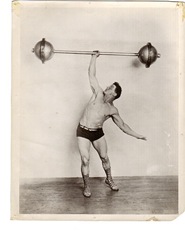

Time to add to the BMA collection of academic studies on what makes people rich. Previous findings include that watching TV makes you poor, being smart does not help, and financial literacy classes reduce financial literacy.

Today’s entry is exercise. An economics professor at Cleveland State University has discovered that regular exercise will increase your pay. As the SmartMoney blog that brought this important finding to my attention put it, Want a 9% Raise? Hit the Gym.

Just to be clear, Professor Kosteas does not merely present a correlation between regularly working out and making more money. He argues cause and effect, that “Regular physical activity has been linked to improved mental function, psychological wellbeing and energy levels, all of which can result in increased productivity and translating into higher earnings.” (I could not find the final paper on-line for free. The quote is from a working draft.)

Read more »

I know many of you have been asking yourselves, what does Frank think of all this crisis stuff going on in Europe? Is he worried about it? Should I be?

Is he worried about it? Should I be?

The trouble in Europe has been going on for rather a while now, arguably since the financial crisis began in 2008, although it took a while for everybody to really notice. So quite a lot has already been written and said about it. If you have not been paying close attention, then 1) good for you and 2) maybe my comments will help fill you in.

It is really a pair of twin interrelated crises on the very slow burn in Europe. There is a banking crisis. And there is a sovereign debt crisis.

The European bank problems are similar to the ones we had on this side of the Atlantic. Indeed, in as much as European banks bought surprisingly large amounts of American mortgage backed securities, it is the exact same problem. But European banks, particularly Spanish and Irish ones, also lent heavily into their very own hometown real estate bubbles.

Read more »

With a coordination that I am sure both found embarrassing, The New York Times and The Wall Street Journal both ran stories on Saturday with tips on how to deal with a bout of deflation.

This raises several questions. Do we expect deflation? If so, why? What is deflation, anyway? Why is it so bad? Is the advice from these two giants of the mainstream any good? And what was it about last weekend that inspired them to write about, of all things, deflation?

That’s a long post’s worth of rhetorical questions. So, without further ado, let’s dive right in. Personally, I do not expect deflation in the near term, at least not enough to notice. Whether or not it is expected, or even seriously worried about, in the larger investment community is a harder question to answer.

The WSJ opens its piece telling us that “The markets are signaling that a bout of deflation may be coming.” But the only market indicator cited is a rally in bonds. True, the yield on 10-year Treasuries is down this year, although it is up from where it was at the end of 2008. And yet a rally in bonds is not exactly an unambiguous statement about deflation. The bond market goes up and down all the time. Why is this rally a deflation prediction?

Read more »

A while back, I wrote about the assumption made by many personal finance gurus that rich people are good with money. This is a basic tenet of a variety  of millionaire secrets books, that those rich folks got that way because they knew tricks you don’t. Of course, I don’t think it’s anything like that simple.

of millionaire secrets books, that those rich folks got that way because they knew tricks you don’t. Of course, I don’t think it’s anything like that simple.

A new-to-me blog called Pop Economics (which I found via Smart Spending – Thanks Karen) recently brought up a similar but more philosophical question. Are smarter people better with money?

At one level, it is a silly question. Does anybody believe the contrary hypothesis, that they are worse? More or less by definition, we consider smarter people to be a little quicker to pick up mental skills and gain wisdom. That is what smart means.

Read more »

A little while back the Wall Street Journal ran a pair of articles about things we should do in preparation for the inevitable effects of the federal budget deficit. Brett Arends led off on February 4 with The Deficit: How to Protect Yourself and then on the 6th we got a round up of advice from most of the rest of the WSJ staff in Protecting Yourself from the Giant New Deficit: How to Keep the Scary U.S. Debt From Eating Up Your Assets.

To a degree, items like these almost comically miss the big picture. They remind me of pieces popular a while back that said that in anticipation of global warming we should all buy land in the Canadian interior. If the government continues on its present course, and I for one am not ready to concede that that is a certainty, it will be an economic calamity that will make us all drastically worse off. The best thing a person can do about the deficit is to vote for leaders willing to do the ugly and unpopular things necessary to reduce it.

But if you can ignore the big picture and focus on only the near term effects of the current and upcoming deficits, it is possible to come up with some coherent advice. Not that the crew at the WSJ consistently do this.

Read more »