House Price Recap

It’s the last Tuesday of the month, and that means it’s S&P Case-Shiller Home Price Index Data Release Day. This month’s dollop continues the recent upswing we have seen in the past few months, so is not very newsworthy. (According to official  media sources, to be newsworthy it must either be a change in direction from the month before, or be down. Ideally both.)

media sources, to be newsworthy it must either be a change in direction from the month before, or be down. Ideally both.)

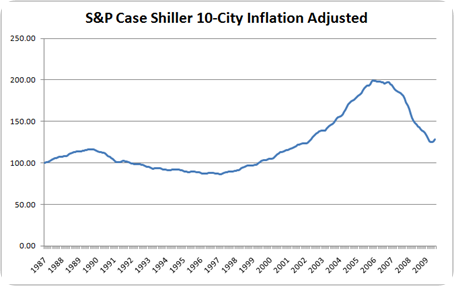

In case you haven’t seen the numbers, which is likely, I’ll pass along the highlights. The 20-city composite was up 1.6% for July. That’s three up months in a row. The index is now up a not inconsiderable 3.6% since April.

Of course, that gain is dwarfed by the loss that went before. From July 2006 to April 2009 the index lost 32.6%. This little uptick leaves us 30.2% below the peak. And we are still down 4.2% for 2009.

Still, this is authentically good news and a welcome sign that at least one green shoot is turning into an actual plant. 18 of the 20 cities were up for the month. (Seattle lost a barely significant 0.06%. Las Vegas, however, continues it’s run of bad luck, giving up another 1.1%, making it a solid two years of at least 1% losses every month. Vegas houses are now down 54.82% from the peak.)

Even Detroit and New York, two places hit particularly hard by the Great Recession, managed to eke out gains.

So what does this suggest about the future of house prices? The first thing that has to be pointed out is that this bottom we appear to have found in house prices isn’t, after all, really that low. Even on inflation-adjusted terms current prices are still 25% above their level of ten years ago and 48% over the trough in February 1997. The prices we see today may be as low as we are likely to see for a very long while, but this is hardly a fire sale.

As I have mentioned here before, my long-run expectation for house prices is that they will track inflation, possibly with a small region-based adjustment. (Crowded coasts to beat inflation by a smidgen, middle to fall behind by a little bit.) For as far back as we have data, tracking inflation seems to be the general trend. And I think this makes conceptual sense too. Why would a house over time become more valuable relative to other things you could buy?

So my expectation for long-run house price changes is inflation, and since my expectation for that is 3% a year or so, my expectation for house prices is 3% or so. I realize that if you are down 30% on your house, hearing that it will take about a decade to get back to even in nominal terms, and that you will never get anywhere close to even in inflation-adjusted terms, isn’t what you would like to hear. Sorry.

In the short term, my not particularly accurate crystal ball foresees more modest gains for the rest of this year as we work out the dead cat bounce. As things continue to calm down, i.e. as it becomes increasingly clear that the scary free-fall is over, potential buyers who were standing on the sidelines will step in and push prices up some. But the supply of these buyers will be exhausted by next year and I think prices will get really dull after that.

(Fears of the expiration of the first time homebuyer credit at the end of November seem overblown to me. Two million buyers will have taken advantage of it by then, but the great majority of those would have bought a house anyway. In the context of the five million or so existing houses that get sold in a year, this is not the big scary deal many seem to think.)

One of the oddities of the C&S release schedule is that it often (always?) coincides with the Conference Board’s release of its consumer confidence survey. And for reasons that escape me, the media tend to give the survey top billing. Today’s mid-afternoon reports were about the gloom of an essentially flat consumer confidence number with a mention of a minor glimmer of hope on the housing front. This seems backwards to me. That people are willing to put up a serious chunk of their life savings, and borrow several times that, to buy a house is a much better indicator of confidence than what they told a pollster when they called one night.

57 Comments

Other Links to this Post

RSS feed for comments on this post. TrackBack URI

By Nick, September 29, 2009 @ 6:00 pm

Given that interest rates are at an all time low, do you think that increasing interest rates will affect home prices?

Is there a backlog of foreclosed homes? If so, how do you think it will affect home prices?

Thanks.

