Our Personal Finance Problem

This is the 100th post to Bad Money Advice. In honor of that milestone I thought I would get a little more philosophical and reflective than usual.

I am generally very suspicious of arguments founded on the assertion that never in history has some aspect of our lives been more difficult or challenging than it is today. Some parts of life in the good old days may have been less  complicated then they are now, but it was a brutal simplicity. I remember years ago when somebody remarked to my grandfather how dirty the streets in New York had become. He rolled his eyes and pointed out that when he was a child those streets where covered in horse manure. And you may think it is stressful to raise kids today, but consider what it was like a few hundred years ago when half of them died before reaching adulthood.

complicated then they are now, but it was a brutal simplicity. I remember years ago when somebody remarked to my grandfather how dirty the streets in New York had become. He rolled his eyes and pointed out that when he was a child those streets where covered in horse manure. And you may think it is stressful to raise kids today, but consider what it was like a few hundred years ago when half of them died before reaching adulthood.

But there is at least one part of our lives that really is much more difficult and harder than it was hundreds of years ago. That is the somewhat amorphous subject that we call personal finance. Don’t get me wrong, I am in no way pining for the old days. In the past there was no such thing as an activity called personal finance for most people because, by our standards, in the past most people spent their lives broke. A person might save food for the coming winter, but not money for retirement. Until recently, there was no such thing as retirement for ordinary folks, and, if you go back far enough, hardly such a thing as money.

Most people throughout most of history lived only barely above subsistence. You worked, rather literally, to keep food on the table and a roof over your head. If there were coins left over, your choices of what to do with them were limited. There were no malls to go to, no credit cards to max out, no cars to lease or buy, and no vacations to go on. Medical expenses were also not a big worry.

Even as recently as a hundred years ago, knowledge of the ways of money, of what we now call personal finance, was a non-issue for all but a small elite. There was just so little leeway for a person to do it either well or badly. But as the 20th Century progressed, and the wealth of the average American grew geometrically, so did the importance and difficulty of personal finance. Indeed, it probably grew faster. Today, the impact on a person’s material life of doing personal finance well or badly can be profound.

We are now so accustomed to this rapid growth in the number of choices that we have that we tend to lose sight of the fact that this is all so new and so much more bewildering than it was even a few decades ago. Lost in the discussion of defined contribution plans occasioned by recent events is the fact that these schemes are themselves only a few decades old. Current retirees are the first generation to have used them to fund a significant part of their retirement. Today’s 60 year-olds are the first ones to experience a widespread collapse in their self-directed retirement savings just before they planned to retire.

Again, this is all a side effect of the massive increase in the wealth of the average American over the past few generations, which has meant a similar increase in the number of available financial choices. A person would have to have a very grim view of human nature to think that having more choices was a bad thing.

But by the same token, the consequences of making poor choices have also grown and somehow, as a society, our understanding and knowledge of personal finance has not kept up. It is as if we all had cars but did not know how to drive them. There is an entire area of common knowledge missing from our heads.

I spend a lot of time pointing out the faults of the big personal finance gurus such as Suze Orman and Dave Ramsey. In a way, this is a bit unfair to them. They are media personalities. In a more perfect world, they would be the equivalent of, for example, CNN’s healthcare correspondent or a host of a radio talk show on healthy living. Those roles have their place, but nobody would consider them to be a viable substitute for doctors and hospitals. The problem is that with regard to personal finance, we have no doctors or hospitals. We have only Suze and Dave and their ilk. And in the land of the blind the one eyed man is king.

My self-appointed role is as the guy who points out what is wrong with what little personal finance advice and education we now have. A person could argue that this was counter-productive, that what we have got now should be embraced as a good start and built on. I do not think so. Pretending that mainstream personal finance advice is wise and thoughtful encourages a complacency that the problem is not as bad as it is. For example, it has been suggested that all we need to do is require high schoolers to take a course in personal finance, a plan which assumes the miraculous appearance of teachers able to teach the course and textbooks for them to use.

Moreover, a lot of the personal finance advice out there is just plain bad. If I can stop one person from doing something really stupid based on the advice of “experts” then this will have been all worthwhile.

My hope is that by starting a dialog on the merits of personal finance advice, and the state of personal finance in America, we can begin what will undoubtedly be a long process of building that missing bit of common knowledge.

