ING Sends a Postcard

I guess I should start out by stating that I do not find anything in this bit of junk mail to be the least confusing or misleading. Do you?

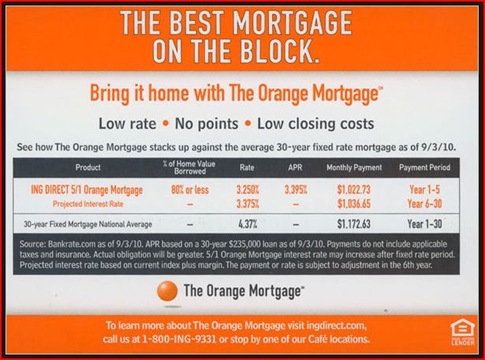

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

Moreover, the text below the numbers, which is a lot clearer in real life than in this screen capture of a scan, reads, in part:

5/1 Orange Mortgage interest rate may increase after fixed rate period. Projected interest rate based on current index plus margin. The payment or rate is subject to adjustment in the 6th year.

I think they meant “and” rather than “or” in that last sentence, but this hits all the important highlights. The loan has a fixed rate for five years, then it may get more expensive. They may not call it an ARM, but they own up to the (fairly obvious) drawbacks of it. And these sentences are a significant portion of the total text on the card, which ends by encouraging the reader to “learn more” about the product by calling or visiting a website.

I guess I ought to disclose that I took out this particular mortgage from ING last March. Rates were higher then. (In fact, they have gone down further since this card was printed at the start of September.) So there wasn’t very much chance I would have been confused by the ad. But would anybody?

Ron Lieber at The New York Times thinks so. In his Your Money column this weekend, In Mortgage Ad, Two Wrongs Don’t Make a Right, he affects a tone of exasperated outrage.

One of the most important lessons of the mortgage collapse is that potential borrowers need clear explanations of exactly what kind of commitment they are making.

This ad, which he calls “very 2005” is a violation of that expensively learned lesson.

Lieber’s two wrongs refer to the fact that ING did not use the phrase “adjustable rate mortgage” and that it did use an unrealistically rosy projection of what the interest rate might be in years six through thirty.

With regard to the non-use of the term ARM, Lieber may have a point, albeit a legalistic and literal minded one. According to Lieber, since 2008 Fed regulations have required that advertisements for adjustable rate mortgages “must specifically describe that loan as an ‘ARM,’ an ‘adjustable-rate mortgage’ or a ‘variable-rate mortgage.’”

ING responded to this without admitting that they broke a Fed rule, but more or less promising to use the term ARM on future postcards. They also pointed out that although this card did not say “adjustable rate” it did say “rate is subject to adjustment.”

Am I to infer that if the card called the product the “ING DIRECT 5/1 Orange ARM” but skipped the bits about how the interest rate could go up, Lieber would be happier?

And as for the projected interest rate being too low, Lieber acknowledges that, wrong or not, ING deserves no blame for it. Fed regulations specify how those projections are to be made, leaving no leeway to the lender. Basically, the current rate is extrapolated out. If the adjustment formula is LIBOR plus 2.75%, and that would give you 3.375% today, then you must project 3.375% for year six and beyond.

Lieber calls this projection “utter nonsense” because it assumes that our current low rates will continue for decades. I agree that if I had to bet money on it I would say that rates will be higher in the future than they are now. But that is a judgment call and does not make the projection nonsense. Far from it. It is not immediately obvious what other way the projection could be made. And ING doesn’t say “interest rate may change after fixed rate period” it says “interest rate may increase after fixed rate period.”

Ultimately, critiquing the ad copy on a postcard is a bit silly. Lieber does not even claim to have been the least bit confused or misled by it himself. (Something that is not true of the author of this remarkably similar blog post from last February about a postcard from ING pitching a five year balloon mortgage.)

As I said, I refinanced with this ING product in the spring. It took months to arrange. I feel like I signed my name a hundred times at the closing and left with several pounds of paper, most of it disclosures of one kind or another. Mortgages are big complicated things.

Outrage that not enough of the details of the mortgage terms are disclosed in a piece of junk mail, or any advertisement is, well, utter nonsense. The card also neglected to mention that ING will escrow for property tax, insist that you have homeowner’s insurance, and may foreclose if you do not make the payments. Aren’t those things important too?

The postcard tells a consumer the single most important fact about the mortgage: the rate. The rest of the details are quite standard, assuming that you know what a “5/1” mortgage is. If you do not, you will find out all about it soon enough. That is why we have closings with all that paper and why the process is a lot more involved than buying something with a credit card. The idea that borrowers could be denied “clear explanations of exactly what kind of commitment they are making” is absurd.

