Earlier this week The Wall Street Journal ran a piece on, of all things, the importance of the correlation coefficients between the returns of investments. I have mixed feelings about it.

On the one hand, correlation between asset returns is a neglected subject of great importance. The mid-Twentieth Century realization of its central role was the start of modern financial theory as we now know it. A professional level understanding of risk begins and ends with correlations, so it would make some sense for amateur investors to know at least the basics.

On the one hand, correlation between asset returns is a neglected subject of great importance. The mid-Twentieth Century realization of its central role was the start of modern financial theory as we now know it. A professional level understanding of risk begins and ends with correlations, so it would make some sense for amateur investors to know at least the basics.

On the other hand, the article serves as a good reminder of why they know so little. Despite being called Why the Math of Correlation Matters, it contains no math. This might be because the author worried that her readers would find the math scary and hard, but I fear it is because the author herself finds it scary and hard.

Read more »

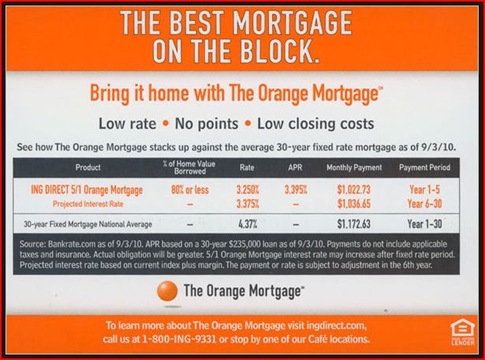

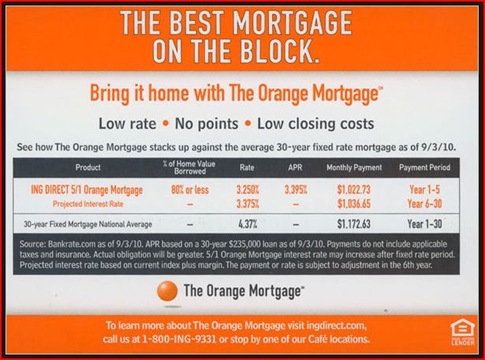

I guess I should start out by stating that I do not find anything in this bit of junk mail to be the least confusing or misleading. Do you?

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

Read more »

Just for fun, today let’s play journalist and headline writer.

Here are the morning’s facts that we have to work with: 1) For the month of July 2010, the Case-Shiller 20-City Home Price Index was up 0.6% and the 10-City was up 0.8%. 2) For the year to July, the indexes are up 3.2% and 4.1%, respectively. 3) House prices are now at the level they were in fall 2003, but are still about 50% higher than they were in January 2000.

Okay, so what’s the headline you would use for your story reporting this news? Here are some I think would be appropriate:

“July Brought More Modest House Price Increases”

“S&P Case-Shiller at Highest Level Since ‘08”

“House Prices Continue Recovery Despite Tax Credit Expiration”

Or, taking more of a big picture approach:

“With Dust Settling, House Prices Hold on to Half of Boom Gains”

Read more »

Today I am going to write about The New York Times again.

I know. I know. I shouldn’t. I promised to stop taking the Times seriously a while back. But I just can’t stay away. Including the Thursday re-run I wrote about it twice last week. I just can’t help it. Moths and flames.

On Wednesday last the Times published Looking Ahead to the Spend-Down Years. I am honestly not sure how to characterize the topic of the article, other than to say it had to do with retirement and money and cited the work of several clueless academics with evidently too much time on their hands.

The piece was illustrated with creepy but eye-catching computer generated images of a man’s head as he aged. This was explained in the first few paragraphs.

Read more »

This is actually two questions in one. There is the personal finance version: Is owning a house a shrewd move for a consumer? And there is the broader policy one: Is home ownership something that the government should be  encouraging as much as it does?

encouraging as much as it does?

Both are good questions. The first is of great practical importance to many people. But the second is probably more interesting. And it is nearly impossible to discuss one without the other.

Brett Arends at the Wall Street Journal gives it a good try in his latest column, taking as inspiration a recent Time cover story that is entirely on the policy question, to write on the personal finance version.

He starts out by making the point that a Time cover reading “Rethinking Homeownership” is as good a sign as any that the real estate market is bottoming out. He shows us a 2005 Time cover reading “Home $weet Home” that was, in hindsight, a clear indication that the market was then about to peak. I do not disagree, but I would have been much more impressed with Arends if I hadn’t read this blog post at The Big Picture two days earlier that made the same point with pictures of the same two Time covers.

Read more »

On the one hand, correlation between asset returns is a neglected subject of great importance. The mid-Twentieth Century realization of its central role was the start of modern financial theory as we now know it. A professional level understanding of risk begins and ends with correlations, so it would make some sense for amateur investors to know at least the basics.

On the one hand, correlation between asset returns is a neglected subject of great importance. The mid-Twentieth Century realization of its central role was the start of modern financial theory as we now know it. A professional level understanding of risk begins and ends with correlations, so it would make some sense for amateur investors to know at least the basics.