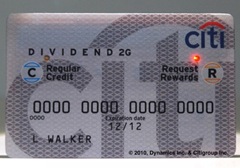

Last week I wrote about credit card technology, in particular the “chip and PIN” or “smart” cards that Europeans have been using for decades. I said that although the technology used by European (and Canadian, it turns out) cards is unquestionably more sophisticated than the dumb old plastic we simple Americans carry, it is not particularly “smart.” The only meaningful advantage is in fighting fraud, but that problem has such a tiny economic impact that it is hard to imagine how upgrading from our current swiping system could possibly make sense.

Americans carry, it is not particularly “smart.” The only meaningful advantage is in fighting fraud, but that problem has such a tiny economic impact that it is hard to imagine how upgrading from our current swiping system could possibly make sense.

Indeed, I still do not understand how adopting chip and PIN makes economic sense outside the USA. I can understand it making psychological sense. Everybody seems to have an irrationally exaggerated fear of credit card fraud. And there is no discounting the cool factor: the natural human attraction to new technology.

Speaking of which, two readers pointed me to a New York Times blog entry posted two days later on even higher tech cards now in the pipeline.

Read more »

What is the total cost of airline delays in the US? Funny you should ask. A recent 82 page paper from The National Center of Excellence for Aviation Operations Research (miraculously acronymed as NEXTOR) estimated a total cost of $32.9B for 2007.

What is the total cost of airline delays in the US? Funny you should ask. A recent 82 page paper from The National Center of Excellence for Aviation Operations Research (miraculously acronymed as NEXTOR) estimated a total cost of $32.9B for 2007.

It is a wonderful paper. That it uses 2007 data tells you that it was a multi-year effort. It has ten primary authors and employed the “assistance” of six others mentioned on the title page. And they included in their calculation everything from the cost to the airlines of paying flight crew to wait around to the added cost to passengers who take earlier flights than they really need to account for the possibility of delays. I look forward to reading it through someday.

The $32.9B NEXTOR laboriously comes up with sounds pretty big, but in context it’s not quite as alarming as I think they mean it to be. It is about $109 per American per year, or about $39.40 per air passenger-flight. Now, of course, that’s not zero. If there was something easy we could do to eliminate that “waste” we would be better off.

Read more »

Yesterday the Wall Street Journal’s Developments blog (it covers real estate) carried a post Is Your Rent Too Damn High? inspired by a classic only-in-New-York character, Jimmy McMillan, the Rent is Too Damn High Party’s candidate for governor. The photo alone makes it worth the click.

Yesterday the Wall Street Journal’s Developments blog (it covers real estate) carried a post Is Your Rent Too Damn High? inspired by a classic only-in-New-York character, Jimmy McMillan, the Rent is Too Damn High Party’s candidate for governor. The photo alone makes it worth the click.

The post muses, without resolution, on the eternal question of how high is too high.

Many personal finance experts say you should spend no more than 35% of your gross income on rent (not including renter’s insurance) whether you live in a high- or low-cost area. Of course, this amount can mean the difference between living in a studio on the outskirts of an expensive city or living large in a condo overlooking the beach in a low-cost area.

Many experts say this? It is the sort of faux wisdom that is often attributed to unnamed others and then passed on half-heartedly. I spent several minutes looking around the web for first hand advice on how much to budget on rent. I didn’t find much. There is lots of stuff out there on how big a mortgage you should take on, but relatively little discussion of renting. I guess renters just aren’t interested in personal finance.

Read more »

The New York Times ran an article over the weekend about how even though “smart” credit cards are more advanced, there is almost no reason to expect them to be adopted here in the USA. That is an interesting story, which I will get to in a moment, but the article revealed an astonishing statistic that is worth the distraction.

The New York Times ran an article over the weekend about how even though “smart” credit cards are more advanced, there is almost no reason to expect them to be adopted here in the USA. That is an interesting story, which I will get to in a moment, but the article revealed an astonishing statistic that is worth the distraction.

Fraud losses for the credit card companies are currently running at just six cents per $100 charged. That is 0.06%. Put that into the context of the average fee paid by the merchant to the card company, around 1.8%. Or the 1% to 2% that we all expect to get back from our cards in the form of rewards.

0.06%, or as we finance types would call it, 6 basis points, is a very small number. In the context of a retail store it is the moral equivalent of zero. For most merchants it is an order of magnitude smaller than “shrinkage” i.e. theft of inventory.

Read more »

Is now a good time to invest in stocks?

Like the weather, the market outlook is a topic that can always be discussed, whatever the circumstances, and generally without much in the way of a definitive conclusion. It is often reduced to a question of whether or not the market is expensive or cheap just now.

Lately, the most popular measure of market valuation appears to be the current market price divided by the last ten years average earnings. This is variously known as PE10, the cyclically adjusted PE (CAPE), or Shiller’s PE, in honor of the Yale economist Robert Shiller who has popularized it. (But would never claim to have invented it. He calls it CAPE and so shall I.)

In just the past week, CAPE was sagely mentioned in both The New York Times and The Wall Street Journal. The Times called it “a conservative method” and used it to make the case that stocks are not particularly cheap at the moment. The Journal used it to make the argument that the market can be effectively timed, but left it to the reader to draw his own short-term conclusions.

Read more »

Americans carry, it is not particularly “smart.” The only meaningful advantage is in fighting fraud, but that problem has such a tiny economic impact that it is hard to imagine how upgrading from our current swiping system could possibly make sense.

Americans carry, it is not particularly “smart.” The only meaningful advantage is in fighting fraud, but that problem has such a tiny economic impact that it is hard to imagine how upgrading from our current swiping system could possibly make sense.