I suppose a person could argue that advertising for mortgages, or any complex financial thing, should just be banned to prevent consumers from getting the false impression that they understand what is going on. In as much as that would decrease competition, that would not help much.

Or perhaps complicated things like ARMs should be abolished. I suspect that Lieber would be sympathetic to this idea. There are two problems with it. First, even a 30 year fixed is complex animal that needs a lot of explaining to the uninformed. And second, removing ARMs from the marketplace makes most borrowers worse off, since they must pay higher rates on fixed mortgages. As I have argued before, ARMs should almost certainly be more popular than they are.

Some bits of personal finance are complicated. That is an inevitable side-effect of living in a wealthy and advanced society. And it means that some important things cannot be fully described on the back of a postcard.

90 Comments

Other Links to this Post

RSS feed for comments on this post. TrackBack URI

By jim, October 4, 2010 @ 1:40 pm

I do think the ‘projected’ interest rate for years 6-30 being based on todays rate is stupid and useless. I don’t know why the government would mandate that, it just causes any such projection to be meaningless and/or misleading.

I think it would make more sense to require a lender to disclose the maximum possible interest rate for an ARM and how fast it adjusts. Thats useful information. I’m sure they could fit that on their postcard.

By Holly, October 4, 2010 @ 4:03 pm

As for the ING mortgage, I remember reading in the past that a balloon payment of the remaining mortgage principal was due at the end of year 5, unless you qualify for a refinance w/ING at their current rate (or something like that). Have they done away with that?

Problem w/an ARM, from what we know now, is that when the rate adjusts, the borrower may then be financing at a considerably higher rate/payment…and if something terrible has happened to the borrower prior to the 5th year rate adjustment that would disquialify them from refinancing (home is ‘underwater’, long-term unemployment, medical emergency and bills, or bankruptcy), then they could be stuck in/a dire circumstance.

But, of course, real estate can be a risky adventure.

By jim, October 4, 2010 @ 5:40 pm

ING direct website says: “After the 5 or 10-year period, the remaining balance is due. Keep in mind, at that time you may qualify to renew your rate for another 5 or 10 years at the current Easy Orange rate.”

By mightymouselives, October 5, 2010 @ 10:52 am

There is a whole lot of difference between an adjustible rate (based upon a predetermined formula) and having to requalify at a future date. This offer would scare me to death.

By Panele Fotowoltaiczne, August 18, 2013 @ 5:05 am

I think that this it’s a very interesting concept and I agree with you. This post has truly enriched my science and experience, I’m happy. I found this site and I can share with you my observations and thoughts. If you have new solutions or ideas, please send me a message by email.

By suba, April 29, 2023 @ 5:10 pm

I’d like to find out more? I’d like to findout some additional information.

By Crupad, May 11, 2023 @ 6:32 am

buy tadalafil 5mg online cheap buy cialis sale top ed pills

By Doups, May 17, 2023 @ 6:52 pm

Some people think that low deposits are unlikely to lead to worthwhile bonuses. This is far from the truth. Even a minimum deposit of $10 can bring extra bonus points. Next, you can use 10 dollar casino bonus credits to have fun at the casino’s expense and without risking your wallet. There are $10 minimum deposit casinos out there that do indeed offer this as a possibility, and the best $10 deposit online casino USA options out there include: Sitemap Fair Go Casino is another casino that allows players to both make a minimum deposit as well as withdrawal in Bitcoin, making it a great option for cryptocurrency users. While a Bitcoin minimum deposit is $25, it’s more traditional payment methods are less expensive – it accepts Visa, Mastercard, and Poli, all with a $20 minimum deposit, and the ever-popular pre-paid Neosurf card, with a minimum deposit of $10.

https://www.easy-sewing.co.kr/bbs/board.php?bo_table=free&wr_id=495514

The following review sections focus and expand upon our top 5 slot welcome bonus picks. We provide you with a summary of our our testing data in an organised format. We’re confident that our expertise and thorough analysis will help you find the perfect slot welcome bonus to suit your needs. Read our full reviews of each slot site if you need more details. DraftKings Casino Michigan holds a license with the Michigan Gaming Control Board through a partnership with Bay Mills Resort & Casino in Brimley, MI. DraftKings Casino offers an extensive selection of slots and table games, plus some of the more lucrative leaderboard tournaments in the country. Unlike other online casinos that focus primarily on slots leaderboards, DraftKings offers prize pools for both slots and table game players.

