mg us

By how to start a payment processing company, September 3, 2023 @ 4:18 am

This is without a doubt one of the best articles I’ve read on this topic! The author’s extensive knowledge and zeal for the subject are evident in every paragraph. I’m so appreciative for finding this piece as it has enriched my knowledge and sparked my curiosity even further. Thank you, author, for investing the time to produce such a phenomenal article!

By link bokep, September 3, 2023 @ 4:54 pm

I additionally believe that mesothelioma is a unusual form of most cancers that is typically found in those previously exposed to asbestos. Cancerous tissue form in the mesothelium, which is a protective lining that covers almost all of the body’s internal organs. These cells generally form inside lining in the lungs, stomach, or the sac which encircles one’s heart. Thanks for expressing your ideas.

By Nzhkvn, September 4, 2023 @ 2:12 am

prasugrel 10 mg over the counter dimenhydrinate cheap tolterodine online order

By you could try here, September 5, 2023 @ 12:40 pm

What an eye-opening and well-researched article! The author’s meticulousness and capability to present intricate ideas in a understandable manner is truly praiseworthy. I’m totally enthralled by the scope of knowledge showcased in this piece. Thank you, author, for providing your expertise with us. This article has been a real game-changer!

By barbecue grill hk, September 6, 2023 @ 4:13 am

I loved your article.Much thanks again. Fantastic.

By sadovoe-tut.ru, September 6, 2023 @ 1:25 pm

Great blog you’ve got here.. It’s hard to find good quality writing like yours these days. I seriously appreciate people like you! Take care!!

By 美国CS代写, September 6, 2023 @ 5:16 pm

Thank you ever so for you blog post.Much thanks again. Cool.

By CNC Turning Service, September 6, 2023 @ 7:48 pm

Awesome blog.Really thank you! Really Cool.

By Huazhijun lab bench, October 7, 2023 @ 12:51 pm

I value the article. Cool.

By Whuoqv, October 7, 2023 @ 2:36 pm

phenytoin 100mg oral ditropan price order ditropan 5mg online cheap

By payday loan near me, October 7, 2023 @ 2:48 pm

Hmm it seems like your site ate my first comment (it was extremely long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog blogger but I’m still new to the whole thing. Do you have any tips and hints for beginner blog writers? I’d definitely appreciate it.

By Pyqlgq, October 7, 2023 @ 3:08 pm

perindopril 4mg cost order perindopril 4mg generic order allegra online cheap

By money loans near me, October 7, 2023 @ 7:51 pm

Your means of describing all in this article is in fact pleasant, all be able to without difficulty know it, Thanks a lot.

By situs togel online terpercaya, October 7, 2023 @ 8:52 pm

I truly appreciate this post. I?ve been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thx again

By online television, October 8, 2023 @ 5:17 pm

I always spent my half an hour to read this blog’s posts every day along with a cup of coffee.

By online television, October 8, 2023 @ 8:03 pm

As the admin of this site is working, no uncertainty very rapidly it will be well-known, due to its quality contents.

By Iwakbx, October 9, 2023 @ 4:16 pm

buy baclofen 10mg how to get ozobax without a prescription order toradol 10mg pills

By online television, October 10, 2023 @ 1:38 pm

What’s up everyone, it’s my first visit at this site, and article is in fact fruitful in favor of me, keep up posting such posts.

By Ickwgk, October 10, 2023 @ 10:16 pm

loratadine 10mg oral claritin where to buy priligy 30mg pills

By bonito, October 11, 2023 @ 2:32 am

Really informative blog.Much thanks again. Want more.

By online television, October 11, 2023 @ 5:47 am

It is perfect time to make some plans for the future and it is time to be happy. I have read this post and if I could I wish to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I wish to read more things about it!

By Qpoert, October 11, 2023 @ 10:42 am

baclofen cost buy ketorolac cheap buy generic ketorolac

By stream-pumps, October 11, 2023 @ 12:59 pm

A big thank you for your blog article.Much thanks again. Really Great.