1,221 Comments

Other Links to this Post

-

Interesting Reads 5-8-2009 | OneMint — May 9, 2009 @ 4:07 am

-

buy here pay here birmingham al — August 17, 2020 @ 3:31 am

-

custom surgical masks — March 10, 2023 @ 8:13 am

-

how to replace clock hands — March 10, 2023 @ 10:22 am

-

promotional coffee mugs — March 10, 2023 @ 12:49 pm

-

bathtub reglazing near me — March 10, 2023 @ 1:57 pm

-

metal water bottles — March 10, 2023 @ 2:45 pm

-

gas fireplace service & repair — March 10, 2023 @ 5:04 pm

-

promo products suppliers — March 10, 2023 @ 9:16 pm

-

metal hands — March 11, 2023 @ 12:23 am

-

Click Here — March 11, 2023 @ 10:42 am

-

chimney fireplace repair — March 11, 2023 @ 12:49 pm

-

branded products — March 11, 2023 @ 4:22 pm

-

tub refinishing — March 11, 2023 @ 6:10 pm

-

imprinted promotional gifts — March 11, 2023 @ 11:23 pm

-

custom lanyards — March 12, 2023 @ 12:15 am

-

fireplace maintenance gas — March 12, 2023 @ 1:54 am

-

Learn More — March 12, 2023 @ 4:42 am

-

chimney repair peoria — March 12, 2023 @ 8:25 am

-

Clock making parts — March 12, 2023 @ 11:42 am

-

branded face masks — March 12, 2023 @ 1:24 pm

-

metal clock mechanism — March 12, 2023 @ 6:44 pm

-

custom surgical masks — March 12, 2023 @ 8:04 pm

-

branded products — March 12, 2023 @ 8:27 pm

-

logo safety glasses — March 13, 2023 @ 2:59 am

-

navigate to this website — March 13, 2023 @ 4:08 am

-

tub glazer near me — March 13, 2023 @ 5:13 am

-

clock movement — March 13, 2023 @ 9:00 am

-

custom printed signage — March 13, 2023 @ 9:53 am

-

safety kits — March 13, 2023 @ 10:41 am

-

fireplace service and repair — March 13, 2023 @ 10:47 am

-

safety kits — March 13, 2023 @ 12:50 pm

-

clock building videos — March 13, 2023 @ 2:57 pm

-

storage near me — March 13, 2023 @ 7:40 pm

-

parts of a clock — March 13, 2023 @ 7:42 pm

-

water bottles with logo — March 13, 2023 @ 7:58 pm

-

how to replace clock hands — March 13, 2023 @ 10:06 pm

-

cheapest storage units near me — March 14, 2023 @ 1:55 am

-

parts for clocks — March 14, 2023 @ 2:09 am

-

embroidered shirts — March 14, 2023 @ 2:26 am

-

how to replace clock hands — March 14, 2023 @ 4:36 am

-

colorado music festival 2023 — March 14, 2023 @ 5:26 am

-

vehicle storage — March 14, 2023 @ 8:02 am

-

clock mechanisms — March 14, 2023 @ 8:29 am

-

promo items — March 14, 2023 @ 8:49 am

-

personal promotional products — March 14, 2023 @ 9:45 am

-

best clock movement — March 14, 2023 @ 10:59 am

-

synchronized clocks for stadiums — March 14, 2023 @ 1:46 pm

-

car stroage — March 14, 2023 @ 2:14 pm

-

corporate gifts — March 14, 2023 @ 10:22 pm

-

logo face masks — March 14, 2023 @ 10:28 pm

-

time synchronazation clocks — March 15, 2023 @ 3:36 am

-

branded face masks — March 15, 2023 @ 4:52 am

-

cheapest storage units near me — March 15, 2023 @ 10:59 am

-

visit website here — March 15, 2023 @ 11:17 am

-

small clock inserts — March 15, 2023 @ 12:07 pm

-

first aid kits — March 15, 2023 @ 1:18 pm

-

clock building videos — March 15, 2023 @ 4:05 pm

-

branded face masks — March 15, 2023 @ 5:42 pm

-

clock Inserts videos — March 15, 2023 @ 7:16 pm

-

imprinted promotional gifts — March 15, 2023 @ 8:44 pm

-

caveman live music festival — March 15, 2023 @ 10:35 pm

-

clock repair videos — March 15, 2023 @ 11:47 pm

-

corporate gifts — March 16, 2023 @ 12:09 am

-

trailer storage — March 16, 2023 @ 12:46 am

-

printed water bottles — March 16, 2023 @ 4:08 am

-

missoula self storage — March 16, 2023 @ 7:40 am

-

time movement hands — March 16, 2023 @ 9:35 am

-

imprinted knee pads — March 16, 2023 @ 12:56 pm

-

storage unit prices near me — March 16, 2023 @ 2:36 pm

-

clock repair videos — March 16, 2023 @ 2:58 pm

-

imprinted promotional gifts — March 16, 2023 @ 7:09 pm

-

storage unit — March 16, 2023 @ 9:37 pm

-

clock repair videos — March 16, 2023 @ 10:34 pm

-

outdoor clocks for schools — March 16, 2023 @ 10:48 pm

-

click Here — March 17, 2023 @ 12:11 am

-

promotional products — March 17, 2023 @ 1:35 am

-

Click Here — March 17, 2023 @ 2:28 am

-

branded products — March 17, 2023 @ 9:50 am

-

monument lake resort music festival — March 17, 2023 @ 11:12 am

-

mini storage missoula mt — March 17, 2023 @ 11:28 am

-

time synchronazation clocks — March 17, 2023 @ 1:19 pm

-

branded face masks — March 17, 2023 @ 2:15 pm

-

mechanisms for clocks — March 17, 2023 @ 3:28 pm

-

logo printed face masks — March 17, 2023 @ 8:38 pm

-

clock manufacture — March 17, 2023 @ 10:55 pm

-

missoula storage units — March 18, 2023 @ 1:18 am

-

custom lanyards — March 18, 2023 @ 2:52 am

-

get more info here — March 18, 2023 @ 4:22 am

-

first aid kits — March 18, 2023 @ 7:39 am

-

storage missoula mt — March 18, 2023 @ 8:08 am

-

badge reels — March 18, 2023 @ 9:05 am

-

best motor for clocks — March 18, 2023 @ 1:26 pm

-

indoor boat storage near me — March 18, 2023 @ 2:41 pm

-

corporate gifts — March 18, 2023 @ 2:43 pm

-

clock repair videos — March 18, 2023 @ 6:31 pm

-

how to build your own clock — March 18, 2023 @ 8:34 pm

-

how to build your own clock — March 19, 2023 @ 1:35 am

-

mini storage missoula — March 19, 2023 @ 3:59 am

-

branded products — March 19, 2023 @ 9:46 am

-

rv storage near me — March 19, 2023 @ 10:46 am

-

small clock inserts — March 19, 2023 @ 3:40 pm

-

promo items — March 19, 2023 @ 3:55 pm

-

wireless time clocks — March 19, 2023 @ 4:26 pm

-

boat storage near me — March 19, 2023 @ 5:46 pm

-

clock dial face fit ups — March 19, 2023 @ 10:48 pm

-

synchronized wireless time systems — March 19, 2023 @ 11:49 pm

-

clock movement — March 20, 2023 @ 12:53 am

-

boat storage missoula — March 20, 2023 @ 12:55 am

-

metal water bottles — March 20, 2023 @ 2:14 am

-

personal promotional products — March 20, 2023 @ 3:52 am

-

best americana music festivals — March 20, 2023 @ 3:59 am

-

metal clock mechanism — March 20, 2023 @ 7:47 am

-

car stroage — March 20, 2023 @ 8:16 am

-

clock parts manufacturing — March 20, 2023 @ 12:52 pm

-

custom surgical masks — March 20, 2023 @ 3:40 pm

-

clock hands repair — March 20, 2023 @ 7:59 pm

-

click Here — March 20, 2023 @ 9:40 pm

-

check it out here — March 20, 2023 @ 10:07 pm

-

self storage missoula mt — March 20, 2023 @ 11:12 pm

-

customized lanyards — March 20, 2023 @ 11:44 pm

-

clock mechanisms — March 21, 2023 @ 3:04 am

-

imprinted protective eyewear — March 21, 2023 @ 3:31 am

-

accessories for clocks — March 21, 2023 @ 4:31 am

-

Check It Out Here — March 21, 2023 @ 5:20 am

-

rv storage missoula — March 21, 2023 @ 6:35 am

-

coffee mugs — March 21, 2023 @ 9:22 am

-

luggage tags — March 21, 2023 @ 1:57 pm

-

imprinted promotional gifts — March 21, 2023 @ 3:11 pm

-

Clock making parts — March 21, 2023 @ 5:12 pm

-

clock mechanisms — March 21, 2023 @ 6:12 pm

-

custom printed face masks — March 21, 2023 @ 9:03 pm

-

clock repair videos — March 22, 2023 @ 12:20 am

-

weston colorado americana music festival — March 22, 2023 @ 6:58 am

-

how to build your own clock — March 22, 2023 @ 7:57 am

-

reusable face masks — March 22, 2023 @ 12:10 pm

-

clock inserts suppliers — March 22, 2023 @ 2:40 pm

-

embroidered hats — March 22, 2023 @ 3:13 pm

-

self storage — March 22, 2023 @ 7:30 pm

-

clock mechanisms — March 22, 2023 @ 9:44 pm

-

get more info here — March 23, 2023 @ 4:28 am

-

labor day weekend — March 23, 2023 @ 5:13 am

-

time synchronazation clocks — March 23, 2023 @ 7:17 am

-

trailer storage — March 23, 2023 @ 10:08 am

-

metal water bottles — March 23, 2023 @ 10:11 am

-

clock manufacture — March 23, 2023 @ 11:22 am

-

imprinted protective eyewear — March 23, 2023 @ 2:14 pm

-

cheapest storage units near me — March 23, 2023 @ 5:32 pm

-

best clock movement — March 23, 2023 @ 6:23 pm

-

hospital clock system — March 23, 2023 @ 11:20 pm

-

parts for clocks — March 23, 2023 @ 11:46 pm

-

get redirected here — March 24, 2023 @ 2:28 am

-

clock parts manufacturing — March 24, 2023 @ 4:09 am

-

tub refinishing — March 24, 2023 @ 6:25 am

-

synchronized wireless clock systems — March 24, 2023 @ 7:03 am

-

phoenix fireplace repair — March 24, 2023 @ 10:05 am

-

best motor for clocks — March 24, 2023 @ 12:03 pm

-

USA Made clock movements — March 24, 2023 @ 3:01 pm

-

synchronized wireless clocks for sale — March 24, 2023 @ 5:22 pm

-

fireplace repair services peoria — March 24, 2023 @ 5:39 pm

-

mechanism for clocks — March 24, 2023 @ 7:49 pm

-

resurface bathtub — March 24, 2023 @ 8:44 pm

-

Learn More — March 24, 2023 @ 10:26 pm

-

clocks for businesses — March 25, 2023 @ 12:31 am

-

