Time to follow up on a few topics I have written about in the past and mention a few more tidbits not worthy of entire posts.

Bad Books

On Friday, the Consumer Product Safety Commission recalled another half million electrical DIY books to add to the million or so recalled from the same publisher in January. Some of the books were originally published in the 1950s. No explanation of why this batch was overlooked nine months ago. Also still no word on what, exactly, is wrong with them.

I had some fun with this in January, but darker thoughts are now creeping into my head. Is it just me, or is anybody else uncomfortable with the idea of a government agency recalling “dangerous” books?

Read more »

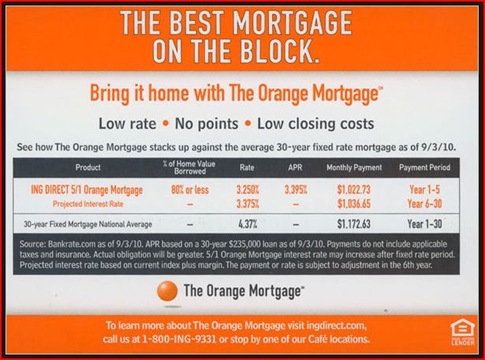

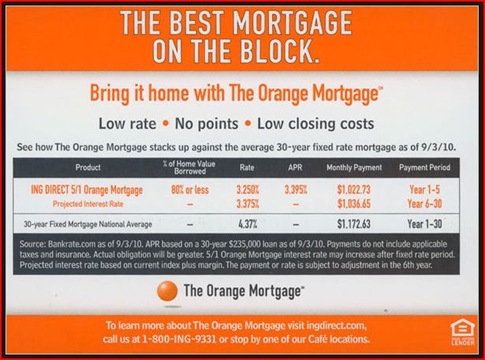

I guess I should start out by stating that I do not find anything in this bit of junk mail to be the least confusing or misleading. Do you?

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

In case you can’t read it, it is a postcard from ING pitching their “ING DIRECT 5/1 Orange Mortgage.” It lays out what the loan would cost as compared to an average 30 year fixed. Although it does not use the term “adjustable rate mortgage” or “ARM” it gives the reader plenty of clues, including calling it a 5/1 and breaking out the numbers into two periods, with the interest rate for the second (Year 6-30) period labeled as “projected.”

Read more »

There were two big and obvious seasonal trends in the frugalosphere this past month. The arrival of September means it is time to get serious about Christmas shopping. And it was, as we all know, National Coupon Month. But did you know that NCM is only 13 years old? Seems like it has always been there, but it was just in 1997 that it “was first introduced by the Promotion Marketing Association, Inc. (PMA) to heighten awareness to savings and increase coupon usage.”

There were two big and obvious seasonal trends in the frugalosphere this past month. The arrival of September means it is time to get serious about Christmas shopping. And it was, as we all know, National Coupon Month. But did you know that NCM is only 13 years old? Seems like it has always been there, but it was just in 1997 that it “was first introduced by the Promotion Marketing Association, Inc. (PMA) to heighten awareness to savings and increase coupon usage.”

In celebration, there were the usual pro-coupon posts, but also at least one in the this-has-gone-too-far vein. Coupons for Lottery Tickets – Seriously? from Provident Planning informed us that just because you get a two-for-one coupon for lottery tickets in the mail, that doesn’t mean that it is a good deal. As the author points out, the Pennsylvania Lottery (who sent out the coupons) only pays out 61% percent of their revenue in prizes, so a $2 ticket is really worth only $1.22. You would have to get a serious discount to turn that into a good deal.

Read more »

[Today’s Thursday re-run first appeared September 1, 2009.]

A few days ago there was an encouraging little post on The Wallet about how we’re spending more on life’s smaller luxuries in the face of the Great Recession. I call it encouraging because I think it is the direction most people should go in their spending, more on the small stuff, less on the big things,  and I like reading positive articles about how consumers are doing this. Not that I really think this is going on.

and I like reading positive articles about how consumers are doing this. Not that I really think this is going on.

My theory, admittedly not based on much science, is that we’re happier if we spend more on the smaller things we like than on the big things. A great big house may indeed add joy to our lives, but not as much as the equivalent in nights out on the town. (Or rounds of golf, or manicures or whatever floats your boat.)

Happiness is obviously completely subjective and unquantifiable. Which is why it is so hard for us to think analytically about how to spend our money to maximize it. The $750 car payment for that new set of wheels seems like a good idea. We think that we will enjoy driving it. And we are probably right about that. But the question to ask is not whether or not the car will be enjoyable but whether or not it will be as enjoyable as other possible uses for $750 a month. And that’s really a hard question to answer.

Read more »

Yesterday WalletPop posted 10 Dumb Reasons to Take Out a Loan. Oh, how I like list posts. Ideas homogenized into orderly little chunks. It’s like blog dim sum. Or sushi. Or maybe Chicken McNuggets.

I am too much of a fussbudget not to point out that three of the listed items are not dumb reasons to borrow but dumb ways to borrow. Still, I think I can come up with ten easy-to-digest responses. Here goes.

I am too much of a fussbudget not to point out that three of the listed items are not dumb reasons to borrow but dumb ways to borrow. Still, I think I can come up with ten easy-to-digest responses. Here goes.

1. Buying a Timeshare. I have to agree that buying a new timeshare, that is, from the developer, is probably always a bad idea. (On the other hand, buying one used, from some other sap who bought new and now will take any reasonable offer, sounds like an interesting idea to me. I’ve never done it.)

But does borrowing the money to buy a timeshare make it worse? I don’t see how. Indeed, once you set aside the foolishness of buying the thing, a loan to do it seems quite reasonable. The developer may provide financing on special terms and I think that under some circumstances the interest is tax deductible.

Read more »