By Tour packages for Varanasi, October 11, 2023 @ 5:33 pm

Thanks a lot for the article post.Much thanks again. Will read on…

By merchant services business model, October 12, 2023 @ 8:08 am

Have you ever considered publishing an ebook or guest authoring on other websites? I have a blog centered on the same information you discuss and would really like to have you share some stories/information. I know my readers would enjoy your work. If you’re even remotely interested, feel free to shoot me an email.

By чек на проживание в гостинице купить, October 13, 2023 @ 2:42 am

Thanks for one’s marvelous posting! I quite enjoyed reading it, you’re a great author.I will be sure to bookmark your blog and will eventually come back in the foreseeable future. I want to encourage one to continue your great job, have a nice afternoon!

By ososlot, October 13, 2023 @ 12:04 pm

I loved your post.Really thank you! Want more.

By Exdatc, October 13, 2023 @ 6:00 pm

fosamax pill buy furadantin sale furadantin 100 mg cheap

By Jobs in Canada, October 14, 2023 @ 9:22 am

A big thank you for your post.Really looking forward to read more. Really Cool.

By Electric Transaxles Blog, October 15, 2023 @ 3:14 am

Thanks for the blog post. Will read on…

By zenithund slew drive, October 15, 2023 @ 10:28 am

I am so grateful for your post.Really thank you! Really Cool.

By zenithund slew drive, October 15, 2023 @ 11:31 am

Muchos Gracias for your blog.Really thank you! Really Great.

By ku, October 15, 2023 @ 1:45 pm

Muchos Gracias for your article post.Thanks Again. Really Great.

By etransaxle blog, October 15, 2023 @ 3:56 pm

Awesome blog article. Will read on…

By документы на гостиницу в москве, October 15, 2023 @ 6:54 pm

If some one desires expert view regarding blogging after that i advise him/her to pay a visit this website, Keep up the good job.

By Dcpnhl, October 15, 2023 @ 11:13 pm

buy propranolol medication clopidogrel 75mg pill clopidogrel pills

By stars77, October 16, 2023 @ 1:59 am

I really like and appreciate your blog post.Thanks Again. Will read on…

By zenithund new energy, October 16, 2023 @ 2:15 am

I cannot thank you enough for the article post. Really Great.

By ku, October 16, 2023 @ 5:43 am

Thank you for your blog post.Really looking forward to read more. Awesome.

By 体育直播, October 16, 2023 @ 8:06 am

Hey, thanks for the blog.Really thank you! Keep writing.

By visit site, October 16, 2023 @ 12:30 pm

Im obliged for the article post.Thanks Again. Keep writing.

By bblogo, October 16, 2023 @ 4:04 pm

I really like and appreciate your article post.Really looking forward to read more. Great.

By чеки гостиницы с подтверждением, October 16, 2023 @ 4:28 pm

Excellent post. I used to be checking continuously this blog and I am inspired! Very useful information specially the ultimate phase I deal with such info a lot. I used to be seeking this particular info for a long timelong time. Thank you and good luck.

I deal with such info a lot. I used to be seeking this particular info for a long timelong time. Thank you and good luck.

By btyr, October 17, 2023 @ 2:54 am

Thank you for this article. I would also like to mention that it can end up being hard while you are in school and just starting out to create a long credit history. There are many individuals who are just simply trying to make it through and have a good or favourable credit history can be a difficult element to have.

By reference, October 17, 2023 @ 8:44 am

A big thank you for your article.Really thank you! Cool.

By чеки на гостиницу в москве с подтверждением, October 17, 2023 @ 9:38 am

Great delivery. Outstanding arguments. Keep up the good work.

By online television, October 17, 2023 @ 2:31 pm

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

By btyr, October 17, 2023 @ 10:05 pm

Thanks for the auspicious writeup. It in reality was a leisure account it. Glance complicated to far added agreeable from you! By the way, how can we communicate?

By Yueyjl, October 18, 2023 @ 4:13 am

nortriptyline 25mg cost buy panadol no prescription order anacin 500mg online cheap

By etransaxle, October 18, 2023 @ 5:23 am

Major thanks for the post.Really thank you! Want more.