fireplace repair near me — March 25, 2023 @ 1:04 am

-

metal clock mechanism — March 25, 2023 @ 3:36 am

-

tile reglazing colors — March 25, 2023 @ 3:42 am

-

clocks for hospitals — March 25, 2023 @ 5:34 am

-

hour hands for clocks — March 25, 2023 @ 5:57 am

-

clocks for schools — March 25, 2023 @ 7:46 am

-

wood stove repair peoria — March 25, 2023 @ 8:35 am

-

countertop resurfacing — March 25, 2023 @ 10:39 am

-

clock manufacture — March 25, 2023 @ 11:22 am

-

learn more — March 25, 2023 @ 1:13 pm

-

clock motor suppliers — March 25, 2023 @ 1:21 pm

-

clocks for businesses — March 25, 2023 @ 2:53 pm

-

tub refinishing — March 25, 2023 @ 5:39 pm

-

clock mechanisms — March 25, 2023 @ 7:04 pm

-

clock synchronization wirelessly — March 25, 2023 @ 10:00 pm

-

fireplace repair service — March 25, 2023 @ 11:31 pm

-

refinish bathtub and tile — March 26, 2023 @ 12:48 am

-

clock repair parts — March 26, 2023 @ 2:39 am

-

mechanism for clocks — March 26, 2023 @ 4:13 am

-

wirelessly synchronize clocks — March 26, 2023 @ 4:32 am

-

time synchronazation clocks — March 26, 2023 @ 5:11 am

-

fireplace maintenance and repair — March 26, 2023 @ 7:22 am

-

Learn More — March 26, 2023 @ 10:04 am

-

clock repair videos — March 26, 2023 @ 11:38 am

-

synchronized wireless clocks for sale — March 26, 2023 @ 11:56 am

-

get more info — March 26, 2023 @ 12:25 pm

-

fireplace service and repair near me — March 26, 2023 @ 3:05 pm

-

ceramic tile restoration — March 26, 2023 @ 3:11 pm

-

time movement hands — March 26, 2023 @ 5:29 pm

-

clock synchronization software — March 26, 2023 @ 7:30 pm

-

outdoor clocks for business — March 26, 2023 @ 7:43 pm

-

fireplace repair costs — March 26, 2023 @ 10:32 pm

-

best clock movements — March 27, 2023 @ 12:52 am

-

clock inserts suppliers — March 27, 2023 @ 2:30 am

-

synchronized wireless clocks for sale — March 27, 2023 @ 3:13 am

-

bathtub reglazing cost los angeles — March 27, 2023 @ 5:33 am

-

fireplace repair phoenix az — March 27, 2023 @ 6:07 am

-

small clock inserts — March 27, 2023 @ 8:21 am

-

Clock kits and dials — March 27, 2023 @ 10:52 am

-

clock inserts suppliers — March 27, 2023 @ 5:55 pm

-

clock inserts suppliers — March 27, 2023 @ 6:49 pm

-

best clock movement — March 27, 2023 @ 11:25 pm

-

learn more — March 28, 2023 @ 12:40 am

-

DIY clock replacement parts — March 28, 2023 @ 1:27 am

-

click Here — March 28, 2023 @ 2:41 am

-

parts for clocks — March 28, 2023 @ 6:35 am

-

small clock inserts — March 28, 2023 @ 8:58 am

-

DIY clock replacement parts — March 28, 2023 @ 10:15 am

-

check it out here — March 28, 2023 @ 3:17 pm

-

refinish bathroom tile — March 28, 2023 @ 4:39 pm

-

clock making replacement parts — March 28, 2023 @ 5:49 pm

-

Best digital clocks — March 28, 2023 @ 10:29 pm

-

reglazing tile — March 28, 2023 @ 11:35 pm

-

clock motor suppliers — March 29, 2023 @ 12:01 am

-

clock mechanisms — March 29, 2023 @ 1:18 am

-

gas fireplace service and repair — March 29, 2023 @ 1:55 am

-

facilities services companies — March 29, 2023 @ 5:39 am

-

reglazing tile — March 29, 2023 @ 6:33 am

-

clock mechanisms — March 29, 2023 @ 7:31 am

-

best clock movement — March 29, 2023 @ 8:49 am

-

Facility wireless clocks — March 29, 2023 @ 12:58 pm

-

click Here — March 29, 2023 @ 3:04 pm

-

fireplace repair services near me — March 29, 2023 @ 5:01 pm

-

best hands for clocks — March 29, 2023 @ 6:35 pm

-

outdoor clocks for business — March 29, 2023 @ 8:10 pm

-

clock repair parts — March 29, 2023 @ 10:32 pm

-

metal clock mechanism — March 29, 2023 @ 11:52 pm

-

gas fireplace service and repair near me — March 30, 2023 @ 12:29 am

-

best clock movements — March 30, 2023 @ 1:42 am

-

tub reglazing los angeles — March 30, 2023 @ 2:46 am

-

best clock movements — March 30, 2023 @ 5:59 am

-

fireplace repair phoenix — March 30, 2023 @ 7:55 am

-

Learn More — March 30, 2023 @ 8:49 am

-

tub refinishing — March 30, 2023 @ 9:25 am

-

wirelessly synchronize clocks — March 30, 2023 @ 10:25 am

-

time movement hands — March 30, 2023 @ 1:35 pm

-

DIY clock replacement parts — March 30, 2023 @ 2:13 pm

-

tub refinishing — March 30, 2023 @ 4:04 pm

-

clock motor suppliers — March 30, 2023 @ 4:13 pm

-

clock mechanisms — March 30, 2023 @ 8:59 pm

-

gas fireplace repairman near me — March 30, 2023 @ 10:35 pm

-

tile refinishing — March 30, 2023 @ 10:40 pm

-

GPS Receiver — March 31, 2023 @ 12:35 am

-

accessories for clocks — March 31, 2023 @ 4:22 am

-

clock repair videos — March 31, 2023 @ 4:28 am

-

repair for gas fireplace — March 31, 2023 @ 5:41 am

-

metal clock mechanism — March 31, 2023 @ 7:29 am

-

hospital clock system — March 31, 2023 @ 7:41 am

-

metal hands — March 31, 2023 @ 11:41 am

-

hour hands for clocks — March 31, 2023 @ 11:51 am

-

chimney flashing repair — March 31, 2023 @ 12:53 pm

-

mechanism for clocks — March 31, 2023 @ 3:13 pm

-

ceramic tile refinishing cost — March 31, 2023 @ 6:38 pm

-

clock building videos — March 31, 2023 @ 6:50 pm

-

DIY clock hands repair — March 31, 2023 @ 7:17 pm

-

gas fireplace maintenance phoenix — March 31, 2023 @ 8:01 pm

-

clock accessories — March 31, 2023 @ 10:50 pm

-

metal clock mechanism — April 1, 2023 @ 2:49 am

-

More about the author — April 1, 2023 @ 3:13 am

-

bath tub refinishers — April 1, 2023 @ 8:01 am

-

best clock movement — April 1, 2023 @ 8:44 am

-

gas fireplace repairman near me — April 1, 2023 @ 10:30 am

-

clocks for hospitals — April 1, 2023 @ 12:15 pm

-

get more info here — April 1, 2023 @ 1:50 pm

-

fireplace inspection — April 1, 2023 @ 5:57 pm

-

gas fireplace repair services near me — April 2, 2023 @ 1:08 am

-

clock dial face fit ups — April 2, 2023 @ 1:11 am

-

ceramic tile resurfacing — April 2, 2023 @ 4:32 am

-

gas fireplace service cost — April 2, 2023 @ 8:24 am

-

hour hands for clocks — April 2, 2023 @ 8:36 am

-

best clock movement — April 2, 2023 @ 12:18 pm

-

parts for clocks — April 2, 2023 @ 12:25 pm

-

clock dial face fit ups — April 2, 2023 @ 4:00 pm

-

visit website here — April 2, 2023 @ 7:07 pm

-

quartz clock fit-ups — April 2, 2023 @ 8:04 pm

-

repair fireplace peoria — April 2, 2023 @ 10:47 pm

-

mechanism for clocks — April 2, 2023 @ 11:19 pm

-

click to read more — April 3, 2023 @ 1:20 am

-

time movement hands — April 3, 2023 @ 3:38 am

-

metal hands — April 3, 2023 @ 6:45 am

-

clocks for schools — April 3, 2023 @ 7:13 am

-

refinish tub and tile — April 3, 2023 @ 8:11 am

-

mechanism for clocks — April 3, 2023 @ 8:53 am

-

visit website here — April 3, 2023 @ 2:06 pm

-

gas fireplace repairman — April 3, 2023 @ 2:13 pm

-

outdoor clocks for business — April 3, 2023 @ 2:15 pm

-

resurface bathtub — April 3, 2023 @ 2:56 pm

-

plastic dial hand — April 3, 2023 @ 6:47 pm

-

clock making replacement parts — April 3, 2023 @ 8:54 pm

-

clock movement — April 3, 2023 @ 9:52 pm

-

how to build your own clock — April 4, 2023 @ 1:43 am

-

Clock making parts — April 4, 2023 @ 8:41 am

-

get more info here — April 4, 2023 @ 9:47 am

-

clock parts manufacturing — April 4, 2023 @ 3:41 pm

RSS feed for comments on this post. TrackBack URI

By Austin, May 7, 2009 @ 11:47 am

And that is exactly why I follow this blog so closely. You serve a necessary function, especially for people who read a slew of personal finace columns every day, as a common sensical detractor and clarifier to people outside the industry.

So, thanks.

By Dan Ray, May 7, 2009 @ 12:01 pm

Mr. Curmudgeon, sir, well done on No. 100; may there be hundreds more. The choices for consumers has become mind-numbingly complex, and so lacking in transparency that we truly are in the land of the blind.

By Dave C., May 7, 2009 @ 12:21 pm

Hi Frank! This was a nicely thought out post and helped me to put my current finances into perspective with respect to the past.

I commented on your post at my blog, and mentioned a bit about “many choices” being a good thing. I don’t necessarily always agree with that idea, though being able to exercise control over the direction of our finances does feel gratifying.

By Rob Bennett, May 7, 2009 @ 12:31 pm

The perspective provided here is perfectly balanced.

We really are in trouble today. As you point out, money management is more important today than it has ever been. And we don’t know what we are doing. That sounds bad because it is bad.

But the reason why we are so pathetic is that all of this is pretty darn new to us. We have never been this rich a society before. So naturally we are experiencing some growing pains.

We need to all do what we can to take things to the next level.