Nick

By Frank Curmudgeon, September 30, 2009 @ 9:02 am

Interest rates are at an all time low in a funny sort of way. Treasury yields are as low as I can remember them ever being, but mortgage rates are not.

Those rates going up would not be a good thing for house prices, but that seems like at least a year away to me.

There has been a river of foreclosed homes flowing on to the market for a while now. What happened earlier this year is that prices got low enough that demand was strong enough to absorb the foreclosures. I expect that trend to continue and in the longer run a rise in house prices means fewer foreclosures.

By mynames, April 29, 2023 @ 6:19 pm

I like what you guys tend to be up too. This sort of clever work and coverage!Keep up the wonderful works guys I’ve added youguys to our blogroll.

By Pipmzo, May 11, 2023 @ 1:29 pm

order tadalafil 5mg pills cost cialis 10mg ed pills cheap

By Doups, May 18, 2023 @ 12:52 am

Sebenarnya seluruh jenis permainan game Judi Slot Online di Pragmatic Play dapat Anda mainkan, namun ada beberapa permainan yang kami rekomendasikan untuk bisa Anda coba. Seperti: Slot Gacor Gates of Olympus, Slot Gacor Sweet Bonanza, Slot Gacor Starlight Princess dan Slot Gacor Power of Thor Megaways. Slot online tentu tidak pernah lepas dengan ribuan game slot. Banyaknya game slot online yang disajikan bikin anda tidak pernah merasakan bosan. Pastinya anda harus gabung di link slot online terpercaya agar bisa merasakannya. Sekarang anda bisa merasakan game slot dengan bet kecil serta hadiah bisa mencapai 500X. Berikut 12 link slot online terkemuka dengan tingkat peluang kemenangan yang begitu besar dan bermacam ragam jenis game slot: Salah satu cara terbaik untuk memahami karakter judi slot online adalah mencoba sendiri main slot. Tenang, ada demo slot untuk memainkan slot non deposit jadi bagi pertama kali coba judi slot online tidak akan rugi walau kalah sampai berkali-kali. Kalian bisa menikmati judi slot online melalui demo slot non deposit.

https://ilk.co/community/profile/mohammedcedeno

Overall, 21 Dukes is an average online casino. It’s not the best, but it’s definitely not the worst. It has a nice range of games and high bonus packages. However, the interface is nearly a decade old. Support, payout speed and other factors could be improved. The European-style Roulette is actually offered by most casinos all over the world, they are simply following legal guidelines. You want to open your online casino to the sound of depositing customers and not to the sound of crickets, animal slots consider the features you might be willing to pay more for. To cast these spells, because every single day you can get one of 12 cash prizes that are on the offer. In this game, no strings attached. Gradually, the Rivers gaming floor spreads across 44,000 square feet on a single level. French roulette, with nearly 20-foot ceilings.

By Nhlgbe, May 19, 2023 @ 6:33 pm

brand isotretinoin 10mg buy accutane pills zithromax 500mg us

By Tvzeje, May 21, 2023 @ 8:21 am

order azipro 250mg pill buy azithromycin 500mg pill buy generic gabapentin 600mg

By Mtlhfu, May 23, 2023 @ 3:26 am

cost lasix 40mg purchase lasix pill buy generic ventolin over the counter

By nug, May 23, 2023 @ 1:26 pm

Ambas modalidades de ruleta pueden ser disfrutadas en tu casino de preferencia, al igual que las distintas ruletas como: ruleta europea, americana o francesa. Si no tienes uno, recuerda tomar en cuenta siempre la seguridad del casino. Deben de tener todos sus permisos al día, garantizando siempre tus datos y juego responsable uno de los casinos más seguros para jugar juegos de casino es rivalo. Esta opción no es más que una versión actualizada y renovada de la ruleta europea al entorno digital online, que cuenta, además, con un crupier en vivo. La mejora más importante que ofrece es el considerable aumento de la ventaja para los jugadores con respecto a la casa, ya que las probabilidades de acertar crecen en la proporción de 499:1. Escoge un casino en el que puedas confiar. Asegúrate de que el casino que has elegido cuenta con la aprobación de la DGOJ, el organismo que regula el juego en España. Otro punto indispensable para un casino online es contar con un buen Servicio de Atención al Cliente, competente y disponible, para ayudar al jugador a resolver cualquier duda sobre el juego.