By online television, October 18, 2023 @ 6:45 am

Hi there! I know this is kinda off topic nevertheless I’d figured I’d ask. Would you be interested in exchanging links or maybe guest writing a blog article or vice-versa? My website discusses a lot of the same subjects as yours and I believe we could greatly benefit from each other. If you happen to be interested feel free to send me an e-mail. I look forward to hearing from you! Wonderful blog by the way!

By Hmrrle, October 18, 2023 @ 4:09 pm

glimepiride price brand misoprostol 200mcg order arcoxia 60mg

By Laser Hair Removal Uxbridge, October 18, 2023 @ 11:53 pm

It is really a great and helpful piece of info. I?m satisfied that you just shared this useful info with us. Please stay us up to date like this. Thank you for sharing.

By gshopper reviews, October 19, 2023 @ 4:50 am

Thanks a lot for the article post. Really Cool.

By 출장마사지, October 19, 2023 @ 9:59 am

Great post. I was checking constantly this blog and I am impressed! Extremely helpful info particularly the last part I care for such info a lot. I was looking for this particular information for a very long time. Thank you and good luck.

I care for such info a lot. I was looking for this particular information for a very long time. Thank you and good luck.

By online television, October 19, 2023 @ 10:24 am

I am in fact pleased to read this webpage posts which consists of plenty of useful information, thanks for providing such information.

By online television, October 19, 2023 @ 1:13 pm

Wow, awesome blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your site is wonderful, let alone the content!

By nature paintings, October 20, 2023 @ 9:21 am

http://www.thebudgetart.com is trusted worldwide canvas wall art prints & handmade canvas paintings online store. Thebudgetart.com offers budget price & high quality artwork, up-to 50 OFF, FREE Shipping USA, AUS, NZ & Worldwide Delivery.

By Yttrium sputter targets, October 20, 2023 @ 10:10 am

Muchos Gracias for your blog.Thanks Again. Want more.

By Byoaoe, October 20, 2023 @ 2:02 pm

buy medex pill coumadin 5mg usa maxolon price

By Explore the Horizon, October 20, 2023 @ 2:08 pm

Great beat ! I wish to apprentice while you amend your site, how could i subscribe for a blog site? The account aided me a applicable deal. I had been a little bit acquainted of this your broadcast offered vivid transparent concept

By heavy duty towing straps, October 20, 2023 @ 4:42 pm

Im thankful for the article.Thanks Again. Fantastic.

By kudatogel, October 20, 2023 @ 11:41 pm

Throughout this awesome scheme of things you actually get a B- for hard work. Where exactly you actually confused everybody ended up being in your particulars. You know, people say, details make or break the argument.. And it could not be more accurate right here. Having said that, allow me reveal to you just what exactly did work. The text is definitely quite convincing and that is possibly why I am making an effort to opine. I do not really make it a regular habit of doing that. 2nd, whilst I can easily notice the leaps in reasoning you make, I am not necessarily sure of just how you appear to unite the points which in turn produce the final result. For now I shall yield to your issue but hope in the future you link the dots much better.

By slab handler, October 21, 2023 @ 7:18 am

Thanks for sharing, this is a fantastic blog article. Fantastic.

By fire resistant rope, October 21, 2023 @ 11:36 am

I really liked your blog post.Thanks Again. Fantastic.

By big baller online casino, October 21, 2023 @ 2:12 pm

I discovered more new things on this weight reduction issue. 1 issue is a good nutrition is especially vital while dieting. An enormous reduction in bad foods, sugary meals, fried foods, sweet foods, beef, and white flour products may be necessary. Retaining wastes parasites, and wastes may prevent aims for fat loss. While certain drugs in the short term solve the problem, the unpleasant side effects are certainly not worth it, plus they never present more than a short lived solution. It is a known incontrovertible fact that 95 of fad diet plans fail. Many thanks sharing your notions on this weblog.

By Cigtlt, October 21, 2023 @ 10:05 pm

purchase orlistat generic order diltiazem 180mg for sale diltiazem price

By Онлайн казино, October 21, 2023 @ 11:09 pm

An intriguing discussion is worth comment. I believe that you ought to write more on this issue, it might not be a taboo subject but generally people don’t discuss such subjects. To the next! Kind regards!!