By Pelvki, May 19, 2023 @ 5:51 pm

isotretinoin without prescription how to buy isotretinoin zithromax 500mg pills

By Gwcfmf, May 21, 2023 @ 7:40 am

azithromycin 250mg oral omnacortil 20mg uk order gabapentin 600mg pills

By Zldzqw, May 23, 2023 @ 2:40 am

buy generic furosemide 40mg best allergy medicine for adults cost ventolin

By Cfsdwf, May 24, 2023 @ 9:08 pm

levitra us plaquenil 400mg canada oral hydroxychloroquine

By Ucmmcz, May 25, 2023 @ 7:14 am

brand ramipril 5mg buy etoricoxib medication arcoxia 60mg tablet

By Sthenb, June 14, 2023 @ 7:49 pm

ampicillin 250mg ca purchase ciprofloxacin pill buy cheap generic flagyl

By Minpvw, June 15, 2023 @ 12:03 pm

order sumycin 500mg without prescription order flexeril 15mg generic cost baclofen

By Viendv, June 16, 2023 @ 3:40 pm

order bactrim 480mg pill cleocin usa cleocin 300mg usa

By Yxqbnh, June 17, 2023 @ 1:34 am

order toradol sale colcrys 0.5mg brand order inderal 10mg

By Tuyvaf, June 18, 2023 @ 11:37 am

buy erythromycin 500mg for sale buy erythromycin no prescription tamoxifen 20mg without prescription

By Vjbrrl, June 18, 2023 @ 3:49 pm

clopidogrel ca where can i buy methotrexate warfarin brand

By Bewjyo, June 20, 2023 @ 6:25 am

purchase metoclopramide online cheap generic esomeprazole 40mg nexium order

By Szyown, June 20, 2023 @ 8:36 am

purchase rhinocort without prescription order bimatoprost online careprost price

By Rhpezh, June 21, 2023 @ 11:06 pm

order topamax generic order imitrex 25mg generic levaquin canada

By Seulry, June 22, 2023 @ 5:36 am

robaxin 500mg ca sildenafil order sildenafil order online

By Ytogke, June 23, 2023 @ 2:00 pm

avodart tablet ranitidine for sale online meloxicam brand

By Mdqayo, June 24, 2023 @ 2:12 am

buy aurogra tablets generic aurogra 100mg estradiol 1mg usa

By Lkjnze, June 25, 2023 @ 4:06 am

celebrex 100mg ca tamsulosin tablet buy generic zofran for sale

By Izkbcn, June 26, 2023 @ 12:21 am

purchase lamotrigine generic lamictal 50mg brand minipress 2mg brand

By spravki-kupit.ru, June 26, 2023 @ 5:10 pm

медицинская справка

By Doafam, June 26, 2023 @ 7:34 pm

purchase spironolactone without prescription buy aldactone 25mg without prescription valacyclovir 500mg over the counter

By диплом высшего образования с занесением в реестр, June 27, 2023 @ 1:22 pm

Hi there, I do believe your site could be having browser compatibility issues. When I look at your web site in Safari, it looks fine however when opening in IE, it has some overlapping issues. I just wanted to give you a quick heads up! Other than that, fantastic blog!

By Reeohx, June 28, 2023 @ 1:20 am

buy retin gel sale tadalafil 20mg oral how to buy avana

By Rtnlsi, June 28, 2023 @ 10:20 am

order proscar 1mg online order finasteride 1mg generic viagra online

By накрутить просмотры яппи, July 30, 2023 @ 7:47 am

An intriguing discussion is worth comment. I do believe that you ought to write more on this subject, it might not be a taboo subject but usually people don’t speak about such subjects. To the next! All the best!!

By Ychafl, July 31, 2023 @ 3:27 pm

order trileptal online buy urso pill urso cheap

By Hbtkce, July 31, 2023 @ 4:36 pm

order decadron 0,5 mg online cheap decadron pill buy nateglinide 120mg online

By smartremstroy.ru, August 1, 2023 @ 12:25 am

Hi there! This post couldn’t be written any better! Looking at this post reminds me of my previous roommate! He always kept talking about this. I am going to forward this information to him. Pretty sure he will have a very good read. Thank you for sharing!

By daachnik.ru, August 1, 2023 @ 9:47 pm

You ought to take part in a contest for one of the finest blogs on the net. I will recommend this site!

By delaremontnika.ru, August 2, 2023 @ 12:58 pm

It’s in fact very difficult in this busy life to listen news on TV, thus I only use world wide web for that purpose, and take the most recent news.

By химчистка диана цены на услуги в борисове, September 2, 2023 @ 12:14 pm

If some one wants to be updated with most recent technologies after that he must be go to see this site and be up to date every day.