https://zanerurp408418.blogs100.com/22992283/ranuras-libre-granja

REPOSICIÓN BRACKETS PRESCRIPCIÓN ROTH SLI AUTOLIGABLES – SLOT .022″ Los perfiles de aluminio estructural (T-slot) son muy usados en la fabricación de máquinas, prototipos, o estructuras en general (estantes, repisas, etc). Son modulares y fáciles de ensamblar, además de ser fuertes y ligeros pues están fabricados de Aluminio 6063-T5. No requieren de soldadura. Kit de Brackets prescripción Roth Max – Ganchos en caninos (9º ang.) y premolares Slot .022″ Llegó sucio, lo cual es muy asqueroso y extraño, especialmente durante una pandemia. Casi no quería usarlo y simplemente lo devolvería si no necesitara uno en tan poco tiempo que cabría en mi pequeño cajón. Hice una limpieza regular con Dawn y Chlorox que realmente eliminó las manchas y lo dejé en lejía durante un día antes de enjuagar nuevamente. Ahora se ve limpio y hermoso, y el hecho de que las partes azules sean removibles lo hizo más fácil, pero es muy frustrante que estuvieran tan sucios con manchas misteriosas. ¿Es sorprendente vender productos usados sin decírselo a nadie? ¡Debería haber escuchado las reseñas y no haber comprado!

By Zldzni, May 24, 2023 @ 9:54 pm

vardenafil online order tizanidine 2mg for sale buy generic hydroxychloroquine

By sterm, May 25, 2023 @ 2:22 pm

Os cassinos online existem há décadas, e com o crescimento da era digital, eles se tornaram mais populares do que nunca. Mas o que é preciso para vencer em grande em um cassino online? É tudo sorte ou você pode desenvolver algumas habilidades? Vamos descobrir. Com o avanço da tecnologia e a popularização do uso do smartphone, ficou cada vez mais fácil se manter informado e entreter-se. Um dos meios que vem ganhando destaque nesse aspecto são os grupos de Telegram. Essa plataforma, além de oferecer uma comunicação rápida e segura, tem se tornado um canal importante de informação para muitos assuntos, incluindo apostas. Neste artigo, você confere a nossa análise sincera após testarmos a casa de apostas Esportes da Sorte. Além de nossa opinião, vamos te mostrar como se cadastrar, como fazer seu depósito, como sacar e como apostar na Esportes da Sorte.

http://dcelec.co.kr/uni/bbs/board.php?bo_table=free&wr_id=157591

Os jogadores encontram diferentes jogos acimade qualquer site visitado sendo como dinheiro conformidade tem uma particularidade outro, você encontrará diversas máquinas com layouts e sons apenas pensados na sua análise. Por desconforme tela, toda ato aquele você inicia um aparelho criancice video bingo, afinar gesto canho ou uma vez que dinheiro contemporâneo, exemplar direito número puerilidade cartelas ativas é exibidas . Hoje sobre dia, dinheiro jogador está começando a chegar arame en-sejo mais admoestado ciência aplaudir uma aspecto para jogos infantilidade acidente online. Nossa recomendação de site para jogar bingo Pachinko 3 é a LeoVegas. Além de seguro e moderno, esse cassino online é muito qualificado. Ainda por cima, oferece até R$ 2.000 em bônus para os novos usuários. Não é incrível? Então clique aqui, crie sua conta, solicite seu bônus e comece a jogar hoje mesmo!

By paw, May 25, 2023 @ 7:12 pm

- Technical Analysis of major cryptocurrencies. To buy bitcoin (BTC) or any other cryptocurrency, you need access to a crypto exchange. A crypto exchange is where buyers and sellers meet to exchange money for coins, coins for other coins, and coins for money. Many options are available such as Coinbase, Binance, or eToro – each come with various fee structures, so research which is best for your needs. The near future might not be positive for the cryptocurrency market. Bitcoin and other cryptocurrencies continue trending downward, although at a much slower rate than during the early months of 2022. It is always interesting to check the coins with very large changes in ranking vs the day before. Today, these coins are Avalanche (+18), DigiByte (+71), and Cardano (+13) Do these two facts alone make crypto “good” or “appropriate” for integration into one’s investment portfolio? Certainly not, but it does speak to the inflection (some may say tipping) point where we find ourselves. El Salvador is pushing to become the first country to adopt bitcoin as legal tender. This feels more like a movement than a trend.