But we all also need always to keep in mind that the reason why things are so troubled today is that we are taking on challenges that did not exist in earlier times. We are experiencing a crisis but we are also experiencing an OPPORTUNITY. I believe that the two are related. We are experiencing the crisis because we have not yet figured out what we want to do about the opportunity.

We might not make it to the other side. But we might. And, if we do, things are going to be better than ever when we get there.

Rob

By ObliviousInvestor, May 7, 2009 @ 12:55 pm

There’s no question that yours is one of my absolute favorites.

Not to be pessimistic, but I agree with your tagline that “mainstream personal finance advice is not what it should be.”

In my view, you play an important role. Please, keep it up.

By ObliviousInvestor, May 7, 2009 @ 12:56 pm

…your blog that is

By Scott Hamilton, May 7, 2009 @ 1:23 pm

You are not being pessimistic, you are raising the standard of personal finance by educating the masses on how bad it is. If we all demand a better product, then someone will create it. In contrast, if no one demands a better product, we will continue to get bad advice. The ability of everyone to evaluate personal finance guru’s is a noble goal, not pessimistic.

By Jim Blankenship, CFP®, EA, May 7, 2009 @ 2:35 pm

Absolutely spot on assessment as usual, Frank.

I’d add to your observations that, not only do we find ourselves with too many choices and poor (or non-existent) avenues for advice, the greater majority of people take a dive into the saving/investing pool with, at best, only a vague concept of a goal. And without a goal, how can we determine what is the right way to invest (in this case)? If our goal is simply to make as much money as we can (believe it or not, that’s a common answer) then it’s no shock that most folks take *way* more risk than is appropriate to their circumstances – and suffer the consequences.

And if it’s not enough that we haven’t set goals, for whatever reason, developing and discussing goals is one of those activities that ranks up there with a campfire “kumbaya” session for most folks: “Great concept. Yeah, everyone should do it. But no, I haven’t done it myself.”

If Step One is setting goals, Step Zero needs to be determining our personal values. This is even tougher, because it requires the individual to turn inward and actually acknowledge what it is that drives us to do things we do. Tough as it may be, to be truly successful at setting goals, the goals must be based on your values or you’ll have a difficult time reconciling the two; that’s why we often miss our goals or get completely distracted and off course.

Thanks once again for a well-written and thought-provoking post, Frank. Keep up the great work, looking forward to many more 100′s of posts!

jb

By TJR, May 7, 2009 @ 3:16 pm

I regard your blog as “advanced personal finance”, to be read after the “get out of debt slowly” courses offered by the other blogs.

By Mary, May 7, 2009 @ 3:39 pm

Congrats on the 100th post. As has already been said – looking forward to many more. Your blog is by far, the best one that I’ve added to my reading list in a long time.

By SJ, May 7, 2009 @ 4:59 pm

Bravo and congrats.

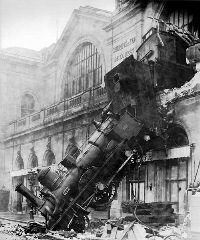

I enjoyed the picture

By SaveBuyLive, May 7, 2009 @ 5:28 pm

Personally, I’ve found my own education in personal finance to be a very mentally stimulating journey. Probably because of all the complexity buried in it.

From the more practical standpoint of needing to do things with my money, I’ve found personal finance to be a bit aggravating. Too much complexity, too many contradictory opinions and not much in the way of readily available supporting data.

By racy, May 7, 2009 @ 9:12 pm

BMA is a daily read for me, Frank. Thanks & keep up the good work.

By GPR, May 8, 2009 @ 1:05 am

Congratulations. It’s a well written blog, even when you get all wonkish about statistics!

Your story is making me picture my grandfather, who made it through a depression and a war. When he started at the paper mill he stood at the gate every morning hoping to be picked to work that day.

I doubt he’d have much sympathy for people who have trouble getting 72 month loans for a new car.

By GPR, May 8, 2009 @ 1:07 am

@SaveBuyLive:

Earn more. Spend less. Everything else is trivia.

That’s the title and full contents of my new book.

By Kevin M, May 8, 2009 @ 10:23 am

I never thought about the issue of people to teach the high schoolers personal finance, but that is spot-on. How can we trust other people who have failed at personal finance to teach our kids the “right” way? I guess textbooks can help, but I think experience is a better teacher most of the time.

By Don P, May 8, 2009 @ 11:37 am

Marcus @ creditmattersblog turned us on to your blog. Thanks Marcus. You’re a peach.

~Don from SW OH

By Johnson, May 8, 2009 @ 10:02 pm

Why do you reference hacks like Orman and Ramsey? Why not Jane Quinn, Eric Tyson, Andy Tobias and others who have expertise, credentials and a track record of excellent advice

By Frank Curmudgeon, May 9, 2009 @ 8:50 am

That’s a good question. I did reference Tyson the other day, but I probably should spend more time on the saner members of the second tier.

By Kimberly Cole, April 7, 2010 @ 4:49 pm

Great post! I agree that personal finances are more complicated than ever and that we are indeed going through some growing pains. However, I think there have been a number of instances in history when we’ve had to go through some uncomfortable transitions financially. For example, Andrew Hamilton suggested the idea of a central federal bank in the 1700s to create a standard form of currency. Up until then, coins and bills were issued separately by state banks. There were certainly a lot of kinks to work out then, and I think we’re still working out some of those kinks, but there’s no doubt that we’ve come a long way. Hopefully there will be similar progress in terms of handling our current financial changes. It’s just too bad that the most sophisticated way we seem to be able to handle these problems is through trial and error.

By monica, February 24, 2011 @ 11:10 pm

so, i’m someone who makes 15K/year has debt, no savings and a poor budget. isn’t dave ramsey a good place to start?

By Professor Lembach, March 11, 2011 @ 4:16 am

I’m afraid you indulging in a bit of ahistorical arrogance here. “Personal finance” has always existed, and don’t you think it was a far more difficult subject when most people were just hanging on and were mostly illiterate? Reading ROeder’s “The Man Of The Renaissance” keenly illustrates that even lowly clerks like Machiavelli lived on credit and well beyond their meager means. It’s just that most of the history we know has no concern for the day-to-day of even important people. All we get are big events and important dates. How much do we really know about, say, the credit market for grubstaking in the California Gold Rush?

I will concede that, in the West at least, the standard of living considered “normal” or even “necessary” is higher than almost anyone in the past (and, alas, most of the world in the present) could even aspire to, but that doesn’t mean the fundamental issues have really changed. Indeed, the greatest change isn’t even mentioned in your post: the explosive increase in life expectancy in just the last 100 years or so.

BTW, Bismarck introduced a pension plan in 1889.

By tasacion vivienda referencia catastral, March 10, 2023 @ 12:35 pm

ed medicine india rx pharmacy – canadian pharmacy

By Lawn Mower Repair, March 10, 2023 @ 1:19 pm

Enjoyed every bit of your blog post.Really looking forward to read more. Much obliged.

By Small Engine Spark Plug Service, March 10, 2023 @ 8:18 pm

I really enjoy the blog post.Much thanks again. Awesome.

By ahwatukee, arizona shower reno company, March 11, 2023 @ 3:58 am

Very informative article post. Much obliged.

By Bellingham Internet Marketing, March 11, 2023 @ 7:23 am

Thanks a lot for the article post.Really thank you! Great.

By Custom promotional products, March 11, 2023 @ 9:53 am

Thanks for the article.Really looking forward to read more. Really Great.

By 텐텐벳, March 11, 2023 @ 10:47 am

http://images.google.co.in/url?sa=t&url=https://kibetkorea.net/

By carbon cleaning machine, March 11, 2023 @ 1:27 pm

Enjoyed every bit of your blog.Really looking forward to read more. Cool.

By heater repair Marcus Hook Pennsylvania, March 12, 2023 @ 5:48 am

Major thanks for the article post.Really thank you! Cool.

By solar panels, March 12, 2023 @ 1:08 pm

I appreciate you sharing this blog article. Awesome.

By Aldo Wonders, March 12, 2023 @ 3:11 pm

Палма де Майорка е зашеметяваща дестинация за почивка, която предлага по нещо за всеки. Независимо дали търсите страхотни плажове, богата култура, вкусна храна или купонджийски нощен живот, Палма де Майорка предлага всичко това. Не чакайте повече, резервирайте почивката си в Палма де Майорка още днес и изживейте всичко, което този невероятен град може да предложи!

By auto connector, March 12, 2023 @ 7:54 pm

Thanks again for the article post. Cool.

By anthony natale linkedin, March 13, 2023 @ 4:12 am

Major thankies for the post. Really Cool.

