Houses Have Never Been Cheaper

Ever since the Great Debacle of 2007-08, we have all had house prices on our minds. Other topics may be grabbing headlines, but there has always been a recurring interest in how the old US residential market is doing. And there are good reasons for that. Not only is it a massive asset class, representing a sizeable portion of our national wealth, but for many families the house is the single biggest asset, often exceeding the value of the household’s net worth. And housing is, after all, where this whole nasty economic mess started.

Ever since the Great Debacle of 2007-08, we have all had house prices on our minds. Other topics may be grabbing headlines, but there has always been a recurring interest in how the old US residential market is doing. And there are good reasons for that. Not only is it a massive asset class, representing a sizeable portion of our national wealth, but for many families the house is the single biggest asset, often exceeding the value of the household’s net worth. And housing is, after all, where this whole nasty economic mess started.

Lately the house theme has been about whether now is the time to jump in and buy. Two days ago Time decided to share Why This May Be the Ideal Time to Buy Real Estate. That echoes the sentiments at such places as MSNMoney and The Simple Dollar. And even celebrity rich guys as diverse as Warren Buffet and Donald Trump are in on this one.

Skeptical cynic that I am, my first instincts are always that popular trends are probably wrong, and that goes double if The Donald is involved. But I long ago learned to discount my instincts when it comes to big money issues.

The argument in favor of buying a house now is simple and appealing. Prices are relatively low and when mortgage rates are factored in, houses are just plain cheap. This, it should be pointed out, is a much sounder argument than what you might have heard in favor of houses seven or eight years ago, that however expensive they were, now was a good time to buy because they were set to become even more expensive soon.

But just how cheap are houses? According to the Case-Shiller 10 city composite, prices are down 35% from the June 2006 peak. That is encouraging, but it just means that prices are back to where they were in April ‘03. In other words, it could be argued that all that has happened is that we have returned to normal and that prices are not particularly low or high now.

Fair enough. But the actual cost facing most consumers, and the number that would rationally be compared to rent, is the monthly mortgage payment that would be due if they bought. So the salient question is not how cheap houses are now in terms of raw prices, but in terms of mortgage interest payments.inflatable bouncers

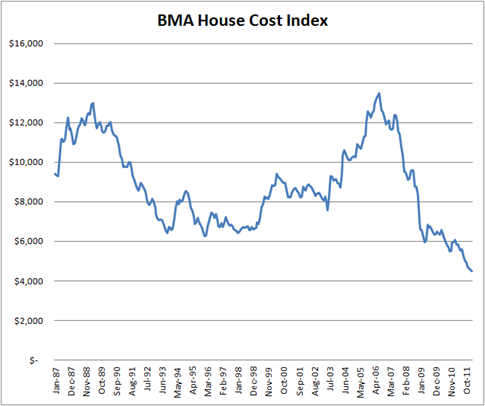

To get at that, I hereby launch the BMA House Cost Index. It aims to measure the real cost of real estate, rather than the price. (Or affordability.) The formula is pretty simple. I start with the good old Case-Shiller 10 city, which goes back to January 1987, and adjust it for inflation using the CPI. I then multiply that number by the average 30-year fixed mortgage rate as reported by Freddie Mac.

The index is scaled to show what it currently costs to pay the interest for a year, in 1987 dollars, on what was $100,000 worth of house in January 1987.

The current reading (which is for February 2012, the latest data point from Case-Shiller) of the BMA HCI is $4479, meaning that it now costs $4479 a year in 1987 dollars to float what was $100,000 worth of real estate back in 1987. That is down from a peak of $13,479 in July 2006, a drop of 67%. And the current value is now just over half the average value since 1987 of $8814.

There is really no escaping the fact, illustrated in the chart above, that houses are now cheaper than they have been in a generation.

Of course, like any index this is a simplification of a complex picture. The Case-Shiller 10-city composite is just a national average that may not accurately reflect reality in your local area or for any particular house. The index does not consider tax effects. Or the availability of mortgages. Or the inflation dividend you get from owning a house. But I think it gets the big picture right.

Other than the low current reading, the most interesting observation to be made from this chart is how ordinary the great house price bubble of ‘03-‘06 looks. As crazy as prices may have gotten in the middle of last decade, in terms of real mortgage payments, what consumers were actually paying monthly in real terms, house costs were actually roughly in-line with what happened in the late 1980s. (And might be similar to many other periods for which we lack data.)

So, in as much as houses really are cheaper than they have been in at least a quarter century, and possibly much longer, popular opinion seems to be on target. However, wet blankets like me need to point out that as cheap as houses are today, there is no law that says that they cannot get even cheaper tomorrow. All we can say is that this is a good time to buy a house, not that it will be someday looked back on as the best time.

10 Comments

Other Links to this Post

RSS feed for comments on this post. TrackBack URI

By AP, May 23, 2012 @ 2:41 pm

Frank, would love to get your thoughts on the housing bubble in Canada. In particular, Toronto is building more condos than NYC and Mexico City combined. It’s freakish, and we can’t even deduct our mortgage interest from our taxes.

By so many metrics, including rents to house price and household income to house price, it’s a terrible time to buy a house. Or a condo. But people think “it’s different here”. Why on earth would that be?