By химчистка диана цены на услуги жодино, September 2, 2023 @ 5:19 pm

Howdy! I just want to give you a huge thumbs up for the great info you’ve got here on this post. I’ll be coming back to your blog for more soon.

By Jyyejo, September 4, 2023 @ 1:17 pm

ferrous sulfate 100 mg pills buy cheap risedronate purchase betapace generic

By Bnowru, September 4, 2023 @ 4:11 pm

etodolac us cilostazol cheap buy pletal 100 mg pills

By sadovoe-tut.ru, September 6, 2023 @ 2:24 pm

Great delivery. Outstanding arguments. Keep up the good work.

By agrosadovnik.ru, September 6, 2023 @ 2:25 pm

Hello, just wanted to say, I liked this post. It was funny. Keep on posting!

By loan near me, October 7, 2023 @ 8:59 pm

Hey there just wanted to give you a quick heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

By Srsdqw, October 8, 2023 @ 1:06 am

claritin drug purchase claritin pills buy priligy 90mg online cheap

By Ibbtbr, October 8, 2023 @ 10:26 am

dilantin 100mg generic flexeril online order buy ditropan generic

By online television, October 8, 2023 @ 9:12 pm

What’s up mates, good article and nice arguments commented here, I am in fact enjoying by these.

By Uutoeq, October 10, 2023 @ 12:24 pm

how to buy ozobax order baclofen 10mg for sale buy ketorolac cheap

By online television, October 10, 2023 @ 2:50 pm

This is very interesting, You are a very skilled blogger. I have joined your feed and look forward to seeking more of your wonderful post. Also, I have shared your site in my social networks!

By Suhsui, October 11, 2023 @ 9:59 am

buy glimepiride 4mg without prescription purchase misoprostol generic order arcoxia sale

By Elzesr, October 12, 2023 @ 4:51 am

order lioresal online cheap order toradol 10mg without prescription buy toradol 10mg

By гостиница с отчетными документами, October 12, 2023 @ 11:09 pm

I love your blog.. very nice colors & theme. Did you create this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to design my own blog and would like to know where u got this from. kudos

By Qmomgf, October 14, 2023 @ 4:38 pm

fosamax 70mg without prescription oral nitrofurantoin 100 mg furadantin pill

By Bxjtju, October 16, 2023 @ 9:32 pm

where can i buy propranolol cost ibuprofen buy plavix generic

By гостиничные чеки москва, October 17, 2023 @ 4:49 am

When someone writes an article he/she keeps the thought of a user in his/her mind that how a user can understand it. So that’s why this post is amazing. Thanks!

By online television, October 17, 2023 @ 3:43 pm

Oh my goodness! Amazing article dude! Many thanks, However I am going through difficulties with your RSS. I don’t know why I can’t subscribe to it. Is there anybody else getting identical RSS problems? Anyone who knows the solution will you kindly respond? Thanx!!

By Xoukpk, October 19, 2023 @ 12:08 am

xenical 120mg for sale purchase diltiazem generic order diltiazem online

By Ijeiav, October 19, 2023 @ 1:37 am

buy nortriptyline paypal panadol 500 mg for sale buy cheap generic acetaminophen

By online television, October 19, 2023 @ 2:26 pm

Hey there, You have performed a fantastic job. I will definitely digg it and personally recommend to my friends. I am sure they will be benefited from this web site.

By Iqlseo, October 22, 2023 @ 3:38 am

order warfarin 5mg generic paxil 20mg generic maxolon pills

By Zrgvip, October 22, 2023 @ 1:16 pm

astelin medication astelin sale buy cheap irbesartan

By стяжка пола стоимость, October 22, 2023 @ 7:51 pm

Хотите получить идеально ровный пол в своей квартире или офисе? Обратитесь к профессионалам на сайте styazhka-pola24.ru! Мы предоставляем услуги по устройству стяжки пола в Москве и области, а также гарантируем качество работ и доступные цены.

By snabzhenie-obektov.ru, October 24, 2023 @ 7:13 am

снабжение строительными материалами

By Vgfjpj, October 25, 2023 @ 12:56 pm

buy pepcid 40mg generic hyzaar online order generic tacrolimus 5mg

By штукатурка по маякам стен, October 26, 2023 @ 7:35 am

Сдайте все трудности процесса оштукатуривание стен профессионалам на mehanizirovannaya-shtukaturka-moscow.ru. Вы в хороших руках.