By anthony natale nj, March 13, 2023 @ 9:49 am

Im thankful for the post.Really thank you! Keep writing.

By anthony natale facebook, March 13, 2023 @ 11:41 am

Say, you got a nice article post. Want more.

By bankers life and casualty michael mendes, March 13, 2023 @ 3:39 pm

Great, thanks for sharing this post.Really thank you! Will read on…

By science, March 13, 2023 @ 6:06 pm

It’s really a nice and useful piece of info. I’m happy that you just sharedthis helpful information with us. Please keep us informedlike this. Thank you for sharing.

By proxy private, March 13, 2023 @ 8:51 pm

This is a very good tip particularly to those new to the blogosphere. Simple but very accurate informationÖ Appreciate your sharing this one. A must read article!

By michael mendes facebook.com, March 13, 2023 @ 10:22 pm

Im thankful for the blog article.Thanks Again. Want more.

By visit website, March 14, 2023 @ 12:52 am

hi!,I like your writing very a lot! share we keep up a correspondence extra about your post on AOL?I require an expert in this area to resolve my problem.May be that’s you! Having a look forward to peer you.

By E&J Funday Orangevale, March 14, 2023 @ 4:59 am

Good article. I’m experiencing a few of these issuesas well..

By Blogspot, March 14, 2023 @ 6:30 am

Hey, thanks for the blog. Cool.

By den pin sieu sang, March 14, 2023 @ 11:21 am

Hello There. I found your blog using msn. Thisis a really well written article. I’ll make sure to bookmark it andreturn to read more of your useful info. Thanks for the post.I’ll certainly comeback.

By auto connector, March 14, 2023 @ 12:31 pm

I really like and appreciate your post.Really looking forward to read more. Want more.

By detailing grodzisk mazowiecki, March 14, 2023 @ 7:20 pm

I cannot thank you enough for the blog.

By last night of the proms, March 14, 2023 @ 8:46 pm

hydroxychloroquine zinc what does hydroxychloroquine treat hydroxychloriqine

By ???????, March 15, 2023 @ 12:18 am

I read this post completely on the topic of the resemblance of latest and preceding technologies, it’s remarkable article.

By news, March 15, 2023 @ 5:38 am

Dice is a niche job board that claims to have more than 3 million registered candidates and two.four million special guests per month.

By learn more, March 15, 2023 @ 7:16 am

Many thanks, Wonderful information.essay writing service reviews do my homework professional writing services

By 먹튀커뮤니티, March 15, 2023 @ 10:22 am

Great, thanks for sharing this post.Really thank you! Really Cool.

By call today, March 15, 2023 @ 11:45 am

There is certainly a lot to learn about this issue.I love all the points you’ve made.

By dumpster rentals, March 15, 2023 @ 2:27 pm

I really like and appreciate your article.Much thanks again. Want more.

By 먹튀커뮤니티, March 15, 2023 @ 5:29 pm

I think this is a real great blog article.Really looking forward to read more. Keep writing.

By www.ariseeventrentals.com, March 15, 2023 @ 7:53 pm

I need to to thank you for this fantastic read!! I certainly loved every little bit of it. I have you book-marked to check out new things you post…

By hoc lam kem tuoi, March 15, 2023 @ 10:42 pm

п»їorder stromectol online ivermectin pills human

By garment surabaya, March 16, 2023 @ 3:11 am

Yourr mode of describing all in this piece of wrting is in fact pleasant, all be capableof simply be aware of it, Thanks a lot.

By https://www.j-b-h-r.com/Quincy/, March 16, 2023 @ 3:26 am

This is a good tip particularly to those new to the blogosphere. Brief but very accurate informationÖ Thanks for sharing this one. A must read post!

By making money online, March 16, 2023 @ 3:23 pm

Heya i’m for the first time here. I found this board and I find Itreally useful & it helped me out a lot. I hope to give something backand help others like you aided me.

By designer malaysia, March 16, 2023 @ 4:46 pm

Hi my friend! I wish to say that this post is amazing, great written and come with almost all significant infos.I’d like to see more posts like this .

By zweeds graniet per m2, March 16, 2023 @ 5:45 pm

Say, you got a nice article post.Really thank you! Want more.

By Cristalyn Rogers, March 16, 2023 @ 10:08 pm

Usually I don’t read article on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, very nice post.

By click here, March 17, 2023 @ 6:33 am

Great post. I was checking constantly this blog and I am impressed! Extremely helpful info specially the last part

By jumparoundwi.com, March 17, 2023 @ 10:10 am

Garland Kuczenski says:I?d need to talk to you right here. Which is not something I normally do! I enjoy reviewing an article that will make people assume. Additionally, many thanks for allowing me to comment!Reply 04/22/2020 at 8:27 am

By 더블찬스, March 17, 2023 @ 10:27 am

http://images.google.ro/url?sa=t&url=http://doublech.com/

By Experienced confinement center for mothers in Kuala Lumpur, March 17, 2023 @ 1:58 pm

I was recommended this blog by my cousin. I am not positive whether or not this put up is written through him as no one else realize such targeted approximately my problem. You are incredible! Thanks!

By free mp3 download, March 17, 2023 @ 6:13 pm

You made some really good points there. I looked on the internet for more info about the issue and found most individuals will go along with your views on this website.

By Betty Chapman, March 17, 2023 @ 7:19 pm

I really enjoy the blog article.Really looking forward to read more. Will read on…

By Sheridan Cassidy, March 18, 2023 @ 12:49 am

You revealed that very well!essay community service help in thesis writing write my essay service

By slot gacor, March 19, 2023 @ 5:56 am

Looking forward to reading more. Great post.Much thanks again. Much obliged.

By Cua nhua gia re, March 19, 2023 @ 3:08 pm

Thanks, I’ve just been searching for info approximately this subject for ages and yours is the greatest I have found out till now. But, what concerning the conclusion? Are you positive concerning the supply?

By ???????, March 19, 2023 @ 5:17 pm

ivermectin over counter uk ivermectin cream 1

By inflatable rentals Warrenton MO, March 19, 2023 @ 7:59 pm

For instance, all but the most laissez-faire of economic thinkingargue that governments must intervene to protect the public when marketsfail, i.e. when they are no longer free and competitive.

By Ryan Dean, March 20, 2023 @ 12:03 am

I’m extremely impressed along with your writing talents and also with the structure foryour blog. Is this a paid subject or did you modify it yourself?Anyway keep up the excellent quality writing, it’s rare to look a great blog like thisone today..

By weight loss meal delivery, March 20, 2023 @ 6:25 am

I cannot thank you enough for the post. Really Cool.

By water slide rentals Hannibal MO, March 20, 2023 @ 9:05 am

Great post. I was checking constantly this blog and I amimpressed! Very useful info particularly the last part

By weight loss meal delivery, March 20, 2023 @ 11:44 am

slot machine online- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Savannah Lawson, March 20, 2023 @ 1:10 pm

I’ll right away grab your rss feed as I can’t find your e-mail subscription link or newsletter service. Do you have any? Please let me know so that I could subscribe. Thanks.

By click here, March 20, 2023 @ 4:35 pm

Hi! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the outstanding work!

By tubidy, March 20, 2023 @ 8:31 pm

You need to take part in a contest for one of the greatest sites online. I’m going to recommend this site!

By Bokep Indonesia, March 20, 2023 @ 9:33 pm

hydroxychloroquine covid 19 chloroquine phosphate brand name

By Madeleine Norman, March 21, 2023 @ 12:12 am

order minomycin order fucidin online suprax for sale Umrxiv wyvgcz

By birthday gift box malaysia, March 21, 2023 @ 3:40 am

What’s up, of course this paragraph is in fact pleasant and I have learned lotof things from it on the topic of blogging. thanks.

By party rentals Rancho Mirage CA, March 21, 2023 @ 6:38 am

So much time invested and only one worth wager to make. There will be data accessible about every thing from group information to the statistics on individual gamers. Lengthier time in betting indicates bigger cash to invest at.

By tubidy, March 21, 2023 @ 6:22 pm

I was pretty pleased to find this site. I need to to thank you for your time due to this wonderful read!! I definitely loved every bit of it and I have you saved to fav to check out new information on your website.

By Gerald Preston, March 21, 2023 @ 7:03 pm

An interesting discussion is worth comment. I think that youshould write more on this subject, it may not be a taboo matter but generally people don’t talk about these subjects.To the next! Best wishes!!

By Jerald Walker, March 22, 2023 @ 2:06 am

I blog frequently and I genuinely appreciate your content. Your article has truly peaked my interest. I will bookmark your blog and keep checking for new information about once a week. I subscribed to your Feed as well.