By Gem Tester, October 22, 2023 @ 4:53 am

Thanks-a-mundo for the article.Much thanks again. Great.

By стяжка пола, October 22, 2023 @ 3:46 pm

Ищете профессионалов для устройства стяжки пола в Москве? Обратитесь к нам на сайт styazhka-pola24.ru! Мы предлагаем услуги по залитию стяжки пола любой сложности и площади, а также гарантируем быстрое и качественное выполнение работ.

By Pallet Inverter, October 22, 2023 @ 4:33 pm

I loved your article post.Much thanks again. Cool.

By стяжка пола стоимость, October 22, 2023 @ 6:41 pm

Хотите получить идеально ровный пол без лишних затрат? Обратитесь к профессионалам на сайте styazhka-pola24.ru! Мы предоставляем услуги по стяжке пола м2 по доступной стоимости, а также устройству стяжки пола под ключ в Москве и области.

By Rapid Prototyping, October 23, 2023 @ 2:58 am

Major thankies for the article post.Much thanks again. Keep writing.

By btyr, October 23, 2023 @ 11:48 am

Have you ever thought about publishing an e-book or guest authoring on other sites? I have a blog centered on the same topics you discuss and would really like to have you share some stories/information. I know my audience would value your work. If you’re even remotely interested, feel free to send me an email.

By EPIC Powder Machinery, October 23, 2023 @ 5:15 pm

A big thank you for your blog post.

By gshoppe, October 24, 2023 @ 3:38 am

I loved your blog.Really looking forward to read more. Much obliged.

By Xbvsej, October 24, 2023 @ 3:59 am

how to buy famotidine famotidine order online prograf price

By snabzhenie-obektov.ru, October 24, 2023 @ 5:31 am

снабжение строительства москва

By Future choice hospitality India limited cancelation policy, October 24, 2023 @ 3:53 pm

I appreciate you sharing this blog article.

By snabzhenie-obektov.ru, October 24, 2023 @ 8:02 pm

поставка материалов на строительные объекты

By btyr, October 25, 2023 @ 12:56 am

Generally I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, quite nice post.

By micin4d, October 25, 2023 @ 2:27 am

Excellent web site. Lots of helpful information here. I?m sending it to some buddies ans additionally sharing in delicious. And certainly, thanks to your effort!

By best camp in rishikesh, October 25, 2023 @ 4:09 am

I really like and appreciate your article.Much thanks again. Keep writing.

By glavdachnik.ru, October 25, 2023 @ 4:57 am

This design is steller! You most certainly know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

By btyr, October 25, 2023 @ 8:07 am

Heya i am for the first time here. I came across this board and I find It really useful & it helped me out a lot. I hope to give something back and help others like you helped me.

By WärmepumpenSEO, October 25, 2023 @ 1:09 pm

Hello There. I discovered your blog the use of msn. That is a very neatly written article. I will be sure to bookmark it and come back to learn more of your useful info. Thanks for the post. I?ll certainly return.

By btyr, October 25, 2023 @ 1:37 pm

Yesterday, while I was at work, my sister stole my iPad and tested to see if it can survive a 25 foot drop, just so she can be a youtube sensation. My iPad is now destroyed and she has 83 views. I know this is completely off topic but I had to share it with someone!

By bigballer, October 25, 2023 @ 3:10 pm

I really appreciate this post. I?ve been looking everywhere for this! Thank goodness I found it on Bing. You have made my day! Thx again

By документы на гостиницу в москве, October 25, 2023 @ 11:21 pm

Undeniably consider that that you stated. Your favourite justification appeared to be at the net the simplest thing to have in mind of. I say to you, I definitely get irked whilst other people consider worries that they plainly do not realize about. You controlled to hit the nail upon the top as smartlyand also defined out the whole thing with no need side effect , folks can take a signal. Will likely be back to get more. Thank you

By Net Zero, October 26, 2023 @ 3:45 am

Say, you got a nice blog post.Much thanks again. Great.

