Category: Housing

Are Timeshares a Good Idea?

Yes. If you can arrange bridge financing, they are a great way to pay off the construction of your new resort. You will have to hire a sales staff and wait a few years to sell the full inventory, but when it is done you will have made a tidy profit.

Yes. If you can arrange bridge financing, they are a great way to pay off the construction of your new resort. You will have to hire a sales staff and wait a few years to sell the full inventory, but when it is done you will have made a tidy profit.

What’s that? You meant is it a good idea for a consumer to buy a timeshare? Oh.

No. It isn’t.

I am reminded of this by a recent item at SmartMoney telling us how the prices for some second-hand timeshares, that is, those owned by consumers who now want out, have dropped to $1. They are not so much for sale as up for adoption, free to a good home. Given the annual fees involved, that is not as illogical as it might sound, but it is a stark contrast to the five figure sums those consumers were dazzled into paying just a few years ago.

What Percent of Your Income to Spend on Rent

Yesterday the Wall Street Journal’s Developments blog (it covers real estate) carried a post Is Your Rent Too Damn High? inspired by a classic only-in-New-York character, Jimmy McMillan, the Rent is Too Damn High Party’s candidate for governor. The photo alone makes it worth the click.

Yesterday the Wall Street Journal’s Developments blog (it covers real estate) carried a post Is Your Rent Too Damn High? inspired by a classic only-in-New-York character, Jimmy McMillan, the Rent is Too Damn High Party’s candidate for governor. The photo alone makes it worth the click.

The post muses, without resolution, on the eternal question of how high is too high.

Many personal finance experts say you should spend no more than 35% of your gross income on rent (not including renter’s insurance) whether you live in a high- or low-cost area. Of course, this amount can mean the difference between living in a studio on the outskirts of an expensive city or living large in a condo overlooking the beach in a low-cost area.

Many experts say this? It is the sort of faux wisdom that is often attributed to unnamed others and then passed on half-heartedly. I spent several minutes looking around the web for first hand advice on how much to budget on rent. I didn’t find much. There is lots of stuff out there on how big a mortgage you should take on, but relatively little discussion of renting. I guess renters just aren’t interested in personal finance.

The Great Foreclosure Scandal

The other day The Wall Street Journal introduced me to a new word. From German, it is fremdschämen, meaning “a feeling of cringing embarrassment for the actions of others.” If only to discuss reality TV shows, English really needs  to adopt this one. We can spell it without the umlauts. It is pronounced something like FREM-shame-in.

to adopt this one. We can spell it without the umlauts. It is pronounced something like FREM-shame-in.

I bring this up because there is a minor scandal brewing that has just inspired fremdschamen in me. The Consumerist has taken to calling it the Foreclosure Fracas. Wednesday’s update on it in The New York Times began:

The uproar over bad conduct by mortgage lenders intensified Tuesday, as lawmakers in Washington requested a federal investigation and the attorney general in Texas joined a chorus of state law enforcement figures calling for freezes on all foreclosures.

ING Sends a Postcard

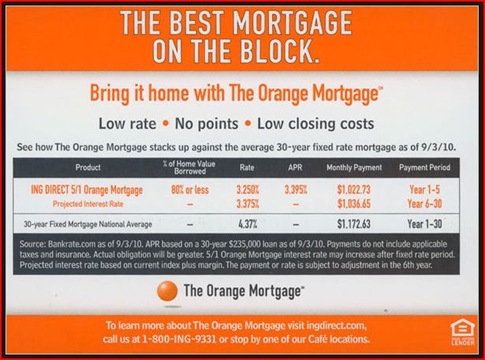

I guess I should start out by stating that I do not find anything in this bit of junk mail to be the least confusing or misleading. Do you?

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”