By 먹튀검증, March 22, 2023 @ 2:19 am

http://cse.google.ad/url?q=http://muktbrk.com/

By Chong muoi dot, March 22, 2023 @ 12:40 pm

order essayrhetorical essay outlinesat essay score

By tubidy mp3 download, March 22, 2023 @ 5:24 pm

Way cool! Some extremely valid points! I appreciate you writing this write-up and also the rest of the site is extremely good.

By Plastic Bottles, March 22, 2023 @ 8:11 pm

Awesome blog post.Thanks Again. Cool.

By sua macbook, March 22, 2023 @ 8:27 pm

Isynep – propecia for sale uk Jlfzia bhnlem

By Spring Cleaners, March 22, 2023 @ 9:36 pm

phpslot- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By mysonsinflatables.com, March 22, 2023 @ 10:35 pm

Very informative post.Really thank you! Much obliged.

By Roland Vaughan, March 22, 2023 @ 11:57 pm

When you act this way, it makes it less likely that your teammates will pass you the ball in the future.

By Malaysia SEO consultant for international strategies, March 23, 2023 @ 3:03 am

whoah this blog is great i love studying your articles. Stay up the good work! You realize, a lot of people are looking round for this information, you could aid them greatly.

By rajbet, March 23, 2023 @ 5:51 am

Thank you, Numerous content.custom writing essay service college essay thesis top professional resume writing services

By cnc machining, March 23, 2023 @ 6:07 am

Appreciate you sharing, great article.Much thanks again. Fantastic.

By Waist Trainer, March 23, 2023 @ 10:22 am

jackpot- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By hgn, March 23, 2023 @ 11:16 am

Thanks , I have just been searching for info approximately this subject for a while and yours is the best I’ve came upon so far. But, what about the bottom line? Are you sure concerning the source?

By kontol besar, March 23, 2023 @ 2:00 pm

I really like it when people get together and share thoughts. Great blog, continue the good work!

By Waist Trainer, March 23, 2023 @ 3:11 pm

casino online gaming- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By diet meal delivery, March 23, 2023 @ 3:24 pm

I’m amazed, I must say. Seldom do I encounter a blog that’s both educative and interesting, and without a doubt, you’ve hit the nail on the head. The issue is something that not enough men and women are speaking intelligently about. Now i’m very happy I came across this in my hunt for something regarding this.|

By Tubidy Mp3 Download, March 23, 2023 @ 4:06 pm

Major thanks for the post.Thanks Again. Will read on…

By weight loss meal delivery, March 23, 2023 @ 6:48 pm

It’s amazing designed for me to have a website, which is good in support of my knowledge. thanks admin|

By Kitty Dennis, March 24, 2023 @ 12:59 am

วันนี้ถ้าหากต้องการจะแทงบอล ไม่ว่าจะเป็นบอลผู้เดียว บอลสเต็ป บอลสด ก็สามารถทำเป็นง่ายๆโดยไม่ต้องเดินทางไปโต๊ะบอลให้ยุ่งยาก เพียงแต่เข้ามาที่ UFABET คุณก็สามารถร่วมบันเทิงใจกับเราได้โดยทันที ฝากถอนอัตโนมัติไม่ยุ่งยากสบายเร็วปลอดภัย

By Tubidy, March 24, 2023 @ 3:56 am

There’s definately a lot to find out about this subject. I like all the points you made.

By https://www.sbssibo.com/about-us/, March 24, 2023 @ 4:57 am

I cannot thank you enough for the blog.Really thank you! Will read on…

By Bokep Live, March 24, 2023 @ 5:20 am

pharmacy technician in canada canadian pharmacy phone calls

By merchant services sales representative, March 24, 2023 @ 11:53 am

ph2bet- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Discrimination claims, March 24, 2023 @ 12:39 pm

A motivating discussion is definitely worth comment.I believe that you ought to publish more on this issue, it may not be a taboo subject but usually people don’t talk about these subjects.To the next! Best wishes!!

By locksmith cardiff, March 24, 2023 @ 3:35 pm

What exactly a man of ability! You have the potential to compose great items that you can’t discover anywhere. to envy

By porn, March 24, 2023 @ 9:20 pm

The very next time I read a blog, Hopefully it won’t fail me just as much as this one. I mean, I know it was my choice to read, however I genuinely believed you would have something useful to say. All I hear is a bunch of whining about something that you could possibly fix if you weren’t too busy looking for attention.

By bounce house rentals, March 24, 2023 @ 10:34 pm

Highly energetic blog, I loved that a lot. Will there be a part 2?

By download lagu mp3 gratis, March 25, 2023 @ 2:56 am

This excellent website truly has all the information I wanted about this subject and didn’t know who to ask.

By www.froggyhops.com/edina_mn_bounce_house_rentals/, March 25, 2023 @ 3:57 am

azithromycin sds flagyl alcoholism cephalexin dogs

By du hoc o Singapore, March 25, 2023 @ 9:38 am

Thanks for the auspicious writeup. It actuallywas a enjoyment account it. Look advanced to far introduced agreeable from you!However, how can we communicate?

By tubidy mp4 mp3 download, March 25, 2023 @ 3:38 pm

Having read this I thought it was extremely informative. I appreciate you spending some time and energy to put this content together. I once again find myself spending a significant amount of time both reading and leaving comments. But so what, it was still worth it!

By Lawrence Mcleod, March 25, 2023 @ 4:46 pm

Awesome issues here. I am very glad to look your post.Thank you so much and I am looking ahead to contact you. Willyou please drop me a mail?

By cholet, March 25, 2023 @ 7:32 pm

This piece of writing will assist the internet viewers for building up new website or even a weblog from start to end.|

By Avery Marshall, March 25, 2023 @ 11:45 pm

Thanks for one’s marvelous posting! I quite enjoyed reading it, you might be a great author.I will always bookmark your blog and may come back later on. I want to encourage you to definitely continue your great writing, have a nice morning!

By starting a merchant processing company, March 26, 2023 @ 2:39 am

jili slot- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By vanzare pisici, March 26, 2023 @ 1:17 pm

gambling- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By download lagu mp3 gratis, March 26, 2023 @ 2:20 pm

There’s certainly a great deal to learn about this subject. I really like all the points you’ve made.

By amateur porn, March 26, 2023 @ 3:05 pm

Currently it seems like Drupal is the best blogging platform available right now. (from what I’ve read) Is that what you are using on your blog?|

By https://www.sbssibo.com/about-us/, March 26, 2023 @ 7:43 pm

I really liked your post.Much thanks again. Cool.

By Agra same day tour from Delhi, March 27, 2023 @ 3:24 am

Thank you ever so for you blog post.Really thank you! Really Cool.

By download lagu terbaru, March 27, 2023 @ 4:13 am

There is definately a lot to find out about this topic. I love all the points you’ve made.

By visit website, March 27, 2023 @ 5:06 am

I do consider all the ideas you’ve presented to your post. They’re really convincing and can certainly work. Nonetheless, the posts are too short for novices. May you please lengthen them a little from next time? Thanks for the post.

By login salam jp, March 27, 2023 @ 6:58 am

slot online- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By visitorbet, March 27, 2023 @ 8:23 am

Generally I do not learn article on blogs, however I would like to say that this write-up very forced me to check out and do it! Your writing taste has been amazed me. Thanks, very great post.|

By click here, March 27, 2023 @ 9:13 am

Hey there! I simply would like to offer you a huge thumbs up for the great info you have right here on this post. I am returning to your blog for more soon.

By visitorbet, March 27, 2023 @ 9:28 am

This is my first time pay a quick visit at here and i am in fact pleassant to read all at one place.|

By visitorbet, March 27, 2023 @ 4:45 pm

cock fighting- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By OGA-031 Practice Exam, March 28, 2023 @ 10:34 am

herbal ed remedies ed pills that work – pharmacy medications

By https://g.co/kgs/tfgzJ2, March 28, 2023 @ 11:58 am

magnificent submit, very informative. I wonder why the other experts of this sector do not understand this. You should proceed your writing. I am confident, you’ve a great readers’ base already!

By tubidy mp3, March 28, 2023 @ 2:13 pm

I’m impressed, I have to admit. Seldom do I encounter a blog that’s both equally educative and interesting, and without a doubt, you’ve hit the nail on the head. The problem is something which not enough people are speaking intelligently about. I am very happy I stumbled across this in my hunt for something relating to this.

By Manufacturing videos, March 28, 2023 @ 5:27 pm

Hi! I could have sworn Iíve been to this blog before but after looking at some of the posts I realized itís new to me. Anyways, Iím certainly pleased I stumbled upon it and Iíll be book-marking it and checking back often!