By Shbyca, October 26, 2023 @ 5:42 am

brand astelin 10 ml buy acyclovir 800mg buy avapro 150mg for sale

By механизированная штукатурка стен, October 26, 2023 @ 6:15 am

Совершите свой ремонт без лишних усилий. Штукатурка по маякам стен с mehanizirovannaya-shtukaturka-moscow.ru обеспечит вам идеально ровные стены.

By Australian High Commission, October 26, 2023 @ 12:21 pm

Thank you for your post.Really looking forward to read more. Want more.

By штукатурка стен, October 27, 2023 @ 2:05 am

Mеханизированная штукатурка стен – это выбор современных людей. Узнайте больше на mehanizirovannaya-shtukaturka-moscow.ru.

By Valve suppliers, October 27, 2023 @ 2:21 am

Great blog post. Great.

By Pqlcvb, October 27, 2023 @ 2:31 am

nexium for sale buy nexium generic order topiramate generic

By 제주출장마사지, October 27, 2023 @ 4:55 am

https://algirdasl889smh3.wikinstructions.com/user

By 제주출장안마, October 27, 2023 @ 5:12 am

https://epicurusd744ctm5.blogsumer.com/profile

By 제주출장안마, October 27, 2023 @ 5:19 am

https://andyj890ywu0.thekatyblog.com/profile

By suzuki sv650 for sale, October 27, 2023 @ 10:42 am

I think this is a real great blog post.Really thank you! Want more.

By winmacsofts, October 27, 2023 @ 1:52 pm

okmark your weblog and check again here frequently. I am quite sure I?ll learn a lot of new stuff right here! Best of luck for the next!

By штукатурка механизированная, October 27, 2023 @ 2:41 pm

Современный рынок предлагает нам множество уникальных решений, включая штукатурку механизированную. Проверьте mehanizirovannaya-shtukaturka-moscow.ru для получения подробной информации.

By Silicone Emulsion, October 27, 2023 @ 5:26 pm

Muchos Gracias for your blog article.Much thanks again. Really Great.

By dyna crash bar, October 28, 2023 @ 2:41 am

Thanks-a-mundo for the article post.Really thank you! Much obliged.

By tin boxes, October 28, 2023 @ 5:50 am

Major thanks for the blog article. Awesome.

By 제주출장마사지, October 28, 2023 @ 9:36 am

https://archer5vw12.boyblogguide.com/22850454/the-best-side-of-chinese-medicine-cracked-tongue

By winmacsofts, October 28, 2023 @ 3:27 pm

Great article. It is extremely unfortunate that over the last 10 years, the travel industry has had to deal with terrorism, SARS, tsunamis, influenza, swine flu, and also the first ever true global tough economy. Through everything the industry has proven to be effective, resilient as well as dynamic, finding new solutions to deal with adversity. There are constantly fresh difficulties and chance to which the marketplace must yet again adapt and respond.

By bearing, October 28, 2023 @ 4:29 pm

Awesome post. Cool.

By Boedtk, October 29, 2023 @ 2:30 am

sumatriptan for sale online oral levofloxacin order avodart 0.5mg sale

By australian wall art, October 29, 2023 @ 5:32 am

http://www.mybudgetart.com.au is Australia’s Trusted Online Wall Art Canvas Prints Store. We are selling art online since 2008. We offer 2000+ artwork designs, up-to 50 OFF store-wide, FREE Delivery Australia & New Zealand, and World-wide shipping to 50 plus countries.

By Wire Rope Sling, October 29, 2023 @ 6:32 am

Thanks for the blog.Thanks Again. Will read on…

By Rnepzf, October 29, 2023 @ 8:28 am

order allopurinol 300mg sale zyloprim 300mg generic buy rosuvastatin 10mg sale

By сделать чеки на гостиницу, October 29, 2023 @ 11:26 am

Pretty! This was an extremely wonderful post. Thanks for providing this info.

By winmacsofts, October 29, 2023 @ 2:04 pm

I believe that avoiding highly processed foods could be the first step to lose weight. They may taste excellent, but highly processed foods currently have very little nutritional value, making you consume more just to have enough energy to get through the day. Should you be constantly taking in these foods, converting to whole grain products and other complex carbohydrates will make you to have more electricity while taking in less. Good blog post.