By Seth, May 24, 2012 @ 11:47 am

But this is only looking at the interest on the loan, right? Without also including the principle I think it paints only a partial picture.

Per your method if housing prices doubled tomorrow but interest rates were cut in half then the chart would be flat. But this does not express the true cost. Nor would it express the now greater danger of interest rates increasing in the future and consequently dropping the price of housing.

By Craig, May 25, 2012 @ 4:36 pm

I hope it’s the time to buy; we’re aiming to close on our third house in June. Last year, we made a substantial upgrade in residence for no increase in month-to-month costs, and turned our original place into a rental.

The third place is a small home in Knoxville, Tennessee, where prices are incomprehensibly low. We’re getting 15-year money for 3.3% and moving my wife’s sister in as a renter. If she pays the rent for fifteen years, we’ll mail her the deed. And if she doesn’t…the mortgage is like two hundred a month. Crazy time, this. We’ll be telling stories about it for the rest of our lives. If this weather holds, we might be looking for another property in 2013.

By Neil, May 25, 2012 @ 4:59 pm

@AP

This seemed like an interesting question to me, so I plugged Frank’s system into a spreadsheet using the Teranet index and CMHC’s “Average 5-year mortgage rate” data-set, which I could only find up to Dec 2011.

https://docs.google.com/spreadsheet/ccc?key=0Arilf8SVoAokdGE3NUtzZzM4c2psbFZ1Wm02VkdLUHc

I also tweaked it to compare both interest cost, and annual payment required to pay it off over a 30-year period. Basically, the interest rate adjustments show that the housing market is not as exciting as price indexes show. I have not figured out whether the Teranet index already compensates for inflation, or if I should add a constant-dollar adjustment as well.

There’s less history available, but my impression is that most Canadian housing is a bad buy. Alberta seems to be an exception, where it looks like an average buy, having gone from one flat line before 2005, through a bubble, to a higher flat line from 2009 onwards. There is reason to believe there may have been a fundamental adjustment in the Alberta market during the 2005-2009 period given the ~30% increase in population.

By A P, May 27, 2012 @ 10:31 am

Thanks Neil! Our mortgages here are all variable rate and generally rates are 5 year duration. We can’t get a 30 year fixed here.

I think condos in particular are a bad buy right now as the condo fees in Toronto are ridiculously high (even compared to Montreal and Vancouver) and the price of the condo is in bubble territory even without the fees.

Thanks for your input and opinion!

By Neil, May 28, 2012 @ 12:43 pm

@AP

The lack of 30 year fixed mortgages does make buying during low-interest/high-price markets a worse option for Canadians than Americans, since it limits their ability to ride out a high-interest/low-price period, but doesn’t really affect the tables I made. I used the average for 5-year fixed rates issued, which seems to be the most popular option for Canadian mortgages (a sizable minority do run with truly variable rates, which would be cheaper).

The market as a whole doesn’t seem to react to that higher risk as far as I can tell, and is probably just assessing based on whether they can afford the payment the bank puts in front of them. Not surprising given the number of homeowners that can’t do math. It does raise significant concerns about what happens when interest rates rise substantially.

By Zach, June 5, 2012 @ 10:24 am

Frank, I would love to get your opinion about the current generation (future homeowners) whom we read about being crushed with student loan debt never seen before. It seems to me, as they pay down this debt, purchasing homes will be put off, keeping prices “cheap” for quite some time. What do you think?

By jefferson nickel mint marks, October 5, 2012 @ 11:45 pm

whoah this weblog is excellent i really like reading your posts.

Keep up the good work! You realize, many people are hunting

round for this information, you can help them greatly.

By mynames, April 29, 2023 @ 5:18 pm

Aw, this was an incredibly nice post. Spending some time and actual effort to produce a good articleÖ but what can I sayÖ I put things off a lot and never manage to get nearly anything done.

By Doups, May 17, 2023 @ 6:52 pm

Free spins no deposit casino bonuses are the latest trend that has emerged with online casinos. It used to be only no deposit casino offers which are still offered by many online casinos, but, with the emergence of USA free spins no deposit required keep your winnings offers, online casino gaming has changed a lot. Other online casino bonus no deposit sites include Unibet. If you would like more information about new online casinos’ no deposit bonus offers, or you would like to discover new online casino no deposit bonus codes, check out our new USA online casinos with no deposit bonuses 2023 guide. The slot you can use for the free spins bonuses can vary depending on the online casino and the promotion. Some casinos may restrict free spins to certain slot games. It’s important to check the terms and conditions of the bonus to see which slot machines are eligible.

http://hanshin.paylog.kr/bbs/board.php?bo_table=free&wr_id=7776

The downside to online keno is the jackpot prizes aren’t usually as lucrative as land-based keno, but if you shop around you can find real cash keno games that offer some huge rewards. For players based outside of the US, there are many options for playing Keno, including these three: 888casino, bet365 Casino and PokerStars Casino. When we review keno online casinos, we look at a variety of factors. Safety is the first an foremoves and that goes without saying. One those basics are tended to we look at what will make your keno playing experience most profitable. We find you casinos with best keno bonuses, a wide variety of keno games and mobile gaming. Real money keno is an exciting lottery-style game in which you choose numbers from a card. You may win money if your numbers are drawn, and the more correct you are, the more money you can earn.