By handyman small engine repair, March 28, 2023 @ 7:29 pm

I really enjoy the blog. Really Cool.

By Julie Hobbs, March 28, 2023 @ 8:15 pm

Enjoyed looking at this, very good stuff, thank you.Also visit my blog … Xoth Keto BHB

By Kerr Harrison, March 29, 2023 @ 1:53 am

Enjoyed every bit of your post.Really looking forward to read more. Really Great.

By water slide rentals Ocala, March 29, 2023 @ 7:03 am

you center yourself and clear your head prior to writing.

By tree cutting roanoke, March 29, 2023 @ 10:13 am

A big thank you for your article.Really thank you! Want more.

By 해외배팅, March 29, 2023 @ 10:13 am

http://maps.google.com.vc/url?q=https://livebet-365.com/

By mp3juice, March 29, 2023 @ 1:10 pm

Nice post. I learn something new and challenging on blogs I stumbleupon every day. It’s always interesting to read through articles from other writers and practice a little something from their web sites.

By Holly Power, March 29, 2023 @ 5:27 pm

Well I really enjoyed studying it. This subject offered by you is very constructive for good planning.

By consultant-seo.io, March 29, 2023 @ 6:17 pm

roulette wheel online- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By tree stump grinder, March 29, 2023 @ 7:15 pm

Thanks again for the blog.Really thank you! Great.

By tubidy mp3 download, March 30, 2023 @ 4:09 am

An impressive share! I’ve just forwarded this onto a co-worker who has been doing a little homework on this. And he in fact ordered me dinner due to the fact that I discovered it for him… lol. So allow me to reword this…. Thanks for the meal!! But yeah, thanks for spending the time to discuss this matter here on your blog.

By BA88, March 30, 2023 @ 5:06 am

slot game- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By mortgage pre approval td, March 30, 2023 @ 5:41 am

A big thank you for your blog.Thanks Again.

By tree stump removal, March 30, 2023 @ 10:26 am

Major thanks for the post.

By bokep indonesia, March 30, 2023 @ 11:30 am

I’d should examine with you here. Which is not one thing I often do! I take pleasure in studying a put up that will make folks think. Also, thanks for allowing me to comment!

By visitorbet, March 30, 2023 @ 1:07 pm

I was recommended this blog by means of my cousin. I am no longer certain whether or not this post is written via him as nobody else know such distinctive approximately my trouble. You are amazing! Thanks!|

By BA88, March 30, 2023 @ 2:50 pm

Pusoy Dos- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Android device, March 31, 2023 @ 6:36 am

Generally I don’t learn article on blogs, however I wish to say that this write-up very pressured me to try and do it! Your writing taste has been surprised me. Thank you, very nice post.

By BA88, March 31, 2023 @ 12:27 pm

poker online- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By pc hilfe lachen, March 31, 2023 @ 8:58 pm

Hello i am kavin, its my first occasion to commenting anywhere, when i read this paragraph i thought i could also make comment due to this brilliant post.|

By free payment processor, April 1, 2023 @ 7:29 am

bingo- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By free credit card processor, April 1, 2023 @ 12:42 pm

pxbet- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By hilfe bei computer einrichten meilen, April 1, 2023 @ 1:12 pm

hello!,I love your writing very a lot! percentage we keep in touch more about your article on AOL? I need an expert in this house to unravel my problem. May be that is you! Taking a look ahead to see you. |

By tubidy, April 1, 2023 @ 5:35 pm

Oh my goodness! Awesome article dude! Thank you so much, However I am going through troubles with your RSS. I don’t know why I can’t join it. Is there anybody else getting identical RSS issues? Anybody who knows the answer will you kindly respond? Thanx.

By free credit card reader, April 2, 2023 @ 12:46 am

texas poker- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Kate Price, April 2, 2023 @ 5:44 pm

I have read so many articles regarding theblogger lovers but this paragraph is truly a nice article, keep it up.

By Gladys Harris, April 2, 2023 @ 11:34 pm

An interesting discussion is definitely worth comment. I believe that you should publish more about this subject matter, it might not be a taboo subject but typically folks don’t speak about these issues. To the next! All the best!!

By free payment processor, April 3, 2023 @ 1:53 am

jackpot- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By muscle tone, April 3, 2023 @ 2:39 am

It’s fantastic that you are getting ideas from this article as well asfrom our dialogue made at this time.

By rent a photo booth in Youngstown OH, April 3, 2023 @ 3:10 am

Only wanna admit that this is very useful, Thanks for taking your time to write this.

By Eric Davis, April 3, 2023 @ 5:49 am

Hi, I do believe this is a great blog. I stumbledupon it

By free payment processing for small business, April 3, 2023 @ 9:33 am

online casino- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By digital gambling platforms, April 3, 2023 @ 1:53 pm

always i used to read smaller content that also clear their motive, and that is also happening with this article which I am reading at this time.

By casinos, April 3, 2023 @ 4:43 pm

Hello, yes this article is truly nice and I have learned lotof things from it regarding blogging. thanks.

By systems, April 3, 2023 @ 9:50 pm

online pharmacy reviews tops pharmacy pharmacy discount card

By jelajahi situs ini, April 3, 2023 @ 11:25 pm

Next time I read a blog, Hopefully it doesn’t fail me as much as this one. I mean, I know it was my choice to read, nonetheless I genuinely thought you would have something useful to talk about. All I hear is a bunch of moaning about something that you could fix if you were not too busy searching for attention.

By Free credit card terminal, April 4, 2023 @ 2:08 am

on line gambling- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Trading online, April 4, 2023 @ 5:43 am

I couldn’t resist commenting. Well written!|

By plastic injection mold manufacturer, April 4, 2023 @ 9:13 am

Thanks for the post.Really thank you! Keep writing.

By Forex fxp, April 4, 2023 @ 9:14 am

Your style is so unique in comparison to other folks I have read stuff from. Thanks for posting when you’ve got the opportunity, Guess I’ll just bookmark this web site.|

By casino dealer, April 4, 2023 @ 9:49 am

Appreciate it for helping out, good information. “Those who restrain desire, do so because theirs is weak enough to be restrained.” by William Blake.

By play, April 4, 2023 @ 3:44 pm

Thanks , I’ve recently been searching for information about this subjectfor a long time and yours is the greatest I have found out so far.But, what concerning the bottom line? Are you certain concerning the source?

By ps100, April 4, 2023 @ 9:37 pm

ivermectin paste for guinea pigs ivermectin cream for rosacea

By point of sale systems for hair salons, April 5, 2023 @ 2:51 am

slot betting- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By salon pos system free, April 5, 2023 @ 8:23 am

maka games- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Bat hdpe, April 5, 2023 @ 8:58 am

Hi, I do think this is a great blog. I stumbledupon it

By best point of sale system, April 5, 2023 @ 12:43 pm

I am regular reader, how are you everybody? This post posted at this site is really pleasant.|

By best point of sale system, April 5, 2023 @ 1:55 pm

I enjoy what you guys tend to be up too. This kind of clever work and reporting! Keep up the awesome works guys I’ve incorporated you guys to my blogroll.|

By mejortorrent, April 5, 2023 @ 9:03 pm

Right away I am ready to do my breakfast, when having mybreakfast coming over again to read other news.

By read article, April 6, 2023 @ 1:20 am

How far to go back on resume hotels ruUYhjhgTDkJHVy

By bounce house rentals, April 6, 2023 @ 2:39 am

Wow that was unusual. I just wrote an extremely long comment but after I clicked submit my comment didn’t appear.Grrrr… well I’m not writing all that over again. Regardless,just wanted to say fantastic blog!

By helpful resources, April 6, 2023 @ 2:58 am

Greetings! Very useful advice within this article! It’s the little changes which will make the greatest changes. Thanks for sharing!

By https://tubidy.web.za, April 6, 2023 @ 9:10 am

Having read this I thought it was extremely informative. I appreciate you spending some time and energy to put this information together. I once again find myself personally spending way too much time both reading and leaving comments. But so what, it was still worthwhile.

By luxury watches, April 6, 2023 @ 10:35 am

I enjoy what you guys tend to be up too. Such clever work and coverage!Keep up the amazing works guys I’ve added you guys to my blogroll.

By slot gacor winlive4d, April 6, 2023 @ 1:21 pm

I want to to thank you for this good read!! I certainly enjoyed every little bit of it. I have got you book-marked to check out new stuff you postÖ

By pcb board manufacturing, April 6, 2023 @ 3:26 pm

Thank you ever so for you blog post.Really thank you! Cool.