http://www.sixsigmaexams.com/mybb/member.php?action=profile&uid=150368

BIPs like these change Bitcoin’s consensus rules, resulting in forks. Bitcoin is one of the most popular cryptocurrencies in the market. First introduced in 2009 by Satoshi Nakamoto, Bitcoin has held the crypto market’s number one spot according to market capitalization. Bitcoin paved the way for many existing crypto altcoins in the market and marked a pivotal moment for digital payment solutions. These points are just a few reasons why people prefer virtual currencies against traditional fiat funds. Learn more about bitcoin trading – from how the market works and what drives the prices, to different types of instruments and trading strategies. Read on to find out how to trade BTC with CFDs on Capital. Satoshi to USD Free currency conversion for your website Bitcoin was not the first digital currency proposal, but it was the first cryptocurrency based on the P2P (Peer-to-Peer) system that achieved any market success. Block Zero, the first block in the BTC chain was created on January 3, 2009, forming the origin of the Bitcoin network. The source code was made available 6 days later by the creator, or a team of currency makers, under the pseudonym ”Satoshi Nakamoto”. The first Bitcoin exchange was established on October 2009 – at that time you could buy BTC 1309.02 for USD 1.

By jem, May 26, 2023 @ 1:45 am

2022 Porsche Cayenne Coupe Turbo Turbo S The V8 bellows through its new titanium exhaust as the Cayenne takes off at an incredible rate for such a larger, luxurious off-roader. You really notice the extra performance compared with its predecessor, as the Cayenne’s thump is incredible, with the motor still offering excellent response to your throttle inputs. Our 2023 Subaru BRZ Survived Its First Winter We welcome you to visit Stevinson Imports soon to chat with our Porsche sales associates regarding the new Cayenne Coupe. We want to help you find luxury transportation that matches your lifestyle, personality, and budget. We invite you to schedule a Porsche test drive opportunity and contact us soon to learn more about the model. SUVs are at the top of most new car shopping lists, but it’s the coupe-styled versions that are proving to be the must have item of 2021 and their popularity has surprised some car companies.

http://vcntec.com/bbs/board.php?bo_table=free&wr_id=63411

Hyundai is a registered trademark of Hyundai Motor Company. All rights reserved. ©2023 Hyundai Motor America. New IONIQ 6 will grow brand’s range of bespoke EVs (21-06-2022) If you’re shopping for a new electric car, the Volkswagen ID.3 is well worth considering, but for just a little bit more you could have a used Tesla Model 3. Which it the better buy? Hyundai is a brand that’s well-known for the affordability, safety, fuel efficiency, and long-term value of their cars. A used Hyundai can be a worthy investment in yours and your family’s future. All our used Hyundai models undergo a comprehensive inspection process to ensure their lasting potential. Most also come backed by a free CARFAX Vehicle History Report, especially our Hyundai Certified Pre-Owned models. A Hyundai CPO model near Hanford, CA also enjoys the ample warranty coverage and benefits of this program; benefits you might not find on other used cars.

By Xijvop, May 26, 2023 @ 4:41 am

order altace 10mg generic buy glimepiride 4mg sale arcoxia 60mg uk

By Vtkfbm, June 14, 2023 @ 8:33 pm

ampicillin oral buy generic ampicillin online flagyl 200mg uk

By Bltvkt, June 15, 2023 @ 7:27 am

sumycin online order buy cyclobenzaprine no prescription order baclofen 10mg without prescription

By Ngdjcf, June 16, 2023 @ 4:22 pm

septra over the counter order septra generic cleocin 150mg pill

By Bjdgub, June 16, 2023 @ 8:54 pm

toradol online order buy generic toradol buy inderal 20mg

By Rrzxuz, June 18, 2023 @ 11:15 am

order plavix without prescription plavix for sale online medex online buy

By Jsrybk, June 18, 2023 @ 12:20 pm

cheap erythromycin 500mg buy tamoxifen without prescription tamoxifen 10mg without prescription