By Vlblnf, October 27, 2023 @ 7:29 pm

where can i buy allopurinol buy rosuvastatin pill crestor 20mg usa

By Elzhgv, October 28, 2023 @ 4:19 am

nexium 20mg tablet topamax 100mg price buy topiramate 200mg pill

By Sqnxvl, October 29, 2023 @ 1:26 pm

order buspirone 5mg sale buspin cost buy cordarone cheap

By Abjbsh, October 29, 2023 @ 3:56 pm

buy imitrex 25mg pill imitrex 25mg canada buy avodart paypal

By купить гостиничные чеки с подтверждением, October 29, 2023 @ 11:25 pm

You really make it seem so easy with your presentation however I in finding this topic to be really something which I think I would never understand. It kind of feels too complicated and very broad for me. I am looking forward on your next publish, I will try to get the hang of it!

By Top Rated Auto Glass Replacement 27526, April 30, 2024 @ 9:20 pm

The posts inspire me regularly. The depth you bring to The topics is truly exceptional.

By GregorySam, June 2, 2024 @ 6:16 pm

https://bit.ly/3wXP2oc

Discover rapid and profitable trading with Exnova.com. Trade over 250 assets with a focus on binary, digital, and blitz options. Achieve impressive returns of up to 95% in as little as 5 seconds. Enhance your trading potential with Exnova.

Click This Site:

https://shorturl.at/e8N8u

By windshield replacement raleigh nc, June 3, 2024 @ 1:57 am

I’m genuinely impressed by the quality of this post. The way you’ve presented the information, with both depth and clarity, is outstanding. It’s clear you have a strong grasp of the subject, and your passion for sharing knowledge is admirable. I learned a lot and felt very inspired. Keep up the great work.

By RaymondNeorm, June 7, 2024 @ 1:19 pm

Welcome to https://Accsmarket.net, your ultimate destination for purchasing a diverse range of accounts across multiple platforms. Whether you’re in need of social media, gaming, or streaming accounts, we provide a seamless solution tailored to your digital requirements. Explore our comprehensive selection of verified accounts and elevate your online presence effortlessly with https://Accsmarket.net.

Click : https://Accsmarket.net

By Kristan Yepsen, June 30, 2024 @ 3:20 pm

This post has been incredibly helpful, like a guiding hand in a crowded room. The guidance is much appreciated.

By Flora Gallipeau, July 1, 2024 @ 1:47 am

http://v0795.com/home.php?mod=space&uid=908018

By Arielle Glotzbecker, July 1, 2024 @ 6:41 pm

https://www.google.fm/url?q=https://kelley-cortez-4.blogbright.net/shattered-no-more-the-ultimate-guide-to-auto-glass-replacement-1717294262

By Deandre Medalion, July 2, 2024 @ 8:17 am

I appreciate the balance and fairness in The writing. Great job!

By Kelly Shinko, July 3, 2024 @ 12:50 am

https://www.webwiki.com/canvas.instructure.com/eportfolios/2943050/Home/Through_the_Looking_Glass_A_Guide_to_Auto_Glass_Replacement

By Luke Spieler, July 3, 2024 @ 9:37 pm

https://maps.google.com.sa/url?q=https://sinkwaste40.bloggersdelight.dk/2024/06/02/through-the-looking-glass-a-comprehensive-guide-to-auto-glass-replacement/

By Cedrick Colglazier, July 20, 2024 @ 6:46 pm

The Writing is like a warm fireplace on a cold day, inviting me to settle in and stay awhile.

By Wayneswobe, July 24, 2024 @ 10:15 pm

We accept YAHOO email account registration upon request.

You only need to pay 50% in advance.

Then send the desired email list.

We will register according to that list.

Pay the remaining 50%. We will send the files to you.

Received file format

Email:password:Cookies

For further details please contact

Telegram

https://t.me/chainsdev

Zalo : O93467O123

By Lupe Miles, August 3, 2024 @ 3:22 pm

Always learning something new here, because apparently, I didn’t pay enough attention in school.

By Israel Alisauskas, August 4, 2024 @ 7:01 am

Explaining things in an understandable way is a skill, and you’ve mastered it. Thanks for clearing things up for me.

By carl cal experts, September 9, 2024 @ 3:51 am

Thoroughly insightful read, or so I thought until I realized it was The expertise shining through. Thanks for making me feel like a novice again!

By carl cal experts, September 9, 2024 @ 8:03 pm

The depth you bring to The topics is like diving into a deep pool, refreshing and invigorating.

By ремонт бытовой техники в москве, September 11, 2024 @ 8:10 am

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем: ремонт крупногабаритной техники в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

By Clemmons Auto Glass, December 28, 2024 @ 7:35 pm

Provoked thought and taught me something new, as if my brain needed more exercise.

By Beryl Winningham, December 29, 2024 @ 1:08 am

You’ve done a fantastic job of breaking down this topic, like unlocking a door to a secret garden. Intrigued to explore more.