By prowadzenie kampanii google ads, April 6, 2023 @ 9:27 pm

Undeniably imagine that that you said. Your favourite reason seemed to be on the net the simplest factor to take into accout of. I say to you, I certainly get irked whilst other people consider concerns that they plainly don’t realize about. You managed to hit the nail upon the highest and outlined out the entire thing without having side effect , other folks can take a signal. Will probably be back to get more. Thank you|

By google ads, April 6, 2023 @ 10:40 pm

You could certainly see your skills in the article you write. The world hopes for more passionate writers such as you who aren’t afraid to say how they believe. At all times go after your heart.|

By read more here, April 7, 2023 @ 2:48 am

Good post. I learn something new and challenging on websites I stumbleupon every day. It will always be useful to read through content from other writers and practice a little something from other websites.

By check this link right here now, April 7, 2023 @ 5:23 am

I like it whenever people come together and share ideas. Great website, stick with it!

By play, April 7, 2023 @ 8:04 am

I wanted to thank you for this excellent read!! I certainly loved every little bit ofit. I have you book marked to check out new things you post…

By Вадим Столар Парус, April 7, 2023 @ 1:14 pm

Pusoy Dos- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By slot machines, April 7, 2023 @ 1:32 pm

Hmm is anyone else encountering problems with the imageson this blog loading? I’m trying to find out if its a problem on my endor if it’s the blog. Any feed-back would be greatly appreciated.

By Mathilde Diefendorf, April 7, 2023 @ 3:25 pm

There are some attention-grabbing closing dates on this article however I don’t know if I see all of them middle to heart. There is some validity but I will take hold opinion till I look into it further. Good article , thanks and we wish more! Added to FeedBurner as effectively

By Фонд Столара, April 7, 2023 @ 6:21 pm

casino gaming- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By upuper, April 7, 2023 @ 7:11 pm

Really informative article. Awesome.

By Bottle games, April 7, 2023 @ 7:15 pm

This is a really good tip especially tothose fresh to the blogosphere. Short but very accurateinformation… Appreciate your sharing this one.A must read article!

By to learn more, April 7, 2023 @ 11:31 pm

instagram takipçi satın alma ne kadarbit.ly/instagram-takipci-satin-almak

By vsol price, April 8, 2023 @ 4:38 am

Major thankies for the blog article.Much thanks again.

By download tiktok mp3, April 8, 2023 @ 5:25 am

Hi my family member! I wish to say that this article is awesome, great written and include almost all important infos. I would like to peer extra posts like this.

By write my essay for me, April 8, 2023 @ 8:48 am

Asking questions are truly nice thing if you are not understanding something fully, however this article gives good understanding even.|

By buy essay writing service, April 8, 2023 @ 9:45 am

Hi to every one, the contents present at this website are in fact amazing for people knowledge, well, keep up the nice work fellows.|

By check these guys out, April 8, 2023 @ 10:32 am

An intriguing discussion is definitely worth comment. I believe that you should write more on this topic, it may not be a taboo matter but typically people don’t speak about such issues. To the next! Many thanks!

By Hoc pha che do uong, April 8, 2023 @ 12:04 pm

I am so grateful for your blog.Much thanks again. Great.

By psicólogo clínico cerca de mí, April 8, 2023 @ 12:09 pm

You made some good points there. I did a search on the issue and found most guys will agree with your blog.

By click here, April 9, 2023 @ 7:35 am

A person essentially lend a hand to make critically posts I might state. This is the first time I frequente

By psicologo familiar malaga, April 9, 2023 @ 7:39 am

Hello, you used to write magnificent, but the lastseveral posts have been kinda boring… I miss your super writings.Past few posts are just a little bit out of track! come on!Stop by my blog … weight-loss pill

By read full report, April 9, 2023 @ 3:02 pm

There is definately a great deal to know about this topic. I really like all the points you’ve made.

By slot online, April 9, 2023 @ 7:11 pm

slot bet – World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Top tips for event planning in London, April 10, 2023 @ 2:40 am

สล็อตออนไลน์โปรสมาชิกใหม่ ฝาก30รับ100 เว็บใหม่ถอนไม่อั้น สล็อตทุนน้อยสล็อตล่าสุด แจกเครดิตฟรี แจกหนักมากกโปรเว็บใหม่ สนใจคลิ๊กลิ้งค์ได้เลย แจกจริง

By Roland Charlton, April 10, 2023 @ 1:50 pm

There exists noticeably a bundle to comprehend this. I suppose you might have made distinct good points in features also.

By click for more info, April 10, 2023 @ 3:51 pm

When I initially commented I seem to have clicked on the -Notify me when new comments are added- checkbox and from now on each time a comment is added I receive four emails with the same comment. Perhaps there is a means you can remove me from that service? Many thanks.

By Humphrey Ball, April 10, 2023 @ 4:35 pm

I have read so many articles regarding the blogger lovers however this paragraph is in fact a good paragraph, keep it up.

By slot online, April 10, 2023 @ 4:37 pm

maka games- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By slot online, April 10, 2023 @ 5:26 pm

slot vip- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By Katie Bishop, April 10, 2023 @ 7:21 pm

Members of the Gucci household, on the other hand, are reportedly not pleasedwith the film.

By tubidy mp3 download, April 10, 2023 @ 8:31 pm

I must thank you for the efforts you have put in penning this website. I am hoping to view the same high-grade content by you in the future as well. In truth, your creative writing abilities has inspired me to get my very own site now

By Lucretia Davidson, April 10, 2023 @ 10:10 pm

I really enjoy the article.Much thanks again. Fantastic.

By read here, April 11, 2023 @ 7:15 am

After looking at a few of the blog posts on your web page, I seriously appreciate your technique of blogging. I added it to my bookmark webpage list and will be checking back in the near future. Take a look at my web site too and tell me what you think.

By plumbing services, April 11, 2023 @ 11:46 am

slot betting- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By players, April 11, 2023 @ 4:17 pm

apartments for rent in puerto rico apartments for rent in burbank ca apartments in providence ri

By Growing Cubes, April 11, 2023 @ 5:19 pm

Fantastic blog article. Really Cool.

By plumbing contractor, April 11, 2023 @ 5:41 pm

online casino games- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By plumbers, April 11, 2023 @ 6:06 pm

online casino- World’s Top Online Casinos, new user welfare register bonus 66₱, daily Betting Rebate 2. fast withdraw, good bonus, variety of games, World brand is trustworthy. Slot games, Card games , Live Casino, Animals(Cockfight games), fishing.

By gaining popularity, April 11, 2023 @ 7:16 pm

lasix 80 – clomid for sale lasix online canada

By gambling experience, April 11, 2023 @ 8:01 pm

This is one awesome blog.Really thank you! Cool.

By roulette Many players, April 11, 2023 @ 11:07 pm

Wow, great article post.Really thank you!Loading…

By Gambling, April 12, 2023 @ 2:53 am

Hi, everything is going fine here and ofcourse every one is sharing information, that’s in fact excellent, keep up writing.

By vsol olt, April 12, 2023 @ 4:25 am

Thank you ever so for you article.Really looking forward to read more. Will read on…

By Anime Character Info, April 12, 2023 @ 4:57 am

509392 986443Read more on that great Post, I linked to you Thank you. 661897

By Ryan Munoz, April 12, 2023 @ 7:48 am

Hi there, just became alert to your blog through Google, and found that it’s truly informative. I’m going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

By 프리카지노쿠폰, April 12, 2023 @ 12:12 pm

I cannot thank you enough for the blog post.Really looking forward to read more. Awesome.

By slot machine, April 12, 2023 @ 1:59 pm

Very good blog post.Much thanks again. Want more.

By Leif Sleeper, April 12, 2023 @ 3:09 pm

Good post und straight auf den Punkt gebracht. Ich bin mir nicht sicher, ob dies wirklich der beste Ort ist, um zu fragen, aber habt ihr Jungs irgendwelche Gedanken zu wo einige professionelle Autoren bekommen? Danke

By Slot machines, April 12, 2023 @ 7:36 pm

Very neat blog post.Really thank you! Will read on…

By 프리카지노, April 12, 2023 @ 7:44 pm

Major thanks for the blog post.Really looking forward to read more. Much obliged.

By no deposit bonuses, April 13, 2023 @ 1:18 am

Excellent post. I was checking constantly this blog and I’m impressed! Extremely useful info specifically the ultimate section

By plumbing services, April 13, 2023 @ 5:59 am

Hi there fantastic blog! Does running a blog like this require a massive amount work? I have very little knowledge of programming however I was hoping to start my own blog soon. Anyways, should you have any suggestions or techniques for new blog owners please share. I understand this is off subject but I just needed to ask. Cheers!|

By plumbing service, April 13, 2023 @ 5:59 am