Free Money Finance had a post yesterday asking How Much of a Role Does Luck Play in Money Success? This was in turn inspired by a Wall Street Journal blog post similarly titled What Role Does Luck Play in Getting Wealthy?

(I have trouble making heads or tails of that blog, The Wealth Report. Sometimes it sounds like serious reporting on the world of the seriously loaded, e.g. Switzerland Ranks No. 1 as Home for the Rich, and sometimes sounds like The Colbert Report’s Colbert Platinum segment. e.g. Oprah: It’s Great to Have a Private Jet. Alas, I digress.)

The degree to which financial success is correlated with talent and hard work, which is to say the degree to which money is distributed justly in our society, is a fundamental question of great importance that I don’t have the energy to tackle today.

What I do want to consider is a smaller and related question: are rich people necessarily good at personal finance? It’s a basic premise of a large segment of the personal finance literature from The Millionaire Next Door to Secrets of the Millionaire Mind through Kiyosaki’s Rich Dad series.

Read more »

Today brings another dollop of data on the housing market. The Wall Street Journal carries a story about a drop in real estate listings in April. An outfit called ZipRealty reports that listings were down 3.6% from March. In general, April is an up month, with the average monthly increase since 1982 being 4.8%, so the down tick is significant. Listings were off 21% from April 2008.

This could be an indication that the number of sales will be down in the coming months, which as I have written before, is bad news if you are a real estate broker.

This could be an indication that the number of sales will be down in the coming months, which as I have written before, is bad news if you are a real estate broker.

But what if you are an ordinary reader of the WSJ concerned about house prices, both because it’s a central issue in the current crisis and possibly because you may yourself own a house? Then this isn’t news at all. Fewer listings could mean that the supply of cheap houses is being exhausted and soon buyers will start bidding up the prices of what’s left. Or it could mean that sellers have become discouraged and have pulled their houses off the market, waiting for conditions to improve. Or half a dozen other reasonable scenarios.

Read more »

This is the 100th post to Bad Money Advice. In honor of that milestone I thought I would get a little more philosophical and reflective than usual.

I am generally very suspicious of arguments founded on the assertion that never in history has some aspect of our lives been more difficult or challenging than it is today. Some parts of life in the good old days may have been less  complicated then they are now, but it was a brutal simplicity. I remember years ago when somebody remarked to my grandfather how dirty the streets in New York had become. He rolled his eyes and pointed out that when he was a child those streets where covered in horse manure. And you may think it is stressful to raise kids today, but consider what it was like a few hundred years ago when half of them died before reaching adulthood.

complicated then they are now, but it was a brutal simplicity. I remember years ago when somebody remarked to my grandfather how dirty the streets in New York had become. He rolled his eyes and pointed out that when he was a child those streets where covered in horse manure. And you may think it is stressful to raise kids today, but consider what it was like a few hundred years ago when half of them died before reaching adulthood.

But there is at least one part of our lives that really is much more difficult and harder than it was hundreds of years ago. That is the somewhat amorphous subject that we call personal finance. Don’t get me wrong, I am in no way pining for the old days. In the past there was no such thing as an activity called personal finance for most people because, by our standards, in the past most people spent their lives broke. A person might save food for the coming winter, but not money for retirement. Until recently, there was no such thing as retirement for ordinary folks, and, if you go back far enough, hardly such a thing as money.

Read more »

Normally, I have the criticizing personal financial gurus business all to myself. I like to think this is because I am the only one who sees the faults in their advice, or alternatively, that I am the only one bold enough to say the emperor has no clothes on. But it is also possible I am the only one who takes them seriously enough to bother writing about what they say.

This is not the case with Suze Orman’s recent advice on credit cards and emergency funds. It took a while, but quite a few people thought it was important enough to comment on critically. Welcome to my world.

It started with Orman’s March 1 Suze Scoop. There’s been some disagreement as to what exactly she told her readers to do, so if you are as obsessed about this stuff as I am, click on that link and come back when you are done. In the event that you have more balance in your life, I’ll quote the first two paragraphs.

If you have an unpaid credit card balance and not much saved up in emergency savings I need you to listen up. My advice has changed.

I want you to only pay the minimum due on your credit card balance and instead make it your top priority to build as much of an emergency cash fund as you can.

Read more »

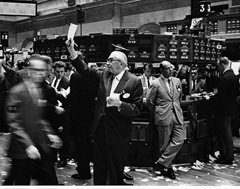

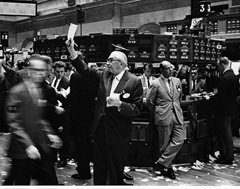

Last weekend The New York Times, no doubt in response to criticism that the media reports nothing but grim news about the economy, did its best to cheer us up with an article about how a stock market debacle from 75 years ago wasn’t really all that bad after all.

It started out squarely addressing the problem.

It started out squarely addressing the problem.

Historical stock charts seem to show that it took more than 25 years for the market to recover from the 1929 crash — a dismal statistic that has been brought to investors’ attention many times in the current downturn.

I’m not that easily cheered up, partly because I understand the nature of the optical illusion that makes those charts “seem to show that it took more than 25 years” to recover from the ‘29 crash. The charts tend to make the uninformed observer think it took 25 years to recover because it’s actually true. It was not until 1954 that the Dow got back to its 1929 high.

Read more »