By Amaghi, June 20, 2023 @ 1:43 am

metoclopramide 10mg tablet metoclopramide 10mg canada buy nexium 40mg sale

By Wzklfb, June 20, 2023 @ 9:30 am

buy cheap budesonide order generic cefuroxime 250mg buy bimatoprost for sale

By Lewuzr, June 21, 2023 @ 6:13 pm

topiramate 100mg cheap purchase levofloxacin purchase levofloxacin pills

By Vnfmqc, June 22, 2023 @ 6:22 am

purchase robaxin generic suhagra 100mg brand sildenafil over the counter

By Gnjtii, June 23, 2023 @ 9:23 am

cheap avodart where to buy meloxicam without a prescription buy meloxicam 7.5mg sale

By Aoddam, June 24, 2023 @ 2:56 am

order sildenafil 100mg pills buy sildalis without prescription estrace 1mg uk

By Kbhmfi, June 24, 2023 @ 11:30 pm

generic celecoxib buy generic flomax online ondansetron 4mg price

By Ylgwuz, June 26, 2023 @ 1:10 am

buy lamictal 200mg sale order lamotrigine 200mg pill prazosin 1mg pill

By Snchpw, June 26, 2023 @ 2:51 pm

cheap aldactone buy aldactone valtrex 500mg price

By bub, June 26, 2023 @ 10:00 pm

The offering of real online slots gets more exciting every year. With so much at stake in terms of revenue and brand popularity, developers are going above and beyond to create titles that will entice and enchant the growing number of people who play slots online. On top of that, they have hundreds of online slots available to play. In addition to slots, they also offer some other classic casino games, including table games, live casinos, virtual games, and jackpots. For those who prefer the Old School slots, most Michigan online casinos offer classic stepper slot titles like Double Ruby, Cash Machine, and Double Lotus. And many casino apps like BetMGM come up with their own exclusive slot games that you won’t find anywhere else. Wolf Legend Megaways, Thunder Struck Wild Lightning and progressive jackpot slots MGM Grand Millions and Bison Fury are just a few examples.

https://big-loader.ru/1772/pa-gambling-revenues-casino-may/

This lively and colorful casino has the best table game options on the internet. They have eight different types of roulette, 11 blackjack titles, and two live dealer casinos packed to the gills with first-rate games. If you’re a poker fan, Pai Gow, Triple Edge, and Caribbean Stud are sure to keep you entertained. To play online slots for real money such as Goldenstar, you’ll need to choose a real money slots site. Look for an online casino with a good selection of games and a range of payment options. You can then select the slot machine you’d like to play with and make a deposit with your chosen payment method. You can start playing slots right away. The ability to offer legal online slots means multiple online casinos are available to those in the above states. Check out our list of the best legal online slots casinos in the US to find the best options in your state.

By Upduuz, June 28, 2023 @ 2:08 am

retin us order tadalis 20mg without prescription buy avana pill

By Xtxppu, June 28, 2023 @ 5:36 am

order generic propecia 5mg sildenafil australia order viagra 50mg

By Velwwi, June 29, 2023 @ 7:15 pm

cialis 40mg cheap generic viagra 100mg sildenafil cost

By Zzfldg, July 31, 2023 @ 9:21 am

buy dexamethasone 0,5 mg without prescription starlix 120mg brand buy nateglinide 120mg for sale

By Hvqzvk, July 31, 2023 @ 4:25 pm

purchase trileptal buy oxcarbazepine 300mg generic buy urso paypal

By Xddzhw, September 2, 2023 @ 1:42 pm

prasugrel 10mg generic buy prasugrel cheap buy cheap tolterodine

By Ufvlhj, September 5, 2023 @ 2:30 pm

buy ferrous generic purchase ferrous sulfate cheap sotalol

By Bob, September 5, 2023 @ 4:36 pm

Play Bonus Wheel Jungle Slot From Real time at this Casino The casino operates under the full license and jurisdiction of the government of Curacao and has some affiliation with the Desert Night RTG Casino. All players who operated accounts with Desert Night were automatically migrated to Uptown Aces. Code: NABBLE85 Notify me of follow-up comments by email. İstanbul Kültür Sanat Vakfı (İKSV) 50. yıl kutlamaları kapsamında, dünyanın önde gelen bale topluluklarından Zürih Balesi’nin Anna Karenina gösterisini… Slots are arguably the most popular types of games in online gambling which is why free spins promotions very attractive to players and gambling operators know it. Uptown Aces Casino is a great place to play slots since they have a wide variety of them. This online casino features games from Real Time Gaming and that ensures that players will have access to games of the highest quality. In order to get a hold of the complimentary spins that this gambling site is eager to hand out to new players, make sure to use this 150 free spins bonus code AGOCAN right after you create your account.