By winmacsofts, October 29, 2023 @ 3:20 pm

Thanks for the ideas you have contributed here. One more thing I would like to say is that personal computer memory needs generally go up along with other innovations in the technological know-how. For instance, when new generations of processor chips are made in the market, there is certainly usually a similar increase in the dimensions calls for of both the laptop or computer memory and hard drive space. This is because the software operated by way of these cpus will inevitably boost in power to benefit from the new technological know-how.

By rotontek, October 29, 2023 @ 4:23 pm

I really enjoy the article post.Much thanks again. Really Cool.

By glavdachnik.ru, October 30, 2023 @ 3:14 am

Good way of describing, and nice post to get information about my presentation topic, which i am going to convey in university.

By 제주출장안마, October 30, 2023 @ 3:21 am

https://remingtonprp89.blogminds.com/5-tips-about-massage-therapy-business-plan-example-you-can-use-today-20605056

By 제주출장마사지, October 30, 2023 @ 3:28 am

https://jimiz579wxw1.wikiparticularization.com/user

By my cash online, October 30, 2023 @ 3:35 am

Very neat article.Really thank you! Cool.

By 제주출장마사지, October 30, 2023 @ 3:40 am

https://archerj3828.idblogmaker.com/22866217/new-step-by-step-map-for-chinese-medicine-body-chart

By 제주출장안마, October 30, 2023 @ 3:41 am

https://elliottp0x11.bloggerchest.com/22842324/healthy-massage-clovis-fundamentals-explained

By 제주출장마사지, October 30, 2023 @ 3:58 am

https://cruzq1223.p2blogs.com/22828109/chinese-medicine-classes-no-further-a-mystery

By гостиничные чеки купить в москве, October 30, 2023 @ 4:18 am

I’m really enjoying the design and layout of your site. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Outstanding work!

By rosymae wedding dress, October 30, 2023 @ 5:39 am

This is one awesome blog.Really looking forward to read more.

By acompañantes Bogota Colombia, October 30, 2023 @ 6:18 am

I do not even understand how I ended up here, however I believed this put up used to be good. I don’t recognise who you might be however certainly you’re going to a famous blogger for those who aren’t already Cheers!

Cheers!

By link bokep, April 29, 2024 @ 9:27 pm

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and everything. Nevertheless just imagine if you added some great images or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could certainly be one of the most beneficial in its niche. Excellent blog!

By Auto Glass Replacement In 27604, April 30, 2024 @ 12:02 am

I appreciate the clarity and thoughtfulness you bring to this topic.

By bokep indo, April 30, 2024 @ 2:37 am

Thanks a lot for your post. I would like to write my opinion that the cost of car insurance differs from one scheme to another, due to the fact there are so many different facets which play a role in the overall cost. One example is, the model and make of the vehicle will have a significant bearing on the cost. A reliable aged family automobile will have a lower priced premium over a flashy performance car.

By 27545 Auto Glass Shop, April 30, 2024 @ 8:20 am

The argumentation was compelling and well-structured. I found myself nodding along as I read.

By 27497 auto glass shop near me, May 1, 2024 @ 4:17 am

The depth you bring to The topics is like diving into a deep pool, refreshing and invigorating.

By 27260 Auto Glass Shop, May 1, 2024 @ 10:36 pm

The post was a beacon of knowledge. Thanks for casting light on this subject for me.

By bokep jepang, May 2, 2024 @ 6:48 pm

I love your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz respond as I’m looking to design my own blog and would like to find out where u got this from. thank you

By bokep indo, May 2, 2024 @ 7:43 pm

Hmm it seems like your blog ate my first comment (it was super long) so I guess I’ll just sum it up what I wrote and say, I’m thoroughly enjoying your blog. I too am an aspiring blog writer but I’m still new to everything. Do you have any recommendations for beginner blog writers? I’d really appreciate it.

By windshield shop in 27283, May 2, 2024 @ 11:07 pm

Reading The Writing is like finding the perfect song that I can’t stop listening to. Play it again?

By bokep jepang, May 3, 2024 @ 6:19 pm

It?s really a cool and useful piece of information. I am glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

By film porno, May 3, 2024 @ 8:19 pm