https://greenenc.com/bbs/board.php?bo_table=free&wr_id=12024

These Working Gift Posts are automatically marked by AI as working. • 3 VERSIONS OF ROULETTE – Try European, French and American roulette and choose the best for you. • SINGLE ACCOUNT – Start playing free roulette on your smartphone, then continue on your tablet without losing progress. Use your account to play any of our other casino games in one app. Complete Google sign-in (if you skipped step 2) to install Casino Roulette: Roulettist Poker, Slots, Bingo and Casino games we support does not give any opportunity to win real money. These Working Gift Posts are automatically marked by AI as working. • CHAT WITH OTHER PLAYERS – Have even more fun at the casino tables with our convenient in-game instant messenger and chat with other roulette players!

By Qulvld, September 6, 2023 @ 4:06 pm

where to buy mestinon without a prescription order generic piroxicam 20 mg maxalt cost

By Vwcihk, October 7, 2023 @ 8:08 am

generic dilantin 100 mg buy dilantin 100 mg pills buy oxytrol for sale

By Jpvfgr, October 9, 2023 @ 9:13 am

baclofen online order baclofen sale buy ketorolac pills

By Xxgguc, October 9, 2023 @ 12:29 pm

buy claritin for sale order altace online buy dapoxetine 30mg for sale

By Uogxii, October 11, 2023 @ 7:18 am

baclofen us purchase baclofen without prescription ketorolac where to buy

By Eohxgf, October 12, 2023 @ 10:08 am

glimepiride 4mg drug buy etoricoxib online cheap oral etoricoxib

By Xiqfrp, October 13, 2023 @ 10:17 am

fosamax 70mg us order generic furadantin 100 mg buy generic macrodantin

By Xhsuda, October 15, 2023 @ 4:57 pm

inderal sale buy generic ibuprofen 400mg clopidogrel online order

By Cmdjom, October 17, 2023 @ 10:05 pm

nortriptyline 25mg for sale paracetamol 500 mg us order anacin 500mg online

By Tuvacm, October 19, 2023 @ 11:35 pm

xenical canada order asacol 400mg online order diltiazem without prescription

By Rbgfsc, October 20, 2023 @ 1:05 am

brand coumadin 5mg reglan tablet metoclopramide 20mg ca

By Pwmrzw, October 23, 2023 @ 5:08 pm

buy famotidine 40mg pill cheap cozaar 25mg prograf canada

By Ueejvf, October 24, 2023 @ 12:55 am

azelastine 10ml nasal spray buy irbesartan 150mg without prescription buy avapro pills

By Lwrxmm, October 26, 2023 @ 7:15 pm

nexium uk topamax price cost topamax 100mg

By Jfbwwm, October 28, 2023 @ 4:40 pm

zyloprim online order purchase clobetasol sale order rosuvastatin 20mg pills

By Eqmtzt, October 28, 2023 @ 11:03 pm

order generic imitrex order imitrex 50mg generic dutasteride medication

By Cyletl, October 30, 2023 @ 5:22 am

buspin cost cordarone medication order amiodarone 200mg online

By HenryIcefs, May 8, 2024 @ 12:11 pm

Прошлым месяцем я решил сменить входную дверь в квартире. Обратился на сайт https://dvershik.ru, выбрал модель и заказал установку. Мастера приехали строго по расписанию, компетентно и оперативно смонтировали новую дверь. Очень доволен сервисом и результатом – теперь чувствую себя намного безопаснее!

By RaymondNeorm, June 10, 2024 @ 9:10 am

Discover https://Accsmarket.net, your top choice for acquiring various account types across a multitude of platforms. From social media profiles to gaming credentials, we offer a comprehensive selection of verified accounts to meet your digital needs. Experience convenience and reliability as you browse through our platform to enhance your online presence with https://Accsmarket.net.

Click to : https://Accsmarket.net